0001702780DEF 14AFALSE00017027802022-01-012022-12-310001702780atus:MathewMember2022-01-012022-12-31iso4217:USD0001702780atus:GoeiMember2022-01-012022-12-310001702780atus:GoeiMember2021-01-012021-12-3100017027802021-01-012021-12-310001702780atus:GoeiMember2020-01-012020-12-3100017027802020-01-012020-12-3100017027802022-10-032022-12-3100017027802022-01-012022-10-020001702780ecd:PeoMemberatus:PensionAdjustmentsServiceCostMemberatus:MathewMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:PensionAdjustmentsServiceCostMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:PensionAdjustmentsServiceCostMember2021-01-012021-12-310001702780atus:GoeiMemberecd:PeoMemberatus:PensionAdjustmentsServiceCostMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberecd:PeoMemberatus:MathewMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberatus:GoeiMemberecd:PeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberatus:GoeiMemberecd:PeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberatus:GoeiMemberecd:PeoMember2020-01-012020-12-310001702780atus:ChangeInPensionValueMemberecd:PeoMemberatus:MathewMember2022-01-012022-12-310001702780atus:ChangeInPensionValueMemberatus:GoeiMemberecd:PeoMember2022-01-012022-12-310001702780atus:ChangeInPensionValueMemberatus:GoeiMemberecd:PeoMember2021-01-012021-12-310001702780atus:ChangeInPensionValueMemberatus:GoeiMemberecd:PeoMember2020-01-012020-12-310001702780ecd:PeoMemberatus:EquityAwardsGrantedFairValueMemberatus:MathewMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedFairValueMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedFairValueMember2021-01-012021-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedFairValueMember2020-01-012020-12-310001702780ecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsVestedMemberatus:MathewMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001702780ecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsUnvestedMemberatus:MathewMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001702780atus:GoeiMemberecd:PeoMemberatus:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberecd:PeoMemberatus:MathewMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberatus:GoeiMemberecd:PeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberatus:GoeiMemberecd:PeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberatus:GoeiMemberecd:PeoMember2020-01-012020-12-310001702780atus:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:PensionAdjustmentsServiceCostMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:ChangeInPensionValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:ChangeInPensionValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:ChangeInPensionValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedFairValueMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedFairValueMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedFairValueMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2022-01-012022-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2021-01-012021-12-310001702780atus:EquityAwardsGrantedInPriorYearsForfeitedMemberecd:NonPeoNeoMember2020-01-012020-12-31000170278012022-01-012022-12-31000170278022022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | | | | |

| ☒ | Filed by the Registrant | | ☐ | Filed by a Party other than the Registrant |

Check the appropriate box: | | | | | | | | | | | | | | |

| | | | | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒ | | Definitive Proxy Statement |

| | |

| ☐ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

| |

ALTICE USA, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant) | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

2023 Notice of Annual Meeting and Proxy Statement

June 14, 2023 at 9:00 a.m. Eastern Daylight Time

1 Court Square West, Long Island City, New York 11101

Altice USA, Inc.

1 Court Square West, Long Island City, New York 11101

Dear Stockholder:

This year’s annual meeting of stockholders will be a completely virtual meeting, conducted solely online through an audio webcast on June 14, 2023 at 9:00 a.m., Eastern Daylight Time. You will be able to attend the virtual annual meeting by logging in at www.virtualshareholdermeeting.com/ATUS2023. You will need the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials (the “Notice”) or your proxy card.

The attached proxy statement provides information on how to participate in the 2023 virtual annual meeting and how to vote your shares and explains the matters to be voted upon in detail.

Your vote is important to us. Stockholders may vote by using a toll-free telephone number or over the Internet. Also, if you receive a paper copy of the proxy card by mail, you may sign and return the proxy card in the envelope provided.

Sincerely,

Dennis Mathew

Chief Executive Officer

April 27, 2023

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF ALTICE USA, INC.

Time: 9:00 a.m., Eastern Daylight Time

Date: June 14, 2023

Place: There will be no physical location for stockholders to attend. Stockholders may only participate by logging in at www.virtualshareholdermeeting.com/ATUS2023 and using the 16-digit control number provided on the Notice or your proxy card.

Purpose:

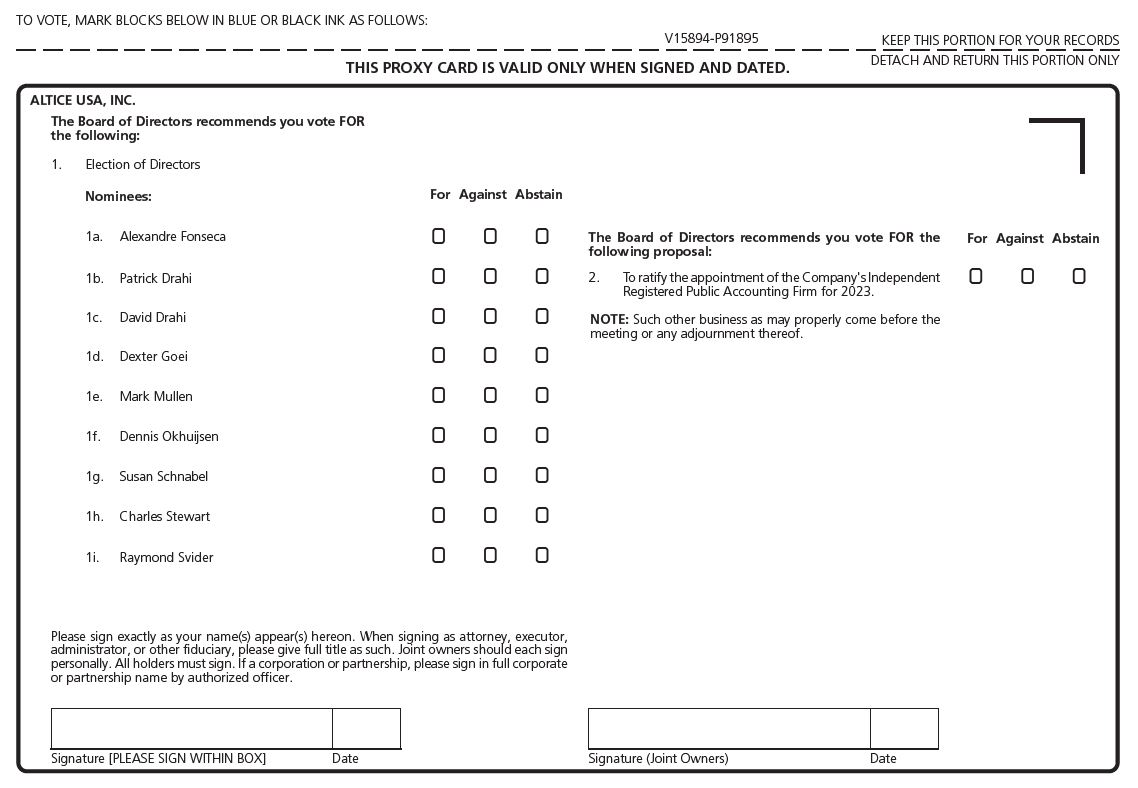

•Elect nine directors

•Ratify appointment of independent registered public accounting firm

•Conduct other business if properly raised

Only stockholders of record on April 19, 2023 may vote at the annual meeting.

Your vote is important. We urge you to vote your shares by telephone, over the Internet or, if you receive a copy of the proxy card by mail, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

Important Notice: Our 2022 Annual Report on Form 10-K and the 2023 Proxy Statement are available at:

https://investors.alticeusa.com/sec-filings/

By order of the Board of Directors,

Michael E. Olsen

Executive Vice President,

General Counsel and Secretary

April 27, 2023

TABLE OF CONTENTS | | | | | | | | |

| | |

| GENERAL INFORMATION | |

| HOW TO VOTE | |

| | VOTING RIGHTS | |

| HOW PROXIES WORK | |

| | REVOKING A PROXY | |

| SOLICITATION | |

| VOTES NEEDED | |

| QUORUM | |

| BOARD AND GOVERNANCE PRACTICES | |

| OVERVIEW | |

| MEETINGS | |

| COMMITTEES | |

| | AUDIT COMMITTEE | |

| COMPENSATION COMMITTEE | |

| | DIRECTOR NOMINATIONS | |

| DIRECTOR SELECTION | |

| | BOARD LEADERSHIP STRUCTURE | |

| | RISK OVERSIGHT | |

| | CORPORATE GOVERNANCE GUIDELINES | |

| CONTROLLED COMPANY | |

| DIRECTOR INDEPENDENCE | |

| BOARD SELF-ASSESSMENT | |

| | EXECUTIVE SESSIONS OF NON-MANAGEMENT BOARD MEMBERS | |

| COMMUNICATING WITH OUR DIRECTORS | |

| CODE OF BUSINESS CONDUCT AND ETHICS | |

| DELINQUENT SECTION 16(A) REPORTS | |

| HEDGING | |

| | DIRECTOR COMPENSATION | |

| DIRECTOR COMPENSATION TABLE | |

| PROPOSAL 1 | |

| | ELECTION OF DIRECTORS | |

| OUR EXECUTIVE OFFICERS | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| EXECUTIVE SUMMARY | |

| | ROLE OF COMPENSATION COMMITTEE | |

| | | | | | | | | |

| BENCHMARKING | | |

| SAY ON PAY | | |

| BASE SALARIES | | |

| | ANNUAL BONUS | | |

| LONG TERM INCENTIVES | | |

| BENEFITS | | |

| PERQUISITES | | |

| POST-TERMINATION COMPENSATION | | |

| EMPLOYMENT AGREEMENTS | | |

| CLAWBACK | | |

| TAX DEDUCTIBILITY OF COMPENSATION | | |

| DESCRIPTION OF NON-GAAP FINANCIAL MEASURES | | |

| REPORT OF COMPENSATION COMMITTEE | | |

| EXECUTIVE COMPENSATION TABLES | | |

| SUMMARY COMPENSATION TABLE | | |

| GRANTS OF PLAN-BASED AWARDS | | |

| AMENDED AND RESTATED ALTICE USA 2017 LONG TERM INCENTIVE PLAN | | |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | | |

| OPTION EXERCISES AND STOCK VESTED | | |

| PENSION BENEFITS | | |

| CABLEVISION CASH BALANCE PENSION PLAN | | |

| CABLEVISION EXCESS CASH BALANCE PLAN | | |

| NONQUALIFIED DEFERRED COMPENSATION TABLE | | |

| PAYMENTS ON TERMINATION OR CHANGE IN CONTROL | | |

| CEO PAY RATIO | | |

| PAY VERSUS PERFORMANCE | | |

| SECURITY AUTHORIZED FOR ISSUANCE UNDER THE LONG TERM INCENTIVE PLAN | | |

| PROPOSAL 2 | | |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | |

| REPORT OF AUDIT COMMITTEE | | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | |

| RELATED PARTY TRANSACTION APPROVAL POLICY | | |

| STOCK OWNERSHIP TABLE | | |

| OTHER MATTERS | | |

| MATTERS TO BE RAISED AT THE 2023 ANNUAL MEETING NOT INCLUDED IN THIS PROXY STATEMENT | | |

| STOCKHOLDER PROPOSALS FOR 2024 ANNUAL MEETING & FUTURE ANNUAL MEETING BUSINESS | | |

| HOUSEHOLDING | | |

| ANNUAL REPORT ON FORM 10-K | | |

| | |

| | | |

GENERAL INFORMATION

HOW TO VOTE

The 2023 Annual Meeting of Stockholders of Altice USA, Inc. (“Altice USA,” the “Company,” “we,” “us” and “our”) will take place on June 14, 2023 at 9:00 a.m. Eastern Daylight Time.

This year’s annual meeting will be a completely virtual meeting of stockholders through an audio webcast live over the Internet. There will be no physical meeting location. Please go to www.virtualshareholdermeeting.com/ATUS2023 for instructions on how to attend and participate in the annual meeting. Any stockholder may attend and listen live to the webcast of the annual meeting over the Internet at such website. Stockholders as of the record date may vote and submit questions while attending the annual meeting via the Internet by following the instructions listed on your proxy card. The webcast starts at 9:00 a.m., Eastern Daylight Time, on June 14, 2023. We encourage you to access the meeting prior to the start time.

As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. All stockholders will have the ability to access the proxy materials on a website referred to in the Notice or to request to receive a printed set of the proxy materials. There is no charge to you for requesting a printed copy of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed set of proxy materials may be found in the Notice. In addition, stockholders may request to receive future proxy materials in printed form by mail or electronically by email on an ongoing basis.

You may vote by telephone, over the Internet, or if you receive a copy of the proxy card by mail, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

VOTING RIGHTS

Only holders of the Company’s Class A common stock (“Class A common stock”) and the Company’s Class B common stock (“Class B common stock”) (together, the “Altice USA common stock”), as recorded in our stock register at the close of business on April 19, 2023, may vote at the annual meeting. On April 19, 2023, there were 270,340,053 shares of Class A common stock and 184,328,571 shares of Class B common stock issued and outstanding. As of the date of this Proxy Statement, the Company has not issued any shares of its Class C common stock or its preferred stock.

Each share of Class A common stock is entitled to one vote per share, and each share of Class B common stock is entitled to twenty-five votes per share, in each case, on any matter submitted to a vote of our stockholders. Except as set forth below or as required by Delaware law, holders of shares of Class A common stock and Class B common stock vote together as a single class on all matters (including the election of directors) submitted to a vote of our stockholders.

HOW PROXIES WORK

The Company’s Board of Directors (the “Board”) is asking for your proxy. If you submit a proxy but do not specify how to vote, the Company representative named in the proxy will vote your shares in favor of the director nominees identified in Proposal 1 in this proxy statement and for Proposal 2.

The Notice contains instructions for telephone and Internet voting. Also, if you receive a paper copy of the proxy card by mail, you may sign and return the proxy card in the envelope provided. Whichever method you use, giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against Proposal 2 or abstain from voting.

You may receive more than one Notice or proxy or voting card depending on how you hold your shares. If you hold shares through another party, such as a bank or brokerage firm, you may receive material from them asking how you want to vote.

REVOKING A PROXY

A stockholder may revoke any proxy which is not irrevocable by submitting a new proxy bearing a later date, by voting by telephone or over the Internet, or by delivering to the Secretary of the Company (the “Secretary”) a revocation of the proxy in writing so that it is received by the Company prior to the annual meeting at 1 Court Square West, Long Island City, New York 11101. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power.

SOLICITATION

These proxy materials are being provided in connection with the solicitation of proxies by the Company and will first be sent to stockholders on or about May 4, 2023. In addition to this mailing, the Company’s employees may solicit proxies personally, electronically or by telephone. The Company pays the costs of soliciting proxies. We also reimburse brokers and other nominees for their expenses in sending these materials to you and obtaining your voting instructions.

VOTES NEEDED

The vote required for Proposal 1 for the election of directors by stockholders, other than in a contested election of directors, shall be the affirmative vote of a majority of the votes cast with respect to a director nominee. For purposes of this paragraph, a ‘majority of the votes cast’ means that the number of votes cast ‘for’ a director must exceed the number of votes cast ‘against’ that director. In any contested election of directors, the nominees receiving the greatest number of the votes cast for their election, up to the number of directors to be elected in such election, shall be deemed elected. Abstentions and “broker non-votes” (as defined below) will not count as votes either ‘for’ or ‘against’ a nominee. A contested election is one in which the number of persons nominated exceeds the number of directors to be elected as of the date that is ten days prior to the date that the Company first mails its notice of meeting for such meeting to the stockholders.

Approval of Proposal 2 requires the affirmative vote of the holders of a majority of the voting power of the shares of stock present at the meeting or represented by proxy and entitled to vote on the subject matter. For Proposal 2, an abstention will have the same effect as a vote against the proposal because an abstention represents a share considered present and entitled to vote.

If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares must be voted as you direct. If you do not give instructions for Proposal 2 to ratify selection of the Company’s independent registered public accounting firm, the broker may vote your shares with respect to Proposal 2 at its discretion. For Proposal 1, the broker cannot vote your shares at all. When that happens, it is called a “broker non-vote.” Broker non-votes are counted in determining the presence of a quorum at the meeting, but they will have no effect on the voting for Proposal 1 because they do not represent shares present and entitled to vote.

QUORUM

In order to carry on the business of the meeting, we must have a quorum. This means that the holders of record of a majority of the voting power of the issued and outstanding shares of capital stock of the Company entitled to vote at the annual meeting must be represented at the annual meeting, either by proxy or present at the Internet meeting.

Notwithstanding the foregoing, where a separate vote by a class or series or classes or series is required, a majority of the voting power of the outstanding shares of such class or series or classes or series, present at the meeting or represented by proxy, shall constitute a quorum entitled to take action with respect to the vote on that matter. Once a quorum is present to organize a meeting, it shall not be broken by the subsequent withdrawal of any stockholders.

BOARD AND GOVERNANCE PRACTICES

OVERVIEW

The board of directors (the “Board of Directors” or the “Board”) of Altice USA currently consists of nine members: Alexandre Fonseca (Chairman), Patrick Drahi, David Drahi, Dexter Goei, Mark Mullen, Dennis Okhuijsen, Susan Schnabel, Charles Stewart and Raymond Svider. See Proposal 1 below for more information.

On March 22, 2023, Gerrit Jan Bakker resigned from the Board and Alexandre Fonseca was appointed as a director of the Company to serve on the Board until the 2023 annual meeting of stockholders and until his successor is duly elected and qualified.

The following section provides an overview of our Board practices, Board committee responsibilities, leadership structure, risk oversight, governance practices and director compensation.

| | | | | |

| Board Independence | •Our Board has determined that three out of nine of our directors qualify as “independent” under the New York Stock Exchange (“NYSE”) Listing Standards. |

| Board Committees | •We have two committees of the Board—the Audit Committee and the Compensation Committee—each of which is composed entirely of independent directors. •Each of our committees operates under its respective written charter and reports regularly to the Board concerning its activities. |

| Executive Sessions | •Our Board holds executive sessions of non-management directors. •The non-management directors specify the procedure to designate the director who will preside at each executive session. |

| Board Oversight of Risk | •Risk management is overseen by our Board with support from the Audit and Compensation Committees. •Our Compensation Committee reviews whether there are risks arising from our compensation practices to ensure that those practices encourage management and other employees to act in the best interests of our stockholders. |

| Corporate Governance Guidelines | •Our Board operates under our Corporate Governance Guidelines, which define director qualification standards and other appropriate governance procedures. |

| Annual Election of Directors | •Our second amended and restated bylaws (“Second Amended and Restated Bylaws”) provide for the annual election of all directors. |

| Majority Voting | •In accordance with our Second Amended and Restated Bylaws, all questions presented to stockholders, other than in respect of the election of directors, are decided by the affirmative vote of the holders of a majority of the voting power of the shares present or represented by proxy and entitled to vote, unless otherwise required under applicable law. •For the election of directors by stockholders, other than in a contested election of directors, the vote required is the affirmative vote of a majority of the votes cast with respect to a director nominee. |

| Related Party Transactions | •Our Related-Party Transactions Approval Policy requires the Audit Committee to review and approve, or take such other action as it may deem appropriate with respect to, any transactions involving the Company and its subsidiaries, on the one hand, and in which any director, officer, greater than 5% stockholder of the Company or any other “related person” under the related‑party disclosure requirements of the SEC has an interest, on the other hand. •The Related‑Party Transaction Approval Policy cannot be amended or terminated without the prior approval of a majority of the Audit Committee. |

| Open Lines of Communication | •Our Board promotes open and frank discussions with senior management. •Our directors have access to all members of management and other employees and are authorized to hire outside consultants or experts at our expense. |

| Self-Evaluation | •Our Board and each of the Committees conduct annual self-evaluations. |

Our Board

Our Board is composed of nine members, three of whom have been determined by the Board to be independent directors under applicable NYSE corporate governance standards. Mr. Alexandre Fonseca is the Chairman of our Board.

We entered into a stockholders’ agreement (the “Stockholders’ Agreement”) in June 2018 with Next Alt S.à r.l. (“Next Alt”), an entity of which Mr. Patrick Drahi is the sole indirect controlling shareholder, and A4 S.A., an entity controlled by Mr. Drahi’s family.

•Under the Stockholders’ Agreement, Next Alt has the right to designate a number of directors to the board (the “Next Alt Designees”) based on Next Alt’s voting power as follows:

◦If Next Alt, A4 S.A., Mr. Patrick Drahi (or his heirs or entities or trusts directly or indirectly under his or their control or formed for his or their benefit) or any of their affiliates (collectively, the “Drahi Group”) beneficially owns in the aggregate, at least 50% of the voting power of our outstanding capital stock, Next Alt will have the right to designate six directors to the Board, and the Company will cause the Board to consist of a majority of directors nominated by Next Alt;

◦If the Drahi Group beneficially owns, in the aggregate, less than 50% of the voting power of our outstanding capital stock, Next Alt will have the right to designate a number of directors to the Board equal to the total number of directors comprising the entire Board multiplied by the percentage of the voting power of our outstanding common stock beneficially owned, in the aggregate, by the Drahi Group, rounding up in the case of any resulting fractional number;

◦If the Drahi Group beneficially owns, in the aggregate, less than 50% of the voting power of our outstanding capital stock, Next Alt will not have the right to designate a number of directors to the Board equal to or exceeding 50% of directors comprising the entire Board. One of Next Alt’s designation nominations will be an individual designated by A4 S.A., and Next Alt will agree to vote its shares in favor of electing the individual designated by A4 S.A;

◦If a director designated by Next Alt or by A4 S.A. resigns or is removed from the Board, as the case may be, only another director designated by Next Alt or by A4 S.A., as the case may be, may fill the vacancy; and

◦In the event Mr. Drahi is not a member of our Board, one representative of the Drahi Group will have board observer rights.

Messrs. P. Drahi, D. Drahi, Fonseca, Goei, Okhuijsen and Stewart are Next Alt Designees to our Board.

Our Board Meeting Quorum Requirements

Our Third Amended and Restated Certificate of Incorporation has the following quorum requirements for meetings of the Board:

•a majority of the number of directors then in office will constitute a quorum;

•in the event Next Alt is entitled to nominate three or more directors to the Board pursuant to the Stockholders’ Agreement, such quorum must include (i) the Chairman of the board of managers of Next Alt nominated by Next Alt to the Board pursuant to the Stockholders’ Agreement and two other directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement or (ii) in the event the Chairman of the board of managers of Next Alt is not a member of the Board, three directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement; and

•in the event Next Alt is entitled to nominate one or two directors to the Board pursuant to the Stockholders’ Agreement and such directors are elected to the Board by the stockholders of the Company, a quorum must include each of the directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement.

MEETINGS

The Board met six times in 2022. Each of our directors in 2022 attended at least 75 percent of the meetings of the Board and the committees of the Board on which he or she served, other than Mr. Stewart. Mr. Stewart attended two-thirds of the meetings of the Board in 2022.

We encourage our directors to attend annual meetings of stockholders. Four of our directors attended our 2022 annual meeting.

COMMITTEES

The Board has two standing committees: the Audit Committee and the Compensation Committee, each of which consists entirely of independent board members.

AUDIT COMMITTEE

Committee members: Messrs. Mullen (Chairman) and Svider and Ms. Schnabel currently constitute the Audit Committee.

The Audit Committee met four times in 2022.

The primary responsibilities of the Audit Committee include:

•overseeing management’s establishment and maintenance of adequate systems of internal accounting, auditing and financial controls;

•reviewing the effectiveness of our legal, regulatory compliance and risk management programs;

•reviewing certain related party transactions in accordance with the Company’s Related Party Transaction Approval Policy;

•overseeing our financial reporting process, including the filing of financial reports; and

•selecting independent auditors, evaluating their independence and performance and approving audit fees and services performed by them.

Our Board has determined that each member of the Audit Committee is “independent” as defined under the listing standards of the NYSE and the requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is financially literate and has accounting or related financial management expertise, as such qualifications are defined under the rules of the NYSE, and that Mark Mullen, Chair of the Audit Committee, is an “audit committee financial expert” within the meaning of SEC rules and regulations.

The text of our Audit Committee charter is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

Our Board has established a procedure whereby complaints or concerns with respect to accounting, internal controls and auditing matters may be submitted to the Audit Committee. This procedure is described under “Communicating with Our Directors” below.

COMPENSATION COMMITTEE

Committee members: Messrs. Svider (Chairman) and Mullen and Ms. Schnabel currently constitute the Compensation Committee.

The Compensation Committee met six times in 2022.

The primary responsibilities of the Compensation Committee include:

•ensuring our executive compensation programs are appropriately competitive, support organizational objectives and stockholder interests and emphasize pay for performance linkage;

•evaluating and approving compensation and setting performance criteria for compensation programs for our chief executive officer and other executive officers;

•overseeing the implementation and administration of our compensation plans; and

•reviewing our compensation arrangements to determine whether they encourage excessive risk-taking and mitigating any such risk.

The text of our Compensation Committee charter is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

Our Board has determined that each member of the Compensation Committee is “independent” and meets the independence requirements applicable to compensation committee members under the rules of the NYSE.

In accordance with its charter, the Compensation Committee has the authority to engage outside consultants to assist in the performance of its duties and responsibilities. In July 2022, the Compensation Committee engaged a

compensation consultant, Frederic W. Cook & Co. (“FW Cook”), to assist in assessing executive officer and director compensation. FW Cook’s advisory services are further described in the “Compensation Discussion and Analysis” below.

DIRECTOR NOMINATIONS

The Board has established a nomination mechanism in our Corporate Governance Guidelines. The Board is responsible for selecting the nominees for election to the Board, subject to the then applicable terms of the Stockholders’ Agreement.

DIRECTOR SELECTION

The Board selects new nominees for election as a director considering the following criteria:

•the then applicable terms of the Stockholders’ Agreement;

•personal qualities and characteristics, accomplishments and reputation in the business community;

•current knowledge and contacts in the communities in which the Company does business and in the Company’s industry or other industries relevant to the Company’s business;

•ability and willingness to commit adequate time to Board and committee matters;

•the fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of the Company; and

•diversity of viewpoints, background and experience.

BOARD LEADERSHIP STRUCTURE

The Chairman shall have general and active management and control of the business and affairs of the Company, subject to the control of the Board and the Stockholders’ Agreement, and shall see that all orders and resolutions of the Board are carried into effect. The positions of Chairman and CEO may be filled by one individual or by two different individuals. Currently, Mr. Fonseca serves as the Chairman of the Board and Dennis Mathew serves as the Company’s CEO.

RISK OVERSIGHT

One of the key functions of our Board is informed oversight of our risk management process. Our Board administers this oversight function directly, with support from the Audit and Compensation Committees, each of which addresses risks specific to its respective areas of oversight. In particular, our Audit Committee is responsible for considering and discussing our major financial risk exposures and cyber-security risks and the steps our management takes to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Board committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise‑level risk. The Board receives reports from members of our senior management and other personnel that include assessments and potential mitigation of the risks and exposures involved with their respective areas of responsibility.

CORPORATE GOVERNANCE GUIDELINES

We are committed to adhering to corporate governance practices that meet applicable U.S. corporate governance standards. Our Board has adopted Corporate Governance Guidelines that serve as a framework within which our Board and its committees operate. These guidelines cover a number of areas including the size and composition of our Board, board membership criteria and director qualifications, director responsibilities, board agenda, role of the chief executive officer, meetings of independent directors, committee responsibilities and assignments, director access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning.

The full text of our Corporate Governance Guidelines may be viewed at our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

CONTROLLED COMPANY

Our Class A common stock is listed on the NYSE under the ticker “ATUS”. Because Mr. Patrick Drahi owns or controls (through entities controlled directly or indirectly by Mr. Drahi or his family (including Next Alt and UpperNext S.C.S.p.) shares representing a majority of the voting power of our outstanding common stock, we are a “controlled company” under NYSE corporate governance rules.

As a controlled company, we are eligible for exemptions from some of the requirements of the NYSE listing rules, including:

•the requirement that a majority of our Board consist of independent directors; and

•the requirement that we have a nominating and governance committee.

Consistent with these exemptions, we do not have a majority of independent directors on our Board or a nominating and governance committee. The responsibilities that would otherwise be undertaken by a nominating and governance committee are undertaken by the full Board, or at its discretion, by a special committee established under the direction of the full Board.

Because of this control, Mr. Drahi and related parties control the outcome of any matters put before the stockholders.

DIRECTOR INDEPENDENCE

Messrs. Mullen and Svider and Ms. Schnabel have been determined by the Board to be independent directors under applicable NYSE corporate governance standards.

BOARD SELF-ASSESSMENT

The Board conducts a self-evaluation at least annually to determine whether it is functioning effectively. The Board periodically considers the mix of skills and experience that directors bring to the Board to assess whether the Board has the necessary tools to perform its oversight function effectively.

In addition, our Audit Committee and Compensation Committee each conduct their own annual self-assessment, which includes an assessment of the adequacy of their performance as compared to their respective charters.

EXECUTIVE SESSIONS OF NON-MANAGEMENT BOARD MEMBERS

Our Corporate Governance Guidelines provide that our non-management directors meet in executive session at least quarterly, with no members of management present. The non-management directors specify the procedure to designate the director who will preside at each executive session. Non-management directors who are not independent under the rules of the NYSE may participate in these executive sessions, but independent directors under the rules of the NYSE meet separately in executive session at least once per year.

COMMUNICATING WITH OUR DIRECTORS

The Board welcomes communications from the Company’s stockholders, and it is the policy of the Company to facilitate communication from stockholders. The Board generally believes it is in the Company’s best interests that designated members of management speak on behalf of the Company. Stockholders and other interested parties wishing to communicate with the Board or with an individual Board member concerning the Company may do so by writing to the Board or to a particular Board member, by mailing such correspondence to:

Corporate Secretary

Altice USA, Inc.

Attn: General Counsel

1 Court Square West

Long Island City, NY 11101

Tel: 1-516-803-2300

Please indicate on the envelope whether the communication is from a stockholder or other interested party. The Board has instructed the Corporate Secretary and other relevant members of management to examine incoming communications and forward to the Board or individual Board members as appropriate, communications he or she deems relevant to the Board’s roles and responsibilities. The Board has requested that certain types of communications not be forwarded, and redirected if appropriate, such as: spam, business solicitations or advertisements, resumes or employment inquiries, service complaints or inquiries, surveys, or any threatening or hostile materials.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Board has adopted a Code of Business Conduct and Ethics for all of our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of our Code of Business Conduct and Ethics is available on our website. Our Code of Business Conduct and Ethics is a “code of ethics” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to or waivers of provisions of our code of ethics on our website.

The full text of the code is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Attn: Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, certain officers and any beneficial owners of more than 10% of our common stock to file reports relating to their ownership and changes in ownership of our common stock with the SEC and NYSE by certain deadlines. Based on a review of Section 16 filings with respect to our company, each of Messrs. Svider and Mullen and Ms. Schnabel filed one Form 4 reporting two transactions and Mr. Stewart filed one Form 4 reporting one transaction after the applicable reporting deadline.

HEDGING

We do not have a formal hedging policy and do not prohibit our directors, officers or employees from entering into hedging transactions.

DIRECTOR COMPENSATION

Compensation for our non-employee directors is determined by our Board with the assistance of the Compensation Committee. See “Director Compensation Table” below for further details on director compensation.

In April 2022, the Board granted to each of the three independent directors (Messrs. Mullen and Svider and Ms. Schnabel) an award of 6,318 restricted share units (“RSUs”) and an option to purchase 19,531 shares of Class A common stock of the Company under the Amended and Restated Altice USA 2017 Long Term Incentive Plan, as amended (the “Amended and Restated Plan”). The options have an exercise price of $11.87 (equal to the volume weighted average trading price of a share of Class A common stock as reported on by the NYSE for the 30-day period immediately preceding the grant date). Each of the options and RSUs vest 50% on April 27, 2023 and 2024, respectively, provided that such director continues to provide services to the Company on the applicable vesting date.

Our directors are also eligible to participate in the Altice USA Employee Product Benefit program, which provides discounted broadband, video and telephony services to employees and certain other service providers who reside in the Optimum footprint.

DIRECTOR COMPENSATION TABLE

The table below shows the compensation paid to or earned by our directors for the year ending December 31, 2022. None of Messrs. Bakker, D. Drahi, P. Drahi, Goei, Okhuijsen or Stewart received any compensation from us for their services as directors of our Board in 2022. Mr. Fonseca was appointed to the Board effective March 22, 2023 and was not a member of the Board in 2022. The compensation received by Mr. Goei for his services as our Executive Chairman during 2022 are described in the “Summary Compensation Table” below.

Compensation for our directors is determined by our Board with the assistance of the Compensation Committee. Each of our independent directors receives a base fee of $72,500 per year. In addition, the Audit Committee chair receives an annual fee of $32,500 and Audit Committee members each receive an annual fee of $22,500. The Compensation Committee chair receives an annual fee of $22,500 and Compensation Committee members each receive an annual fee of $5,000.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Year | | Fees earned or paid in cash ($) | | Stock awards ($)(1) | | Option awards ($)(2) | Total ($) |

| Raymond Svider | | 2022 | | 117,500 | | 65,454 | | 74,999 | 257,953 |

| Mark Mullen | | 2022 | | 110,000 | | 65,454 | | 74,999 | 250,453 |

| Susan Schnabel | | 2022 | | 100,000 | | 65,454 | | 74,999 | 240,453 |

(1)Represents the grant date fair value of RSU awards, as described in the section titled “Director Compensation” above, computed in accordance with FASB ASC Topic 718. The grant date fair value of the RSUs is based on the closing price of $10.36 of our Class A common

stock on the grant date of April 27, 2022. As of December 31, 2022, each of our independent directors held outstanding RSU and option awards with respect to the following numbers of shares of Class A common stock: Mr. Svider—6,318 RSUs and 29,531 options; Mr. Mullen—6,318 RSUs and 29,531 options; and Ms. Schnabel—6,318 RSUs and 27,864 options.

(2)Represents the grant date fair value of the options, as described in the section titled “Director Compensation” above, computed in accordance with FASB ASC Topic 718, excluding forfeiture assumptions. For the stock option awards for our directors, the fair value on the date of grant was calculated using the Black-Scholes option pricing model. The computation of expected life of 5.75 years was determined based on the simplified method (the average of the vesting period and the option term) due to the Company’s lack of recent historical data for similar awards. The interest rate for the period within the contractual life of the stock options of 2.83% is based on the interest yield for U.S. Treasury instruments in effect at the time of grant. The computation of expected volatility of 39.23% is based on historical volatility of the Class A common stock and the expected volatility of common stock of comparable publicly traded companies at the time of grant.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has nominated the nine director candidates named below, all of whom currently serve as our directors, to hold office until our next annual meeting of stockholders. There are no vacancies on the Board.

The Company representatives named in the proxy intend to vote for the election of each of the director nominees below, unless you indicate on your proxy that your vote should be voted against any or all of the nominees.

Information on each of our nominees is given below.

The Board recommends you vote FOR each of the following candidates:

Patrick Drahi, 59, is a director of Altice USA and previously served as its Chairman from 2018 to 2022. Mr. Drahi founded Altice Europe N.V. and its subsidiaries (the “Altice Group”) in 2002. Mr. Drahi is a graduate from the Ecole Polytechnique and Ecole Nationale Supérieure de Télécommunications and began his professional career with the Philips Group in 1988 where he was in charge of international marketing (UK, Ireland, Scandinavia, Asia) in satellite and cable TV (DTH, CATV, MMDS). In 1991, Mr. Drahi joined the US/Scandinavian group Kinnevik‑Millisat, where he was in charge of the development of private cable networks in Spain and France and was involved in the launch of commercial TV stations in Eastern Europe. In 1993, Mr. Drahi founded CMA, a consulting firm specialized in telecommunications and media, which was awarded a mandate from BCTV for the implementation of Beijing’s full-service cable network. In addition, Mr. Drahi founded two cable companies, Sud Câble Services (1994) and Médiaréseaux (1995), where he was involved in several network deployments and buyouts. When Médiaréseaux was taken over by United Pan-Europe Communications N.V. (“UPC”) at the end of 1999, Mr. Drahi advised UPC on its M&A activities until mid-2001. Mr. Patrick Drahi is the father of Dr. David Drahi. Mr. Drahi’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and telecommunications.

David Drahi, 28, joined Altice USA as a director in 2019. Dr. Drahi is co-chief executive officer in charge of technology and new business of Altice group activities in Europe and has held that position since April 2022. Dr. Drahi graduated from the University of Oxford with a D.Phil. in Atomic and Laser Physics, obtained his Master in Optics and Photonics from the Imperial College of London, and pursued his Bachelor of Physics at Ecole Polytechnique Fédérale in Lausanne, Switzerland. His research covered the fields of Quantum Optics and Quantum Cryptography. He previously worked at Cabovisao, previously owned by Altice Europe, and Icart, a subcontractor to Altice Europe. David Drahi is Patrick Drahi's son. Dr. Drahi’s qualifications to sit on our Board include his experience in the areas of corporate strategy and operations.

Alexandre Fonseca, 49, has been Chairman of the Board of Altice USA, since March 2023. Mr. Fonseca is co-chief executive officer in charge of operations of Altice group activities in Europe and has held that position since April 2022. Mr. Fonseca previously served as CEO and CTO at Portugal Telecom, CEO at ONI Portugal and ONI Mozambique, and also previously was the CTO and Technology & IT Executive Director at Cabovisao. Mr. Fonseca holds degrees in Computer Engineering from the Faculty of Science, Lisbon University and a master's degree in Sales and Marketing Management from Team View Institute, Lisbon, and has been a contributing speaker and professor in academic initiatives in the areas of technology and management. Mr. Fonseca’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations and telecommunications.

Dexter Goei, 51, is a director of Altice USA. Mr. Goei served as Chief Executive Officer of Altice USA from 2016 until October 2022 and as Executive Chairman from October 2022 until March 2023. Mr. Goei was chairman of the boards of Altice USA and Altice Europe until the Distribution and a director of Altice Europe until October 2018. Mr. Goei first joined the Altice Group as Chief Executive Officer in 2009, helping to lead its development and growth from a French cable operator to a multinational telecom operator with fixed and mobile assets across six different territories serving both residential and enterprise clients. Prior to joining the Altice Group, Mr. Goei spent 15 years in

investment banking first with JPMorgan and then Morgan Stanley in their Media & Communications Group in New York, Los Angeles and London. He was Co‑Head of Morgan Stanley’s European Media & Communications Group when he left to join Altice. Mr. Goei is a graduate of Georgetown University’s School of Foreign Service with cum laude honors. Mr. Goei’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and telecommunications.

Mark Mullen, 58, joined Altice USA as a director in 2017. Mr. Mullen is co-founder and Managing Director of Bonfire Ventures, founded in 2017. Mr. Mullen also founded Double M Partners in 2012 and has since served as Managing Partner. Both Bonfire and Double M manage early-stage capital funds in Los Angeles. Mr. Mullen also founded Mull Capital in 2005, an evergreen fund that invests directly in startups and in other investment funds. All of the funds focus on investing in internet, media and technology with primary emphasis on business-to-business solutions, security and software. Prior to Double M Partners, Mr. Mullen served as COO of the City of Los Angeles (Economic Policy) and Senior Advisor to the then-Mayor Antonio Villaraigosa where he oversaw several of the City of Los Angeles’s assets, including the LA International Airport (LAX), LA Convention Center, the Planning and Building & Safety Departments, as well as the Office of Small Business Services. From 1993 until 2007, Mr. Mullen ran the international M&A and private equity group for Daniels & Associates, an investment bank focused on the cable TV and broadband industry. Mr. Mullen was a senior partner of Daniels when it was acquired by RBC Capital Markets in 2007 where he stayed until 2010 as Managing Director. Mr. Mullen earned his BSBA with cum laude honors from the University of Denver in 1986 and earned his MBA in international business from the Thunderbird School of Global Management in 1992. Mr. Mullen’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and investments, including, capital markets, capital allocation and mergers and acquisitions.

Dennis Okhuijsen, 52, joined Altice USA as a director in 2017. Mr. Okhuijsen joined the Altice Group in September 2012 and served as its CFO until October 2018. He currently serves as a senior advisor to the Altice group. Before joining the Altice Group, he was a Treasurer for Liberty Global plc from 2005 until 2012. From 1993 until 1996, he was a senior accountant at Arthur Andersen. Mr. Okhuijsen joined UPC in 1996 where he was responsible for accounting, treasury and investor relations up to 2005. His experience includes raising and maintaining non-investment grade capital across both the loan markets as well as the bond/equity capital market. In his previous capacities he was also responsible for financial risk management, treasury and operational financing. He holds a Master’s of Business Economics from the Erasmus University Rotterdam. Mr. Okhuijsen’s qualifications to sit on our Board include his substantial experience in the areas of corporate finance and strategy, including capital markets and capital allocation.

Susan Schnabel, 61, joined Altice USA as a director in 2021. Ms. Schnabel is a founder and has served as the Co-Managing Partner of aPriori Capital Partners since 2014. Prior to forming aPriori Capital, Ms. Schnabel worked at Credit Suisse from 2000 to 2014 where she served as Managing Director in the Asset Management Division and Co-Head of DLJ Merchant Banking. Ms. Schnabel currently serves on the board of directors of Kayne Anderson BDC and ViewRay, Inc. She served on the board of directors of Versum Materials, Inc. from 2016 through 2019 and has significant other board experience with private and public companies. Ms. Schnabel also serves on the Cornell University Board of Trustees (Investment and Finance Committees), the California Institute of Technology Investment Committee and the Board of Directors of the US Olympic & Paralympic Foundation (Finance Committee). Ms. Schnabel received a bachelor of science in chemical engineering from Cornell University and a masters of business administration from Harvard Business School. Ms. Schnabel's qualifications to sit on our Board include her substantial experience in the areas of corporate finance, mergers and acquisitions and strategy.

Charles Stewart, 53, is the Chief Executive Officer of Sotheby's. Mr. Stewart served as Co-President and Chief Financial Officer of Altice USA from 2015 to 2019 and has served as a director of Altice USA since 2018. Mr. Stewart joined Altice USA after 21 years of corporate, finance and investment banking experience in the United States, Latin America and Europe. Most recently, Mr. Stewart served as Chief Executive Officer of Itau BBA International plc from 2013 until 2015, where he oversaw Itau‑Unibanco’s wholesale banking activities in Europe, the United States and Asia. Prior to that, he spent nineteen years at Morgan Stanley as an investment banker in various roles, including nine years focusing on the U.S. cable, broadcast and publishing industries. Mr. Stewart also acted as Deputy Head of Investment Banking for EMEA and was a member of the global investment banking management committee. Mr. Stewart is a graduate of Yale University. Mr. Stewart’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations and finance.

Raymond Svider, 60, joined Altice USA as a director in 2017. Mr. Svider is the Chairman and a Partner of BC Partners. He joined the firm in 1992 and is currently based in New York. Over the years, Mr. Svider has participated and led investments in a number of sectors, including TMT, healthcare, industrials, business services, consumer and retail. He is currently Executive Chairman of PetSmart, Chairman of the Board of Chewy, Inc (NYSE

“CHWY”), Chairman of the Advisory Board of The Aenova Group, and also serves on the boards of Intelsat (NYSE “I”), Navex Global, GFL Environmental (NYSE “GFL”), GardaWorld, Presidio, Inc., EAB (Avatar Topco, Inc.), and Appgate Inc. Mr. Svider previously served as a Director of Accudyne Industries, Teneo Global, Office Depot, Multiplan, Unity Media, Neuf Cegetel, Polyconcept, Neopost, Nutreco, UTL and Chantemur. Mr. Svider is also on the Boards of the Mount Sinai Children’s Center Foundation in New York and the Polsky Center Private Equity Council at the University of Chicago. Mr. Svider received an MBA from the University of Chicago and an MS in Engineering from both Ecole Polytechnique and Ecole Nationale Superieure des Telecommunications in France. Mr. Svider’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, finance and investments.

OUR EXECUTIVE OFFICERS

Our current executive officers are:

| | | | | |

| Dennis Mathew | Chief Executive Officer (CEO) |

| Marc Sirota | Chief Financial Officer (CFO) |

| Michael E. Olsen | Executive Vice President, General Counsel and Secretary |

| Colleen Schmidt | Executive Vice President, Human Resources |

Dennis Mathew, 45, is Chief Executive Officer of Altice USA. Prior to his appointment in October 2022, Mr. Mathew served in various roles with Comcast Corporation, a multinational telecommunications conglomerate, including as Senior Vice President, Western New England Region, Vice President and General Manager, Xfinity Home, Vice President, Xfinity Home Wholesale Product Operations, Vice President, New Businesses. From October 2021 until his appointment as CEO of Altice USA, Mr. Mathew was employed as the Senior Vice President, Freedom Region for Comcast Corporation. Earlier in his career, Mr. Mathew held positions with Arthur Andersen and PricewaterhouseCoopers. Mr. Mathew earned his Bachelor of Science in economics with a concentration in finance and information management from the Wharton School of Management.

Marc Sirota, 52, is Chief Financial Officer of Altice USA. In this role, he oversees the Company’s financial and accounting matters as well as its strategic planning and analysis, internal audit, tax, investor relations and treasury activities. He joined Altice USA in February 2023 as the CFO Telecommunications and was appointed to the role of Chief Financial Officer effective March 1, 2023. Prior to joining Altice USA, Mr. Sirota served in various senior roles at Comcast Corporation, including as CFO at Division and Regional levels, Cable Assistant Controller, and Senior Vice President of Enterprise Business Intelligence. Prior to his employment with Comcast Corporation, Mr. Sirota was employed as an audit manager with Deloitte Touche Tohmatsu Limited. Mr. Sirota received his Bachelor of Science in accounting from Bloomsburg University of Pennsylvania and has completed executive studies at the Wharton School of Management. Mr. Sirota is a certified public accountant.

Michael E. Olsen, 58, is Executive Vice President, General Counsel and Secretary for Altice USA. As General Counsel and Secretary, Mr. Olsen is responsible for all legal affairs for the Company. Prior to his appointment, he served as a Senior Vice President in the Altice USA Legal department where he oversaw the Company’s legal activities in support of US operations, as well supporting regulatory and legislative policies across all of the Company’s business interests. Prior to the acquisition of Cablevision by Altice, Mr. Olsen held the position of Senior Vice President, Legal Regulatory and Legislative Affairs overseeing the Company’s public policy and legal strategy at the FCC, Congress, and before state and local government, developing and implementing legal policy for the Company across the range of its businesses. Mr. Olsen is a former clerk to the US District Court in Los Angeles and graduate of Georgetown University (JD) and Loyola Marymount University (BBA).

Colleen Schmidt, 55, is Executive Vice President, Human Resources of Altice USA. In this role she oversees the human resources function and is charged with conceiving of and executing on organizational and HR initiatives across the Company in order to foster an efficient, high-performing workforce. Ms. Schmidt joined Altice USA through the Cablevision acquisition, where she was serving as Senior Vice President, Human Resources and Internal Communications. Prior to that, Ms. Schmidt spent almost 20 years in HR leadership roles within the electronics distribution, financial services and entertainment industries, including Vice President of Global Talent Management for Arrow Electronics, Managing Director, Human Resources for the Consumer and Global Products and Services divisions of Marsh Inc. as well as earlier roles at Home Box Office and T. Rowe Price Associates. Ms. Schmidt holds a bachelor’s degree in psychology from the University of Virginia.

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

Overview

This section discusses the material components of our executive compensation program for each of our named executive officers in 2022. Our named executive officers are:

•Dennis Mathew, Chief Executive Officer (CEO);

•Dexter Goei, former Chief Executive Officer and Executive Chairman;

•Michael J. Grau, former Chief Financial Officer (former CFO);

•Michael E. Olsen, Executive Vice President, General Counsel and Secretary; and

•Colleen Schmidt, Executive Vice President, Human Resources.

On September 7, 2022, the Company and Mr. Goei mutually agreed to Mr. Goei’s resignation from his role as Chief Executive Officer of the Company and the appointment of Dennis Mathew as the Company’s new Chief Executive Officer, effective October 3, 2022. Effective October 3, 2022, Mr. Goei was appointed as Executive Chairman of the Board, a role in which he served until March 22, 2023. Mr. Goei remains a member of the Board.

Effective March 1, 2023, Mr. Grau ceased his service as Chief Financial Officer of the Company. Mr. Grau remains a non-executive senior advisor to the CEO through July 3, 2023.

The compensation discussed in this section is the compensation paid to our named executive officers with respect to their services to Altice USA in 2022.

Executive Compensation Philosophy

The Company’s executive compensation philosophy is based on the following principles:

•provide total compensation that attracts, motivates and retains individuals with the knowledge, expertise and experience required for each specific role;

•deliver an appropriate proportion of the total compensation package through variable pay elements linked to performance over the short- and long-term;

•encourage and reward performance that will lead to long-term enhancement of stockholder value; and

•take into account compensation practices in the markets in which we operate and compete for talent.

Determination of Compensation

The Compensation Committee is responsible for overseeing our overall compensation structure and assessing whether our compensation structure results in appropriate compensation levels and incentives for executive management. Compensation levels for our named executive officers are determined by the Compensation Committee within the framework of the Company’s executive compensation philosophy, as described above, and in consideration of a number of factors, such as the nature of the role, experience and performance of the individual and compensation levels for similar roles in the market. Each year, the Chairman of the Board reviews the performance of the CEO and recommends to the Compensation Committee base salary adjustments, an annual bonus based upon performance against the objectives approved by the Compensation Committee and long-term incentive grants for the CEO. The management of the Company provides to the Compensation Committee the CEO’s recommendations on the compensation, including an annual bonus and long-term incentive grants for executive officers, other than the CEO.

In July 2022, the Compensation Committee engaged a compensation consultant, FW Cook, to assist it in assessing executive officer and director compensation. Following the commencement of its engagement, a representative of FW Cook attended Compensation Committee meetings when requested, reviewed compensation data with the Compensation Committee and management and participated in general discussion regarding executive officer compensation decisions in relation to 2023 compensation. The Compensation Committee authorized FW Cook to interact with management on behalf of the Compensation Committee as needed in connection with advising the Compensation Committee. The Compensation Committee reviewed the independence of FW Cook pursuant to

NYSE and SEC rules and concluded that FW Cook was independent and its work for the Compensation Committee did not raise any conflicts of interest.

ROLE OF COMPENSATION COMMITTEE

The responsibilities of the Compensation Committee are set forth in its charter. Among other responsibilities, the Compensation Committee (1) establishes our general compensation philosophy and, in consultation with management, oversees the development and implementation of compensation programs; (2) reviews and approves corporate goals and objectives relevant to the compensation of our CEO and the other executive officers of the Company who are required to file reports under Section 16(a) of the Exchange Act, evaluates such executive officers’ performance in light of those goals and objectives and determines and approves their compensation levels based upon those evaluations; and (3) administers our stockholder-approved compensation plans.

BENCHMARKING

The Compensation Committee reviewed and compared compensation for a core peer group of companies in the same general industry or industries as the Company, as well as companies of similar size and business mix to evaluate the competitiveness and appropriateness of our compensation program. For 2022, the Compensation Committee selected the following list of companies that would comprise our peer group for 2022 compensation decisions:

•AT&T Inc.

•Charter Communications, Inc.

•Comcast Corporation

•DISH Network Corporation

•Lumen Technologies, Inc.

•T-Mobile US, Inc.

•Verizon Communications Inc.

The Compensation Committee determined that the peer group represented an appropriate benchmark for the market for our senior executive talent, based on our business operations and competitive labor markets.

At the end of 2021, management presented to the Compensation Committee a comparison of base rate of salary, projected bonus, long-term incentives and total direct compensation (defined as total cash compensation plus the value of long-term incentives) of our named executive officers against the 25th, median and 75th percentiles of the peer group. The information presented to the Compensation Committee included a comparison of the actual 2020 peer group compensation (the most recent peer compensation data available at the time) and projected 2021 compensation levels for the named executive officers to comparable positions among the peer companies. Compensation of Mr. Goei, the Company’s former CEO, was compared to chief executive officers at the peer companies. Compensation of Mr. Grau, the Company’s former CFO, was compared to chief financial officers at the peer group companies. Compensation of Mr. Olsen, the Company’s Executive Vice President, General Counsel and Secretary, was compared to general counsels at the peer group companies. Compensation of Ms. Schmidt, the Company’s Executive Vice President, Human Resources, was compared to top human resources executive roles in the Willis Towers Watson executive general industry compensation survey.

Based on the total compensation review, the Compensation Committee set a general guideline for target total direct compensation for named executive officers at or near the median of the peer group based on a combination of internal and market considerations. Internal factors include experience, skills, position, level of responsibility, historic and current compensation levels, internal relationship of compensation levels between executives, as well as attraction and retention of executive talent. Market considerations include market pay levels and pay practices among a peer group of companies with a reference to the median of the peer group. The Compensation Committee’s decisions are based upon a combination of these considerations and may exceed or fall below the median of the peer group, as the Compensation Committee deems appropriate. The Compensation Committee believed that this range was appropriate in light of the dynamics, diversity, complexities and competitive nature of the Company’s businesses as well as the Company’s performance. The Compensation Committee believed that the guideline for target total direct compensation provided a useful point of reference, along with the other factors described above, in administering the Company’s executive compensation program.

SAY ON PAY

In accordance with the advisory vote on the frequency of the stockholder advisory vote on executive compensation submitted to stockholders at the Company’s 2019 annual meeting, the Company will hold a stockholder advisory

vote on executive compensation every three years. The most recent executive compensation advisory vote was held at the Company’s 2022 annual meeting of stockholders, at which approximately 97% of the votes of holders of Class A and Class B common stock, voting together as a single class, approved the advisory vote on the compensation of the executive officers. The Compensation Committee considered the outcome of this vote for compensation when making compensation decisions for our named executive officers.

The next advisory vote on executive compensation will be held at the 2025 annual meeting of stockholders.

ELEMENTS OF COMPENSATION

BASE SALARIES

The named executive officers receive a base salary to compensate them for services provided to the Company. Base salary is intended to provide a fixed component of compensation reflecting various factors, such as the nature of the role and the experience and performance of the individual. In December 2021, the Compensation Committee reviewed the base salaries of the executive officers of the Company. Based on its review, the Compensation Committee increased Ms. Schmidt's base salary from $350,000 to $375,000, effective January 1, 2022. The Compensation Committee did not make any other changes to the named executive officers' salaries. As of December 31, 2022, Mr. Mathew’s base salary was $1,000,000, Mr. Goei’s base salary was $750,000 while serving as the Company’s Chief Executive Officer until October 2022 and $450,000 while serving as Executive Chairman, Mr. Grau’s base salary was $400,000, Mr. Olsen’s base salary was $400,000 and Ms. Schmidt’s base salary was $375,000.

ANNUAL BONUS

Under our executive compensation program, the Compensation Committee grants annual cash bonus incentive opportunities to executive officers and other members of management. For 2022, each of our named executive officers was eligible to earn an annual performance-based cash bonus under the Altice USA Short Term Incentive Compensation Plan (the “Short Term Incentive Plan”). The purpose of the Short Term Incentive Plan is to motivate and reward our executive officers by making a portion of their cash compensation dependent upon certain Company, corporate, business unit and individual performance goals.

The Compensation Committee reviews the target bonus levels of the named executive officers at least annually. The Compensation Committee evaluates each executive’s performance and responsibilities and may adjust executive target bonus levels accordingly. The Compensation Committee set the following bonus targets for the named executive officers for 2022: Mr. Mathew—$2,000,000 (maximum payout of $4,000,000); Mr. Goei—$3,000,000 (maximum payout of $6,000,000); Mr. Grau—$400,000 (maximum payout of $800,000); Mr. Olsen—$400,000 (maximum payout of $800,000); and Ms. Schmidt—$375,000 (maximum payout of $750,000). Pursuant to the terms of Mr. Mathew’s employment agreement with the Company, Mr. Mathew’s 2022 annual bonus was prorated for the length of his service during 2022 and was deemed earned at target, resulting in an actual payment of $493,151.

The 2022 annual cash bonus incentive opportunity for our named executive officers under the Short Term Incentive Plan was based on Altice USA financial, divisional and operational results as set forth below:

| | | | | | | | | | | | | | | | | | | | |

| Performance Area | | Performance Metrics* | | Weight | | Payout Range |

| Financial | | Adjusted EBITDA | | 25% | | 0% – 200% |

| Divisional | | Divisional Performance | | 50% | | 0% - 200% |

| Operational | | Discretionary Objectives | | 25% | | 0% – 200% |

| Total | | | | 100% | | 0% – 200% |

*Results below the minimum or above the maximum receive no payout or maximum payout, respectively. The Compensation Committee has the discretion to make adjustments downward or upward (to a maximum of 200%) for individual performance and other factors.

For 2022, the Compensation Committee added a Divisional performance metric designed to reflect the performance of the Company’s different business divisions. The Divisional performance metric is earned based on the average payout score of the Company's B2C, Mobile & B2B SMB bonus plan, Operations bonus plan, CTIO bonus plan and the News & Advertising bonus plan. The Operational performance metric is a discretionary measure based on the overall effectiveness of our corporate departments in supporting the Company's financial and operational objectives for the fiscal year, as determined by the Compensation Committee.

For our corporate leaders, including our named executive officers, these performance areas resulted in a payout score equal to 35% of target bonus, reflecting a Financial payout score of 0%, a Divisional payout score of 12.5% and an Operational payout score of 22.5%. The minimum Adjusted EBITDA performance threshold for the financial performance metric, $3,946,500, was not met, resulting in no payout for the Financial performance metric. To increase retention following prior year (2021) payouts for senior leaders that were below target, the Compensation Committee exercised its discretion under the Short Term Incentive Plan to adjust the total payout score to 100% of target.

The definition of Adjusted EBITDA is described in the section titled “Description of Non-GAAP Financial Measures” below.

LONG TERM INCENTIVES

The Compensation Committee designs our executive compensation program to achieve the objectives described above under our “Executive Compensation Philosophy”. We grant equity awards to encourage an ownership culture and align management with stockholders’ interests.

In December 2021, we granted our senior leaders, including Messrs. Goei, Grau and Olsen and Ms. Schmidt a multi-year stock option award and RSU award under the Amended and Restated Plan, the first installment of which vested on December 29, 2022 and the second and third installments of which will vest on December 29, 2023 and 2024, respectively. No additional awards were granted to Messrs. Goei, Grau and Olsen and Ms. Schmidt during 2022.

In connection with Mr. Mathew’s appointment as CEO of the Company, Mr. Mathew was granted an initial equity award of 1,724,138 RSUs and stock options to purchase 3,144,654 shares of Class A common stock, each vesting 50% on October 26, 2024 and 25% on each of October 26, 2025 and 2026. Pursuant to the terms of Mr. Mathew’s employment agreement with the Company, following the second anniversary of the grant date of his initial equity award, Mr. Mathew will be eligible to participate in the Company’s annual long-term incentive program, with an annual target award opportunity of $5,000,000.

The objective of our equity incentive programs has been, and continues to be, to link the personal interests of equity incentive plan participants to those of our stockholders. Because substantially all of our outstanding stock options granted under the Amended and Restated Plan have exercise prices above the recent trading prices of our common stock, the Board, the Compensation Committee and management determined these stock options no longer provide a meaningful compensatory opportunity to the holders of such stock options and, accordingly, are no longer effective as incentives to retain and motivate our employees.

To increase the retention and motivational value of the equity awards held by eligible employees of the Company, on December 16, 2022, the Board approved, and on December 29, 2022, Next Alt, as our stockholder holding a majority of the voting power of our outstanding capital stock, approved a stock option exchange program pursuant to which eligible employees were provided the opportunity to exchange eligible stock options for a number of RSUs and deferred cash-denominated awards (the “Exchange Offer”). We believe that the Exchange Offer is an important component in our efforts to achieve our goal of linking the interests of our employees with those of our stockholders. The Exchange Offer commenced on January 30, 2023 and closed on March 1, 2023. Messrs. Mathew and Goei were not eligible to participate in the Exchange Offer. Each of Messrs. Grau and Olsen and Ms. Schmidt participated in the Exchange Offer.