UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | | | | |

| ý | Filed by the Registrant | | o | Filed by a Party other than the Registrant |

Check the appropriate box:

| | | | | | | | | | | | | | |

| | | | | |

| o | | Preliminary Proxy Statement | | |

| | | | | |

| o | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | | |

| | | | | |

| ý | | Definitive Proxy Statement | | |

| | | | | |

| o | | Definitive Additional Materials | | |

| | | | | |

| o | | Soliciting Material Pursuant to §240.14a-12 | | |

| | | | | |

ALTICE USA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): | |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

2020 Notice of Annual Meeting and Proxy Statement

June 10, 2020 at 9:00 a.m. Eastern Daylight Time

1 Court Square West, Long Island City, New York 11101

Altice USA, Inc.

1 Court Square West, Long Island City, New York 11101

Dear Stockholder:

This year’s annual meeting of stockholders will be a completely virtual meeting, conducted solely online through an audio webcast on Wednesday, June 10, 2020 at 9:00 a.m., Eastern Daylight Time. You will be able to attend the virtual annual meeting by logging in at www.virtualshareholdermeeting.com/ATUS2020. You will need the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials (the “Notice”) or your proxy card.

The attached proxy statement provides information on how to participate in the 2020 virtual annual meeting, how to vote your shares, and explains the matters to be voted upon in detail.

Your vote is important to us. Stockholders may vote by using a toll-free telephone number or over the Internet. Also, if you receive a paper copy of the proxy card by mail, you may sign and return the proxy card in the envelope provided.

Very truly yours,

Dexter Goei

Chief Executive Officer

April 24, 2020

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF ALTICE USA, INC.

Time: 9:00 a.m., Eastern Daylight Time

Date: June 10, 2020

Place: There will be no physical location for stockholders to attend. Stockholders may only participate by logging in at www.virtualshareholdermeeting.com/ATUS2020 and using the 16-digit control number provided on the Notice or your proxy card.

Purpose:

•Elect nine directors

•Ratify appointment of independent registered public accounting firm

•Approve Amended and Restated Altice USA 2017 Long Term Incentive Plan

•Conduct other business if properly raised

Only stockholders of record on April 13, 2020 may vote at the annual meeting.

Your vote is important. We urge you to vote your shares by telephone, over the Internet or, if you receive a copy of the proxy card by mail, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

Important Notice: Our 2019 Annual Report on Form 10-K and the 2020 Proxy Statement are available at:

https://investors.alticeusa.com/investors/alticeusa/sec-filings/default.aspx

By order of the Board of Directors,

Michael E. Olsen

Executive Vice President,

General Counsel and Secretary

April 24, 2020

TABLE OF CONTENTS

| | | | | | | | |

| | |

| GENERAL INFORMATION | | |

| HOW TO VOTE | |

| | VOTING RIGHTS | |

| HOW PROXIES WORK | |

| | REVOKING A PROXY | |

| SOLICITATION | |

| VOTES NEEDED | |

| QUORUM | |

| BOARD AND GOVERNANCE PRACTICES | | |

| OVERVIEW | |

| MEETINGS | |

| COMMITTEES | |

| | AUDIT COMMITTEE | |

| COMPENSATION COMMITTEE | |

| | DIRECTOR NOMINATIONS | |

| DIRECTOR SELECTION | |

| | BOARD LEADERSHIP STRUCTURE | |

| | RISK OVERSIGHT | |

| | CORPORATE GOVERNANCE GUIDELINES | |

| CONTROLLED COMPANY | |

| DIRECTOR INDEPENDENCE | |

| BOARD SELF-ASSESSMENT | |

| | EXECUTIVE SESSIONS OF NON-MANAGEMENT BOARD MEMBERS | |

| COMMUNICATING WITH OUR DIRECTORS | |

| CODE OF BUSINESS CONDUCT AND ETHICS | |

| DELINQUENT SECTION 16(A) REPORTS | |

| HEDGING | |

| | DIRECTOR COMPENSATION | |

| DIRECTOR COMPENSATION TABLE | |

| PROPOSAL 1 | | |

| | ELECTION OF DIRECTORS | |

| PROPOSAL 2 | | |

| | RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| REPORT OF AUDIT COMMITTEE | | |

| OUR EXECUTIVE OFFICERS | | |

| COMPENSATION DISCUSSION AND ANALYSIS | | |

| EXECUTIVE SUMMARY | |

| | ROLE OF COMPENSATION COMMITTEE | |

| | | | | | | | |

| BENCHMARKING | |

| SAY ON PAY | |

| BASE SALARIES | |

| | ANNUAL BONUS | |

| STOCK OPTIONS | |

| CARRY UNIT PLAN | |

| BENEFITS | |

| PERQUISITES | |

| POST-TERMINATION COMPENSATION | |

| EMPLOYMENT AGREEMENTS | |

| CERTAIN 2020 CHANGES TO COMPENSATION STRUCTURE | |

| TAX DEDUCTIBILITY OF COMPENSATION | |

| DESCRIPTION OF NON-GAAP FINANCIAL MEASURES | |

| REPORT OF COMPENSATION COMMITTEE | | |

| EXECUTIVE COMPENSATION TABLES | | |

| SUMMARY COMPENSATION TABLE | |

| GRANTS OF PLAN-BASED AWARDS | |

| 2017 LONG-TERM INCENTIVE PLAN | |

| CARRY UNIT PLAN | |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END | |

| OPTION EXERCISES AND STOCK VESTED | |

| PENSION BENEFITS | |

| CABLEVISION CASH BALANCE PENSION PLAN | |

| CABLEVISION EXCESS CASH BALANCE PLAN | |

| NONQUALIFIED DEFERRED COMPENSATION TABLE | |

| PAYMENTS ON TERMINATION OR CHANGE IN CONTROL | |

| SECURITY AUTHORIZED FOR ISSUANCE UNDER THE 2017 LONG TERM INCENTIVE PLAN | |

| PROPOSAL 3 | | |

| AMENDMENT AND RESTATEMENT OF 2017 LONG TERM INCENTIVE PLAN | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | | |

| RELATED PARTY TRANSACTION APPROVAL POLICY | |

| STOCK OWNERSHIP TABLE | | |

| OTHER MATTERS | | |

| MATTERS TO BE RAISED AT THE 2020 ANNUAL MEETING NOT INCLUDED IN THIS PROXY STATEMENT | |

| STOCKHOLDER PROPOSALS FOR 2021 ANNUAL MEETING | |

| HOUSEHOLDING | |

| ANNUAL REPORT ON FORM 10-K | |

| EXHIBIT A - ALTICE USA AMENDED AND RESTATED 2017 LONG TERM INCENTIVE PLAN | | |

GENERAL INFORMATION

HOW TO VOTE

The 2020 Annual Meeting of Stockholders of Altice USA, Inc. (“Altice USA,” the “Company,” “we,” “us” and “our”) will take place on June 10, 2020 at 9:00 a.m. Eastern Daylight Time.

This year's annual meeting will be a completely virtual meeting of stockholders through an audio webcast live over the Internet. There will be no physical meeting location. The meeting will only be conducted via an audio webcast. Please go to www.virtualshareholdermeeting.com/ATUS2020 for instructions on how to attend and participate in the annual meeting. Any stockholder may attend and listen live to the webcast of the annual meeting over the Internet at such website. Stockholders as of the record date may vote and submit questions while attending the annual meeting via the Internet by following the instructions listed on your proxy card. The webcast starts at 9:00 a.m., Eastern Daylight Time, on June 10, 2020. We encourage you to access the meeting prior to the start time.

As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the Internet. Accordingly, we are sending the Notice to our stockholders (other than those who previously requested electronic or paper delivery). All stockholders will have the ability to access the proxy materials on a website referred to in the Notice or to request to receive a printed set of the proxy materials. There is no charge to you for requesting a printed copy of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed set of proxy materials may be found in the Notice. In addition, stockholders may request to receive future proxy materials in printed form by mail or electronically by email on an ongoing basis.

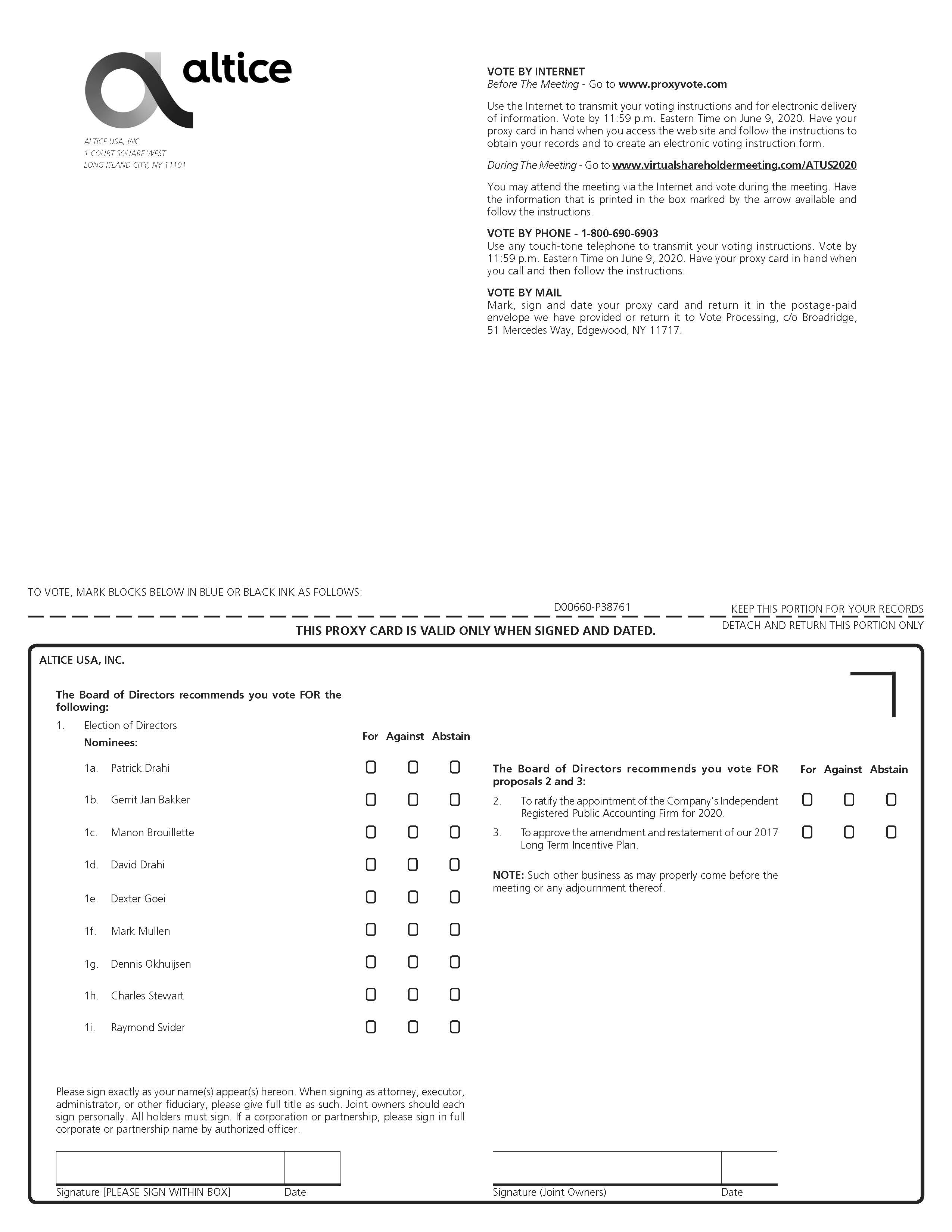

You may vote by telephone, over the Internet, or if you receive a copy of the proxy card by mail, by completing, signing, dating and returning your proxy card as soon as possible in the enclosed postage prepaid envelope.

VOTING RIGHTS

Only holders of the Company’s Class A common stock (“Class A common stock”) and the Company’s Class B common stock (“Class B common stock”) (together, the “Altice USA common stock”), as recorded in our stock register at the close of business on April 13, 2020, may vote at the annual meeting. On April 13, 2020, there were 412,128,117 shares of Class A common stock and 186,196,553 shares of Class B common stock issued and outstanding. As of the date of this Proxy Statement, the Company has not issued any shares of its Class C common stock or its preferred stock.

Each share of Class A common stock is entitled to one vote per share, and each share of Class B common stock is entitled to twenty-five votes per share, in each case, on any matter submitted to a vote of our stockholders. Except as set forth below or as required by Delaware law, holders of shares of Class A common stock and Class B common stock vote together as a single class on all matters (including the election of directors) submitted to a vote of our stockholders.

HOW PROXIES WORK

The Company’s Board of Directors (the “Board”) is asking for your proxy. If you submit a proxy but do not specify how to vote, the Company representative named in the proxy will vote your shares in favor of the director nominees identified in this proxy statement and for Proposals 2 and 3.

The Notice contains instructions for telephone and Internet voting. Also, if you receive a paper copy of the proxy card by mail, you may sign and return the proxy card in the envelope provided. Whichever method you use, giving us your proxy means you authorize us to vote your shares at the meeting in the manner you direct. You may vote for all, some, or none of our director candidates. You may also vote for or against Proposals 2 and 3 or abstain from voting.

You may receive more than one Notice or proxy or voting card depending on how you hold your shares. If you hold shares through another party, such as a bank or brokerage firm, you may receive material from them asking how you want to vote.

REVOKING A PROXY

A stockholder may revoke any proxy which is not irrevocable by submitting a new proxy bearing a later date, by voting by telephone or over the Internet, or by delivering to the Secretary of the Company (the “Secretary”) a revocation of the proxy in writing so that it is received by the Company prior to the annual meeting at 1 Court

Square West, Long Island City, New York 11101. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power.

SOLICITATION

These proxy materials are being provided in connection with the solicitation of proxies by the Company and are first being sent to stockholders on or about April 29, 2020. In addition to this mailing, the Company’s employees may solicit proxies personally, electronically or by telephone. The Company pays the costs of soliciting proxies. We also reimburse brokers and other nominees for their expenses in sending these materials to you and obtaining your voting instructions.

VOTES NEEDED

The vote required for Proposal 1 for the election of directors by stockholders, other than in a contested election of directors, shall be the affirmative vote of a majority of the votes cast with respect to a director nominee. For purposes of this paragraph, a ‘majority of the votes cast’ means that the number of votes cast ‘for’ a director must exceed the number of votes cast ‘against’ that director. In any contested election of directors, the nominees receiving the greatest number of the votes cast for their election, up to the number of directors to be elected in such election, shall be deemed elected. Abstentions and “broker non-votes” (as defined below) will not count as votes either ‘for’ or ‘against’ a nominee. A contested election is one in which the number of persons nominated exceeds the number of directors to be elected as of the date that is ten days prior to the date that the Company first mails its notice of meeting for such meeting to the stockholders.

Approval of Proposals 2 and 3 requires the affirmative vote of the holders of a majority of the voting power of the shares of stock present at the internet meeting or represented by proxy and entitled to vote on the subject matter. For Proposals 2 and 3, an abstention will have the same effect as a vote against the proposal because an abstention represents a share considered present and entitled to vote.

If your shares are held by a broker, the broker will ask you how you want your shares to be voted. If you give the broker instructions, your shares must be voted as you direct. If you do not give instructions, for Proposal 2 to ratify selection of the Company’s independent registered public accounting firm, the broker may vote your shares at its discretion. For the remaining proposals, including the election of directors, the broker cannot vote your shares at all. When that happens, it is called a “broker non-vote.” Broker non-votes are counted in determining the presence of a quorum at the meeting, but they will have no effect on the voting for Proposals 1, 2 and 3 because they do not represent shares present and entitled to vote.

QUORUM

In order to carry on the business of the meeting, we must have a quorum. This means that the holders of record of a majority of the voting power of the issued and outstanding shares of capital stock of the Company entitled to vote at the annual meeting must be represented at the annual meeting, either by proxy or present at the internet meeting.

Notwithstanding the foregoing, where a separate vote by a class or series or classes or series is required, a majority of the voting power of the outstanding shares of such class or series or classes or series, present at the internet meeting or represented by proxy, shall constitute a quorum entitled to take action with respect to the vote on that matter. Once a quorum is present to organize a meeting, it shall not be broken by the subsequent withdrawal of any stockholders.

BOARD AND GOVERNANCE PRACTICES

OVERVIEW

The board of directors (the “Board of Directors” or the “Board”) of Altice USA currently consists of nine members: Patrick Drahi (Chairman), Gerrit Jan Bakker, Manon Brouillette, David Drahi, Dexter Goei, Mark Mullen, Dennis Okhuijsen, Charles Stewart and Raymond Svider. See Stockholder Proposal 1 below for more information.

The following section provides an overview of our Board practices, Board committee responsibilities, our leadership structure, risk oversight, governance practices and director compensation.

| | | | | |

| Board Independence | lOur Board has determined that 3 out of 9 of our directors qualify as “independent” under the New York Stock Exchange (“NYSE”) Listing Standards. |

| Board Committees | lWe have two committees of the Board—the Audit Committee and the Compensation Committee—each of which is composed entirely of independent directors. lEach of our committees operates under its respective written charter and reports regularly to the Board concerning its activities. |

| Executive Sessions | lOur Board holds regular executive sessions of non-management directors. lThe non-management directors specify the procedure to designate the director who will preside at each executive session. |

| Board Oversight of Risk | lRisk management is overseen by our Audit Committee. lOur Compensation Committee reviews whether there are risks arising from our compensation practices to ensure that those practices encourage management and other employees to act in the best interests of our stockholders. |

| Corporate Governance Guidelines | lOur Board operates under our Corporate Governance Guidelines, which define director qualification standards and other appropriate governance procedures. |

| Annual Election of Directors | lOur second amended and restated bylaws (“Second Amended and Restated Bylaws”) provide for the annual election of all directors. |

| Majority Voting | lIn accordance with our Second Amended and Restated Bylaws, all questions presented to stockholders, other than in respect of the election of directors, are decided by the affirmative vote of the holders of a majority of the voting power of the shares present or represented by proxy and entitled to vote, unless otherwise required under applicable law. lFor the election of directors by stockholders, other than in a contested election of directors, the vote required is the affirmative vote of a majority of the votes cast with respect to a director nominee. |

| Related Party Transactions | lOur Related-Party Transactions Approval Policy requires the Audit Committee to review and approve, or take such other action as it may deem appropriate with respect to, any transactions involving the Company and its subsidiaries, on the one hand, and in which any director, officer, greater than 5% stockholder of the Company or any other “related person” under the related‑party disclosure requirements of the SEC has an interest, on the other hand. lThe Related‑Party Transaction Approval Policy cannot be amended or terminated without the prior approval of a majority of the Audit Committee. |

| Open Lines of Communication | lOur Board promotes open and frank discussions with senior management. lOur directors have access to all members of management and other employees and are authorized to hire outside consultants or experts at our expense. |

| Self-Evaluation | lOur Board and each of the Committees conduct annual self-evaluations. |

Our Board

Our Board is composed of nine members, three of whom have been determined by the Board to be independent directors under applicable NYSE corporate governance standards. Mr. Patrick Drahi is the Chairman of our Board.

We entered into a stockholders’ agreement (the “Stockholders’ Agreement”) in June 2018 with Next Alt S.à r.l. (“Next Alt”), an entity of which Mr. Patrick Drahi is the sole indirect controlling shareholder, and A4 S.A., an entity controlled by Mr. Drahi’s family.

•Under the Stockholders’ Agreement, Next Alt has the right to designate a number of directors to the board (the “Next Alt Designees”) based on Next Alt’s voting power as follows:

◦If Next Alt, A4 S.A., Mr. Patrick Drahi (or his heirs or entities or trusts directly or indirectly under his or their control or formed for his or their benefit) or any of their affiliates (collectively, the “Drahi Group”) beneficially owns in the aggregate, at least 50% of the voting power of our outstanding capital stock, Next Alt will have the right to designate six directors to the Board, and the Company will cause the Board to consist of a majority of directors nominated by Next Alt;

◦If the Drahi Group beneficially owns, in the aggregate, less than 50% of the voting power of our outstanding capital stock, Next Alt will have the right to designate a number of directors to the Board equal to the total number of directors comprising the entire Board multiplied by the percentage of the voting power of our outstanding common stock beneficially owned, in the aggregate, by the Drahi Group, rounding up in the case of any resulting fractional number;

◦If the Drahi Group beneficially owns, in the aggregate, less than 50% of the voting power of our outstanding capital stock, Next Alt will not have the right to designate a number of directors to the Board equal to or exceeding 50% of directors comprising the entire Board. One of Next Alt’s designation nominations will be an individual designated by A4 S.A., and Next Alt will agree to vote its shares in favor of electing the individual designated by A4 S.A;

◦If a director designated by Next Alt or by A4 S.A. resigns or is removed from the Board, as the case may be, only another director designated by Next Alt or by A4 S.A., as the case may be, may fill the vacancy; and

◦In the event Mr. Drahi is not a member of our Board, one representative of the Drahi Group will have board observer rights.

Messrs. P. Drahi, Bakker, D. Drahi, Goei, Okhuijsen and Stewart are Next Alt Designees to our Board.

Our Board Meeting Quorum Requirements

Our amended and restated certificate of incorporation (the “Third Amended and Restated Certificate of Incorporation”) has the following quorum requirements for meetings of the Board:

•a majority of the number of directors then in office will constitute a quorum;

•in the event Next Alt is entitled to nominate three or more directors to the Board pursuant to the Stockholders’ Agreement, such quorum must include (i) the Chairman of the board of managers of Next Alt nominated by Next Alt to the Board pursuant to the Stockholders’ Agreement and two other directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement or (ii) in the event the Chairman of the board of managers of Next Alt is not a member of the Board, three directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement; and

•in the event Next Alt is entitled to nominate one or two directors to the Board pursuant to the Stockholders’ Agreement and such directors are elected to the Board by the stockholders of the Company, a quorum must include each of the directors nominated to the Board by Next Alt pursuant to the Stockholders’ Agreement.

MEETINGS

The Board met five times in 2019. Each of our directors in 2019 attended at least 75% of the meetings of the Board and the committees of the Board on which he or she served, other than Mr. Svider.

We encourage our directors to attend annual meetings of stockholders; a majority of our directors attended our 2019 annual meeting.

COMMITTEES

The Board has two standing committees: the Audit Committee and the Compensation Committee, each of which consists entirely of independent board members.

AUDIT COMMITTEE

Committee members: Messrs. Mullen (Chairman) and Svider and Ms. Brouillette currently constitute the Audit Committee.

The Audit Committee met four times in 2019.

The primary responsibilities of the Audit Committee include:

•overseeing management’s establishment and maintenance of adequate systems of internal accounting, auditing and financial controls;

•reviewing the effectiveness of our legal, regulatory compliance and risk management programs;

•reviewing certain related party transactions in accordance with the Company’s Related Party Transaction Approval Policy;

•overseeing our financial reporting process, including the filing of financial reports; and

•selecting independent auditors, evaluating their independence and performance and approving audit fees and services performed by them.

Our Board has determined that each member of the Audit Committee is “independent” as defined under the listing standards of the NYSE and the requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is financially literate and has accounting or related financial management expertise, as such qualifications are defined under the rules of the NYSE, and that Mark Mullen, Chair of the Audit Committee, is an “audit committee financial expert” within the meaning of SEC rules and regulations.

The text of our Audit Committee charter is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

Our Board has established a procedure whereby complaints or concerns with respect to accounting, internal controls and auditing matters may be submitted to the Audit Committee. This procedure is described under “Communicating with Our Directors” below.

COMPENSATION COMMITTEE

Committee members: Messrs. Svider (Chairman) and Mullen and Ms. Brouillette currently constitute the Compensation Committee.

The Compensation Committee met four times in 2019.

The primary responsibilities of the Compensation Committee include:

•ensuring our executive compensation programs are appropriately competitive, support organizational objectives and stockholder interests and emphasize pay for performance linkage;

•evaluating and approving compensation and setting performance criteria for compensation programs for our chief executive officer and other executive officers;

•overseeing the implementation and administration of our compensation plans; and

•reviewing our compensation arrangements to determine whether they encourage excessive risk-taking, and mitigating any such risk.

The text of our Compensation Committee charter is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

Our Board has determined that each member of the Compensation Committee is “independent” and meets the independence requirements applicable to compensation committee members under the rules of the NYSE.

In accordance with its charter, the Compensation Committee has the authority to engage outside consultants to assist in the performance of its duties and responsibilities. The Compensation Committee did not engage an outside consultant in 2019.

DIRECTOR NOMINATIONS

The Board has established a nomination mechanism in our Corporate Governance Guidelines. The Board is responsible for selecting the nominees for election to the Board, subject to the then applicable terms of the Stockholders’ Agreement.

DIRECTOR SELECTION

The Board selects new nominees for election as a director considering the following criteria:

•the then applicable terms of the Stockholders’ Agreement;

•personal qualities and characteristics, accomplishments and reputation in the business community;

•current knowledge and contacts in the communities in which the Company does business and in the Company’s industry or other industries relevant to the Company’s business;

•ability and willingness to commit adequate time to Board and committee matters;

•the fit of the individual’s skills and personality with those of other directors and potential directors in building a Board that is effective, collegial and responsive to the needs of the Company; and

•diversity of viewpoints, background and experience.

BOARD LEADERSHIP STRUCTURE

The Chairman shall have general and active management and control of the business and affairs of the Company, subject to the control of the Board and the Stockholders’ Agreement, and shall see that all orders and resolutions of the Board are carried into effect. The positions of Chairman and CEO may be filled by one individual or by two different individuals. Mr. Drahi serves as Chairman of the Board.

RISK OVERSIGHT

One of the key functions of our Board is informed oversight of our risk management process. Our Board administers this oversight function directly, with support from the Audit and Compensation Committees, each of which addresses risks specific to its respective areas of oversight. In particular, our Audit Committee is responsible for considering and discussing our major financial risk exposures and cyber-security risks and the steps our management takes to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk taking. Board committees report to the full Board as appropriate, including when a matter rises to the level of a material or enterprise‑level risk. In addition, the Board receives detailed regular reports from members of our senior management and other personnel that include assessments and potential mitigation of the risks and exposures involved with their respective areas of responsibility.

CORPORATE GOVERNANCE GUIDELINES

We are committed to adhering to corporate governance practices that meet applicable U.S. corporate governance standards. Our Board has adopted Corporate Governance Guidelines that serve as a flexible framework within which our Board and its committees operate. These guidelines cover a number of areas including the size and composition of the Board, board membership criteria and director qualifications, director responsibilities, board agenda, role of the chief executive officer, meetings of independent directors, committee responsibilities and assignments, board member access to management and independent advisors, director communications with third parties, director compensation, director orientation and continuing education, evaluation of senior management and management succession planning.

The full text of our Corporate Governance Guidelines may be viewed at our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

CONTROLLED COMPANY

Our Class A common stock is listed on the NYSE. Because Mr. Drahi owns or controls (through entities controlled directly or indirectly by Mr. Drahi or his family (including Next Alt, Uppernext and A4 S.A.) as described in “Certain Relationships and Related Party Transactions”) shares representing a majority of the voting power of our outstanding common stock, we are a “controlled company” under NYSE corporate governance rules.

As a controlled company, we are eligible for exemptions from some of the requirements of these rules, including:

•the requirement that a majority of our Board consist of independent directors; and

•the requirement that we have a nominating and governance committee.

Consistent with these exemptions, we do not have (i) a majority of independent directors on our Board or (ii) a nominating and governance committee. The responsibilities that would otherwise be undertaken by a nominating and governance committee are undertaken by the full Board, or at its discretion, by a special committee established under the direction of the full Board.

Because of this control, Mr. Drahi and related parties control the outcome of any matters put before the stockholders.

DIRECTOR INDEPENDENCE

Ms. Brouillette, Mr. Mullen and Mr. Svider have been determined by the Board to be independent directors under applicable NYSE corporate governance standards.

BOARD SELF-ASSESSMENT

The Board conducts a self-evaluation at least annually to determine whether it is functioning effectively. The Board periodically considers the mix of skills and experience that directors bring to the Board to assess whether the Board has the necessary tools to perform its oversight function effectively.

In addition, our Audit Committee and Compensation Committee each conduct their own annual self-assessment, which includes an assessment of the adequacy of their performance as compared to their respective charters.

EXECUTIVE SESSIONS OF NON-MANAGEMENT BOARD MEMBERS

Our Corporate Governance Guidelines provide that our non-management directors meet in executive session at least quarterly, with no members of management present. The non-management directors specify the procedure to designate the director who will preside at each executive session. Non-management directors who are not independent under the rules of the NYSE may participate in these executive sessions, but independent directors under the rules of the NYSE meet separately in executive session at least once a year.

COMMUNICATING WITH OUR DIRECTORS

The Board welcomes communications from the Company’s stockholders, and it is the policy of the Company to facilitate communication from stockholders. The Board generally believes it is in the Company’s best interests that designated members of management speak on behalf of the Company. Stockholders and other interested parties wishing to communicate with the Board or with an individual Board member concerning the Company may do so by writing to the Board or to a particular Board member, by mailing such correspondence to:

Corporate Secretary

Altice USA, Inc.

Attn: General Counsel

1 Court Square West

Long Island City, NY 11101

Tel: 1-516-803-2300

Please indicate on the envelope or in the email whether the communication is from a stockholder or other interested party. The Board has instructed the Corporate Secretary and other relevant members of management to examine incoming communications and forward to the Board or individual Board members as appropriate, communications he or she deems relevant to the Board’s roles and responsibilities. The Board has requested that certain types of communications not be forwarded, and redirected if appropriate, such as: spam, business solicitations or advertisements, resumes or employment inquiries, service complaints or inquiries, surveys, or any threatening or hostile materials.

CODE OF BUSINESS CONDUCT AND ETHICS

Our Board has adopted a Code of Business Conduct and Ethics for all of our employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of our Code of Business Conduct and Ethics is available on our website. Our Code of Business Conduct and Ethics is a “code of ethics” as defined in Item 406(b) of Regulation S-K. We will make any legally required disclosures regarding amendments to or waivers of provisions of our code of ethics on our website.

The full text of the code is available on our website at www.alticeusa.com. A copy may be obtained, without charge, by writing to Altice USA, Inc., Attn: Corporate Secretary, 1 Court Square West, Long Island City, New York 11101.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, certain officers and any beneficial owners of more than 10% of our common stock to file reports relating to their ownership and changes in ownership of our common stock with the SEC and NYSE by certain deadlines. Based on a review of Section 16 filings with respect to our company, the following transactions (all of which were exempt from Section 16(b)) were reported after the applicable reporting deadline: (i) Next Alt S.á. r.l. a 10% owner and director by deputization, Mr. Drahi, a 10% owner and a director, and A4 S.A., as a director by deputization, filed two Form 4s reporting four transactions; (ii) Mr. Goei individually filed a Form 4 reporting four transactions; and (iii) Mr. Mullen filed a Form 4 reporting one transaction.

HEDGING

We do not have a formal hedging policy and do not prohibit our directors, officers or employees from entering into hedging transactions.

DIRECTOR COMPENSATION

Compensation for our non-employee directors is determined by our Board with the assistance of the Compensation Committee. See “Director Compensation Table” below for further details on director compensation.

DIRECTOR COMPENSATION TABLE

The table below shows the compensation paid to or earned by our directors for the year ending December 31, 2019. None of Messrs. Bakker, Bonnin, D. Drahi, P. Drahi, Goei, Okhuijsen and Stewart received any compensation from us for their services as directors of our Board in 2019. On February 20, 2019, Mr. Bonnin resigned as a member of our Board, as reported in a current report filed on Form 8-K with the SEC on February 22, 2019.

Compensation for our directors is determined by our Board with the assistance of the Compensation Committee. Each of Messrs. Mullen and Svider and Ms. Brouillette receives a base fee of $72,500 per year. In addition, the Audit Committee chair receives an annual fee of $32,500 and Audit Committee members each receive an annual fee of $22,500. The Compensation Committee chair receives an annual fee of $22,500 and Compensation Committee members each receive an annual fee of $5,000. The compensation of Mr. Svider is paid to BC Partners LLP.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Year | | Fees Earned or Paid in Cash ($) | | Total ($) |

| Raymond Svider | | 2019 | | 117,500 | | 117,500 |

| Mark Mullen | | 2019 | | 110,000 | | 110,000 |

| Manon Brouillette | | 2019 | | 100,000 | | 100,000 |

PROPOSAL 1

ELECTION OF DIRECTORS

The Board has nominated the nine director candidates named below, all of whom currently serve as our directors, to hold office until our next annual meeting of shareholders. There are no vacancies on the Board.

The Company representatives named in the proxy intend to vote for the election of each of the director nominees below, unless you indicate on your proxy that your vote should be withheld from any or all of the nominees.

Information on each of our nominees is given below.

The Board recommends you vote FOR each of the following candidates:

Patrick Drahi, 56, is the chairman of our Board. He founded Altice Europe N.V. ("Altice Europe") and its subsidiaries (the “Altice Group”) in 2002. Mr. Drahi is president of the board of Altice Europe. Mr. Drahi is a graduate from the Ecole Polytechnique and Ecole Nationale Supérieure de Télécommunications and began his professional career with the Philips Group in 1988 where he was in charge of international marketing (UK, Ireland, Scandinavia, Asia) in satellite and cable TV (DTH, CATV, MMDS). In 1991, Mr. Drahi joined the US/Scandinavian group Kinnevik‑Millisat, where he was in charge of the development of private cable networks in Spain and France and was involved in the launch of commercial TV stations in Eastern Europe. In 1993, Mr. Drahi founded CMA, a consulting firm specialized in telecommunications and media, which was awarded a mandate from BCTV for the implementation of Beijing’s full service cable network. In addition, Mr. Drahi founded two cable companies, Sud Câble Services (1994) and Médiaréseaux (1995), where he was involved in several network deployments and buy-outs. When Médiaréseaux was taken over by UPC at the end of 1999, Mr. Drahi advised UPC on its M&A activities until mid‑2001. Mr. Patrick Drahi is the father of Mr. David Drahi. Mr. Drahi’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and telecommunications.

Gerrit Jan Bakker, 49, joined Altice USA as a director in 2018. Mr. Bakker has over 12 years of experience in the telecommunications and media sector. Mr. Bakker currently serves as Group Treasurer at Altice Europe where Mr. Bakker is responsible for group-wide treasury management activities including financial risk management, liquidity management, intercompany financing, internal banking services, equity-related activities and management reporting. His previous experience also includes service in senior roles at Liberty Global plc where Mr. Bakker

served as Deputy Treasurer. Mr. Bakker earned a Bachelor of Public Administration and Bachelor of Business Administration degrees from Erasmus University in Rotterdam, The Netherlands. Mr. Bakker’s qualifications to sit on our Board include his substantial experience in the areas of corporate finance and telecommunications.

Manon Brouillette, 52, joined Altice USA as a director in 2017. Ms. Brouillette served as Chief Executive Officer of Videotron from 2014 until January 2019. Previously, she served as Vice President of Product at Videotron. Since January 2019, Ms. Brouillette has been an advisor to certain venture capital and private equity firms. She serves on the boards of directors of National Bank of Canada and Cirque du Soleil Entertainment Group. Ms. Brouilette has extensive experience in corporate transformation, new business models and digital transformation. Ms. Brouilette led a series of large-scale strategic rollouts including Videotron’s entry into the wireless market, the transformation to a digital-first cable television business model, and the evolution of Videotron from a content distributor to a fully integrated (creation, production & distribution) video content provider. In 2018, Ms. Brouillette led Videotron’s sub-brand business development, creating Fizz, the first 100% digital mobile and Internet provider in North America. Ms. Brouillette is involved in the women’s leadership programs Effet A and mentors start-up CEOs and Executives. Ms. Brouillette received a bachelor’s degree in communications and marketing from the Université Laval and completed the University of Western Ontario’s Ivey Executive Program. Ms. Brouillette’s qualifications to serve on our Board include her substantial experience in the areas of corporate strategy and operations.

David Drahi, 25, joined Altice USA as a director in 2019. Dr. Drahi graduated from the University of Oxford with a D.Phil. in Atomic and Laser Physics, obtained his Master in Optics and Physics from the Imperial College of London, and received his Bachelor of Science at Ecole Polytechnique in Lausanne, Switzerland. His research covered the fields of Quantum Optics and Quantum Cryptography. He previously worked at Cabovisao, previously owned by Altice Europe, and Icart, a subcontractor to Altice Europe. David Drahi is Patrick Drahi's son. Dr. Drahi’s qualifications to sit on our Board include his experience in the areas of corporate strategy and operations.

Dexter Goei, 48, has served as Chief Executive Officer of Altice USA since 2016. Mr. Goei was chairman of the boards of Altice USA and Altice Europe until the Distribution and a director of Altice Europe until October 2018. Mr. Goei first joined the Altice Group as Chief Executive Officer in 2009, helping to lead its development and growth from a French cable operator to a multinational telecoms operator with fixed and mobile assets across six different territories serving both residential and enterprise clients. Prior to joining the Altice Group, Mr. Goei spent 15 years in investment banking first with JPMorgan and then Morgan Stanley in their Media & Communications Group in New York, Los Angeles and London. He was Co‑Head of Morgan Stanley’s European Media & Communications Group when he left to join Altice. Mr. Goei is a graduate of Georgetown University’s School of Foreign Service with cum laude honors. Mr. Goei’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and telecommunications.

Mark Mullen, 55, joined Altice USA as a director in 2017. Mr. Mullen is co-founder and Managing Director of Bonfire Ventures, founded in 2017. Mr. Mullen also founded Double M Partners in 2012 and has since served as Managing Partner. Both Bonfire and Double M manage early stage capital funds in Los Angeles. Mr. Mullen also founded Mull Capital in 2005, an evergreen fund that invests directly in startups and in other investment funds. All of the funds focus on investing in internet, media and technology with primary emphasis on business to business solutions, security and software. Prior to Double M Partners, Mr. Mullen served as COO of the City of Los Angeles (Economic Policy) and Senior Advisor to the then-Mayor Antonio Villaraigosa where he oversaw several of the City’s assets including the LA International Airport (LAX), LA Convention Center, the Planning and Building & Safety Departments, as well as the Office of Small Business Services. From 1993 until 2007, Mr. Mullen ran the international M&A and private equity group for Daniels & Associates, an investment bank focused on the cable TV and broadband industry. Mr. Mullen was a senior partner of Daniels when it was acquired by RBC Capital Markets in 2007 where he stayed until 2010 as Managing Director. Mr. Mullen earned his BSBA with cum laude honors from the University of Denver in 1986 and earned his MBA in international business from the Thunderbird School of Global Management in 1992. Mr. Mullen’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations, finance and investments, including, capital markets, capital allocation and mergers and acquisitions.

Dennis Okhuijsen, 49, joined Altice USA as a director in 2017. Mr. Okhuijsen joined the Altice Group in September 2012 and served as its CFO until October 2018. He currently serves as a senior advisor to the Altice Group. Before joining the Altice Group, he was a Treasurer for Liberty Global from 2005 until 2012. From 1993 until 1996 he was a senior accountant at Arthur Andersen. Mr. Okhuijsen joined UPC in 1996 where he was responsible for accounting, treasury and investor relations up to 2005. His experience includes raising and maintaining non-investment grade capital across both the loan markets as well as the bond/equity capital market. In his previous capacities he was also responsible for financial risk management, treasury and operational financing. He holds a Master’s of Business Economics from the Erasmus University Rotterdam. Mr. Okhuijsen’s qualifications to sit on our Board include his substantial experience in the areas of corporate finance and strategy, including capital markets and capital allocation.

Charles Stewart, 50, is the Chief Executive Officer of Sotheby's. Mr. Stewart served as Co-President and Chief Financial Officer of Altice USA from 2015 to 2019, and has served as a director of Altice USA since 2018. Mr. Stewart joined Altice USA after 21 years of corporate, finance and investment banking experience in the United States, Latin America and Europe. Most recently, Mr. Stewart served as Chief Executive Officer of Itau BBA International plc from 2013 until 2015, where he oversaw Itau‑Unibanco’s wholesale banking activities in Europe, the United States and Asia. Prior to that, he spent nineteen years at Morgan Stanley as an investment banker in various roles, including nine years focusing on the U.S. cable, broadcast and publishing industries. Mr. Stewart also acted as Deputy Head of Investment Banking for EMEA and was a member of the global investment banking management committee. Mr. Stewart is a graduate of Yale University. Mr. Stewart’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, operations and finance.

Raymond Svider, 57, joined Altice USA as a director in 2017. Mr. Svider is the Chairman and a Partner of BC Partners. He joined the firm in 1992 and is currently based in New York. Over the years, Mr. Svider has participated and led investments in a number of sectors including TMT, healthcare, industrials, business services, consumer and retail. He is currently Executive Chairman of PetSmart, Chairman of the Board of Chew, Inc (NYSE “CHWY”), Chairman of the Board of Accudyne Industries, Chairman of the Advisory Board of The Aenova Group, and also serves on the boards of Intelsat (NYSE “I”), Navex Global, GFL Environmental, and Presidio, Inc. Mr. Svider previously served as a Director of Teneo Global. Office Depot, Multiplan, Unity Media, Neuf Cegetel, Polyconcept, Neopost, Nutreco, UTL and Chantemur. Mr. Svider is also on the Boards of the Mount Sinai Children’s Center Foundation in New York and the Polsky Center Private Equity Council at the University of Chicago. Mr. Svider received an MBA from the University of Chicago and an MS in Engineering from both Ecole Polytechnique and Ecole Nationale Superieure des Telecommunications in France. Mr. Svider’s qualifications to sit on our Board include his substantial experience in the areas of corporate strategy, finance and investments.

PROPOSAL 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has approved the retention of KPMG LLP (“KPMG”) as our independent registered public accountants for 2020. KPMG will audit our financial statements for fiscal year 2020. We are asking that you ratify that appointment, although your ratification is not required. A KPMG representative will attend the annual meeting to answer appropriate questions and to make a statement if he or she desires.

This proposal requires the affirmative vote of the majority of the votes cast by the holders of Class A common stock and Class B common stock, voting together as a single class. In accordance with our Third Amended and Restated Certificate of Incorporation, holders of Class A common stock have one vote per share and holders of Class B common stock have twenty-five votes per share.

The Board recommends you vote FOR this proposal.

KPMG LLP Information

The following table presents fees for services rendered by KPMG in 2019 and 2018.

| | | | | | | | | | | |

| 2019 | | 2018 |

| (in thousands) | | |

Audit Fees(1) | $ | 4,587 | | | $ | 5,114 | |

Audit Related Fees(2) | — | | | 3,125 | |

Tax Fees(3) | 662 | | | 529 | |

All other Fees(4) | 435 | | | — | |

| Total Fees | $ | 5,684 | | | $ | 8,768 | |

(1)Audit fees for 2019 and 2018 consisted principally of fees charged for services related to the annual audit of the Company’s consolidated financial statements, audits of internal control over financial reporting, quarterly reviews of the Company’s interim consolidated financial statements and procedures related to the Company's debt offerings.

(2)Audit related fees for 2018 consisted principally of fees billed for services relating to the Company’s spin-off from Altice Europe and audits of employee benefit plans.

(3)Tax fees for 2019 and 2018 consisted of fees for the preparation of tax returns and tax consultation services.

(4)All other fees primarily relates to diligence services performed.

The Audit Committee’s policy requires that the Audit Committee pre-approve audit and non-audit services performed by the independent registered public accounting firm. The Audit Committee may delegate its pre-approval authority

to the Chairman or any other member of the Audit Committee. All of the services for which fees were disclosed in the table above were pre-approved under the Audit Committee’s pre-approval policy.

REPORT OF AUDIT COMMITTEE

In accordance with its charter, the Audit Committee assists the Board in its oversight of the Company’s financial reporting process. Management of the Company is responsible for the preparation, presentation and integrity of the Company’s financial statements and for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm (the “independent auditor”) is responsible for auditing the Company’s annual financial statements and expressing opinions as to the conformity of the annual financial statements with generally accepted accounting principles and on the effectiveness of the Company’s internal control over financial reporting.

As part of its oversight activities during 2019, the Audit Committee discussed with the independent auditor the overall scope and plans for its audit and approved the terms of its engagement letter. The Audit Committee also reviewed the Company’s internal audit plan. The Audit Committee met with the independent auditors and with the Company’s internal auditors, in each case with and without other members of management present, to discuss the results of their respective examinations, their evaluations of the Company’s internal controls and the overall quality and integrity of the Company’s financial reporting. Additionally, the Audit Committee reviewed the performance, responsibilities, budget and staffing of the Company’s internal auditors. Further, the Audit Committee monitored the Company’s response to matters raised through the confidential hotline and also discussed with management the processes by which the Company assesses and manages exposure to risks.

In the performance of its oversight function, the Audit Committee reviewed and discussed with management and the independent auditor the audited financial statements for the year ended December 31, 2019 and the independent auditor’s evaluation of the Company’s internal control over financial reporting. The Audit Committee discussed with the independent auditor the matters required to be discussed pursuant to Public Company Accounting Oversight Board Auditing Standard No. 1301 (Communications with Audit Committees). The Audit Committee received the written disclosures and the letter from the independent auditor required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee regarding independence, and the Audit Committee discussed with the independent auditor that firm’s independence. All audit and non-audit services performed by the independent auditor were approved in accordance with the Audit Committee’s pre-approval policy, and the Audit Committee has concluded that the provision of such services to the Company is compatible with the independent auditor’s independence.

Based upon the review and discussions described in this report, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019.

| | | | | | | | |

| Members of the Audit Committee | | |

| Mark Mullen (chair) | Manon Brouillette | Raymond Svider |

OUR EXECUTIVE OFFICERS

Our current executive officers are:

| | | | | |

| Dexter Goei | Chief Executive Officer (CEO) |

| Michael J. Grau | Executive Vice President, Chief Financial Officer (CFO) |

| Abdelhakim Boubazine | President, Telecom and Chief Operating Officer (COO) |

| Michael E. Olsen | Executive Vice President, General Counsel and Secretary |

| Colleen Schmidt | Executive Vice President, Human Resources |

Biography for Dexter Goei is provided above in Stockholder Proposal 1.

Michael J. Grau, 54, is Executive Vice President, Chief Financial Officer of Altice USA. In this role, he oversees the Company’s financial and accounting matters as well as its strategic planning and analysis, internal audit, tax, investor relations and treasury activities. He joined Altice USA through the Cablevision acquisition where he most recently served as Executive Vice President of Financial Planning & Control at the Company. Prior to this, Mr. Grau held various leadership roles in finance at Cablevision for more than 15 years. Earlier in his career he held senior financial positions at Winstar Communications, Health Professionals Inc, and Deloitte & Touche. Mr. Grau earned his bachelor’s degree in Accounting from Hofstra University.

Abdelhakim Boubazine, 44, is President, Telecom and Chief Operating Officer of Altice USA, and has served as Chief Operating Officer of Altice USA since 2016. He joined the Altice Group in 2014 as CEO of Altice in the Dominican Republic. There he oversaw cable television, broadband and mobile operations, serving more than 4 million customers. Prior to Altice, Mr. Boubazine was CEO of ERT, a company specializing in the design, construction and operation of the latest‑generation cable and fiber networks in France, Belgium, Luxembourg and the French West Indies and which was one of the main sub‑contractors of Altice in these regions. Prior to joining the telecommunications industry, he had an international career of more than 10 years in the oil and gas industry, where he occupied various operations, business and senior management roles in Europe, Asia, North America, Africa and the Middle East. Mr. Boubazine holds an engineering degree from the École Centrale de Lyon and a Master’s degree in Theoretical Physics from the University of Strasbourg. He is also a post‑graduate in Petroleum Engineering & Management from Imperial College of London.

Michael E. Olsen, 55, is Executive Vice President, General Counsel and Secretary for Altice USA. As General Counsel and Secretary, Mr. Olsen is responsible for all legal affairs for the Company. Prior to his appointment, he served as a Senior Vice President in the Altice USA Legal department where he oversaw the Company’s legal activities in support of US operations, as well supporting regulatory and legislative policies across all of the Company’s business interests. Prior to the acquisition of Cablevision by Altice, Mr. Olsen held the position of Senior Vice President, Legal Regulatory and Legislative Affairs overseeing the Company’s public policy and legal strategy at the FCC, Congress, and before state and local government, developing and implementing legal policy for the Company across the range of its businesses. Mr. Olsen is a former clerk to the US District Court in Los Angeles and graduate of Georgetown University (JD) and Loyola Marymount University (BBA).

Colleen Schmidt, 51, is Executive Vice President, Human Resources of Altice USA. In this role she oversees the human resources function and is charged with conceiving of and executing on organizational and HR initiatives across the Company in order to foster an efficient, high-performing workforce. Ms. Schmidt joined Altice USA through the Cablevision acquisition, where she was serving as Senior Vice President, Human Resources and Internal Communications. Prior to that, Ms. Schmidt spent almost 20 years in HR leadership roles within the electronics distribution, financial services and entertainment industries, including Vice President of Global Talent Management for Arrow Electronics, Managing Director, Human Resources for the Consumer and Global Products and Services divisions of Marsh Inc. as well as earlier roles at Home Box Office and T. Rowe Price Associates. Ms. Schmidt holds a bachelor’s degree in psychology from the University of Virginia.

COMPENSATION DISCUSSION AND ANALYSIS

EXECUTIVE SUMMARY

Overview

This section discusses the material components of our executive compensation program for each of our named executive officers in 2019. Our named executive officers are:

•Dexter Goei, Chief Executive Officer (CEO) and member of our Board;

•Michael J. Grau, Executive Vice President, Chief Financial Officer (CFO);

•Charles F. Stewart, Former Co-President and CFO, and member of our Board;

•Abdelhakim Boubazine, President, Telecom and Chief Operating Officer (COO);

•Michael E. Olsen, Executive Vice President, General Counsel and Secretary; and

•Colleen Schmidt, Executive Vice President, Human Resources.

The compensation discussed in this section is the compensation paid to our named executive officers with respect to their service to Altice USA in 2019.

Executive Compensation Philosophy

The Company’s executive compensation philosophy is based on the following principles:

•provide total compensation that attracts, motivates and retains individuals with the knowledge, expertise and experience required for each specific role;

•deliver an appropriate proportion of the total compensation package through variable pay elements linked to performance over the short- and long-term;

•encourage and reward performance that will lead to long-term enhancement of stockholder value; and

•take into account compensation practices in the markets in which we operate and compete for talent.

Determination of Compensation

The Compensation Committee of our Board of Directors (the “Compensation Committee”) is responsible for overseeing our overall compensation structure and assessing whether our compensation structure results in appropriate compensation levels and incentives for executive management. Compensation levels for our named executive officers are determined by the Compensation Committee within the framework of the Company’s executive compensation philosophy, as described above, and in consideration of a number of factors, such as the nature of the role, experience and performance of the individual and compensation levels for similar roles in the market. Each year, the Chairman of the Board reviews the performance of the CEO and recommends to the Compensation Committee base salary adjustments, an annual bonus based upon performance against the objectives approved by the Compensation Committee, and long-term incentive grants for the CEO. The management of the Company provides to the Compensation Committee the CEO’s recommendations on the compensation, including an annual bonus and long-term incentive grants for executive officers, other than the CEO.

ROLE OF COMPENSATION COMMITTEE

The responsibilities of the Compensation Committee are set forth in its charter. Among other responsibilities, the Compensation Committee (1) establishes our general compensation philosophy and, in consultation with management, oversees the development and implementation of compensation programs; (2) reviews and approves corporate goals and objectives relevant to the compensation of our CEO and the other executive officers of the Company who are required to file reports under Section 16(a) of the Exchange Act, evaluates such executive officers' performance in light of those goals and objectives and determines and approves their compensation levels based upon those evaluations; and (3) administers our stockholder-approved compensation plans.

BENCHMARKING

The Compensation Committee reviewed and compared compensation for a core peer group of companies in the same general industry or industries as the Company, as well as companies of similar size and business mix to evaluate the competitiveness and appropriateness of our compensation program. The Compensation Committee selected the following list of companies that would comprise our peer group for 2019 compensation decisions:

•AT&T Inc.

•CenturyLink, Inc.

•Charter Communications, Inc.

•Comcast Corporation

•DISH Network Corporation

•Frontier Communications Corporation

•Sprint Corporation

•T-Mobile US, Inc.

•Verizon Communications Inc.

•Windstream Holdings, Inc.

The Compensation Committee determined that the peer group currently represented an appropriate benchmark for the competitive market for our senior executive talent, based on our business operations and competitive labor markets.

Management presented to the Compensation Committee a comparison of 2019 actual base salary, projected 2019 bonus, total cash compensation (defined as base salary plus bonus), long-term incentives and total direct compensation (defined as total cash compensation plus the value of long-term incentives) of our named executive officers with the 25th, median and 75th percentile of the peer group.

The Compensation Committee also received information from management comparing actual 2018 peer group compensation and projected 2019 compensation levels for the named executive officers to comparable positions among the peer companies. Compensation of Mr. Goei, the Company’s CEO, was compared to chief executive officers at the peer group companies. Compensation of Mr. Grau, the Company's Executive Vice President and CFO was compared to chief financial officers at the peer group companies. Compensation of Mr. Boubazine, the Company's President, Telecom and COO, was compared to chief operating officers at the peer group companies. Compensation of Mr. Olsen, the Company's Executive Vice President, General Counsel, was compared to general counsels at the peer group companies. Compensation of Ms. Schmidt, the Company's Executive Vice President, Human Resources, was compared to top human resources executive roles in the Willis Towers Watson executive general industry compensation survey.

Based on the total compensation review, the Compensation Committee set a general guideline for target total direct compensation for named executive officers at or near the median of the peer group based on a combination of internal and market considerations. Internal factors include experience, skills, position, level of responsibility, historic and current compensation levels, internal relationship of compensation levels between executives, as well as attraction and retention of executive talent. Market considerations include referencing market pay levels and pay practices among a peer group of companies with a reference to the median of the peer group. The Compensation Committee’s decisions are based upon a combination of these considerations and may exceed or fall below the median of the peer group. The Compensation Committee believed that this range was appropriate in light of the dynamics, diversity, complexities and competitive nature of the Company’s businesses as well as the Company’s performance. The Compensation Committee believed that the guideline for target total direct compensation provided a useful point of reference, along with the other factors described above, in administering the Company’s executive compensation program.

SAY ON PAY

In accordance with the advisory vote on the frequency of the stockholder advisory vote on executive compensation submitted to stockholders at the Company's 2019 annual meeting, the Company will hold a stockholder advisory vote on executive compensation every three years. The most recent executive compensation advisory vote was held at the Company's 2019 annual meeting of stockholders, at which approximately 99% of the votes of holders of Class A and Class B common stock, voting together as a single class, approved the advisory vote on the compensation of the executive officers. More than a majority of the votes of Class A common stock were cast to approve the advisory vote on the compensation of executive officers. The Compensation Committee considered the affirmative outcome of this vote for compensation and has continued to apply the same principles when making compensation decisions for our named executive officers.

The next executive compensation advisory vote will be held at the 2022 annual meeting of stockholders.

ELEMENTS OF COMPENSATION

BASE SALARIES

The named executive officers receive a base salary to compensate them for services provided to the Company. Base salary is intended to provide a fixed component of compensation reflecting various factors, such as the nature of the role and the experience and performance of the individual. The Compensation Committee in 2019 reviewed the base salaries of the executive officers. The Compensation Committee kept the named executive officers’ salaries constant except that, in light of Mr. Grau's promotion to Executive Vice President, Chief Financial Officer, the Compensation Committee increased Mr. Grau's annualized base salary from $325,000 to $400,000 effective January 1, 2020, in connection with Mr. Olsen's role change to Acting General Counsel and Secretary, the Compensation Committee increased Michael Olsen's annualized base salary from $300,000 to $325,000 effective April 6, 2019, and in light of Mr. Olsen's promotion to Executive Vice President, General Counsel and Secretary, the Compensation Committee increased Mr. Olsen's annualized base salary from $325,000 to $400,000 effective January 1, 2020. As of December 31, 2019, Mr. Goei's annualized base salary was $750,000, Mr. Boubazine’s annualized base salary was $500,000, and Ms. Schmidt's annualized base salary was $350,000. Mr. Stewart's annualized base salary was $500,000 (for the portion of the year during which he was an executive officer).

ANNUAL BONUS

Under our executive compensation program, the Compensation Committee grants annual incentive awards, or bonuses, to executive officers and other members of management. For 2019, each of our named executive officers was eligible to earn an annual performance-based cash bonus under the Altice USA Short Term Incentive Compensation Plan (the “Short Term Incentive Plan”). The purpose of the Short Term Incentive Plan is to motivate

and reward our executive officers by making a portion of their cash compensation dependent upon certain company, corporate, business unit and individual performance goals.

The Compensation Committee reviews the target bonus levels of the named executive officers at least annually. The Compensation Committee evaluates each executive’s performance and responsibilities and may adjust executive target bonus levels accordingly. In 2019, the Compensation Committee, in its discretion, increased the 2019 annual target bonus for Mr. Stewart and Mr. Boubazine from 100% to 200% of base salary paid (2019 target equal to $1,000,000 with a maximum payout of $2,000,000, each), increased the 2019 annual target bonus for Ms. Schmidt from 60% to 100% of base salary paid (2019 target equal to $349,038 with a maximum payout of $698,076) and, in connection with Mr. Olsen's role change to Acting General Counsel and Secretary, increased his 2019 annual target bonus from 40% to 60% of base salary paid (2019 target equal to $190,384 with a maximum payout of $380,769). In 2020, the Compensation Committee, in its discretion and in light of Mr. Olsen's promotion to Executive Vice President, General Counsel and Secretary, increased the 2019 annual target bonus for Mr. Olsen from 60% to 100% of target (2019 target of $317,308 with a maximum payout of $634,616). The Compensation Committee maintained the 2019 bonus targets for the other named executive officers: Mr. Goei - $3,000,000 (maximum payout of $6,000,000) and Mr. Grau - 100% of base salary paid (2019 target equal to $324,038 with a maximum payout of $648,076).

The 2019 annual incentive opportunity for our named executive officers consists of a formula-based award based on Altice USA financial and operational results. The Compensation Committee has the discretion to adjust the formula-based award for individual performance and other factors. The 2019 formula-based award performance metrics are below:

Altice USA Performance Metrics

| | | | | | | | | | | | | | |

| Performance Area | | Weight | | Performance Metrics* |

| Financial | | 75% | | Adjusted EBITDA |

| Operational | | 25% | | Corporate Performance |

| Total | | 100% | | |

* Corporate Performance is a measure of the Company's achievement against its 2019 strategic objectives.

The 2019 formula-based annual incentive plan for our corporate leaders, including our named executive officers, after giving effect to plan adjustments approved by the Compensation Committee, had a payout score equal to 25%. Based on the significant shareholder valued delivered in 2019, as well as the successful launch of Altice Mobile and the migration of a major billing/operation system, the Compensation Committee decided to adjust the payout score for corporate leaders, including the named executive officers, from 25% to 50%.

STOCK OPTIONS

In 2019, certain members of management, including Mr. Olsen, Mr. Grau and Ms. Schmidt were granted stock options under the Altice USA 2017 Long Term Incentive Plan (the “Plan”). Historically, our named executive officers were granted stock options in the same month each year. Mr. Goei, Mr. Stewart and Mr. Boubazine were granted stock options in December, and Mr. Grau, Mr. Olsen and Ms. Schmidt were granted stock options in June. In connection with Mr. Olsen's role change to Acting General Counsel and Secretary effective April 2019, the Compensation Committee approved a stock option grant for Mr. Olsen in April rather than in June. Mr. Goei and Mr. Boubazine's long term incentive grants were made in January 2020 (contingent upon shareholder approval) instead of December 2019 and in an effort to align grant cycle timing for all executive officers, Mr. Grau, Mr. Olsen and Ms. Schmidt also received long term incentive grants in January 2020 (contingent upon shareholder approval) instead of June 2020. Additional information regarding these grants is included in Certain 2020 Changes to Compensation Structure and in Proposal 3. Mr. Stewart did not receive a long term incentive award in January 2020 because he is no longer an executive officer.

Mr. Olsen received 88,836 stock options with an exercise price of $22.51, which was determined based on the 30-day volume weighted average of the closing price of Class A common stock as of the day prior to the grant date. On June 26, 2019, Mr. Grau and Ms. Schmidt each received 83,052 stock options with an exercise price of $24.08, which was determined based on the 30-day volume weighted average of the closing price of Class A common stock as of the day prior to the grant date. The stock options granted cliff vest on the third anniversary of the grant date, and are generally subject to continued employment with the Company or any of its affiliates and expire ten years from the date of grant. The options are generally subject to the provisions of the Company’s form of non-qualified stock option award agreement, which was filed with the Commission on January 3, 2018 as Exhibit 99.1 to a

Current Report on Form 8-K. We believe stock options provide the named executive officer with an incentive to improve the Company’s stock price performance and a direct alignment with shareholders’ interests, as well as a continuing stake in the long-term success of the Company.

CARRY UNIT PLAN

On July 13, 2016, the Neptune Management Limited Partnership Carry Unit Plan (the “Carry Unit Plan”) was created to provide participants, including our named executive officers, with an opportunity to participate in the long-term growth and financial success of our operations. When established, CVC 3 B.V. (“CVC 3”), a subsidiary of Altice Europe N.V., controlled the general partner of Neptune Management Limited Partnership (the “Partnership”) and held economic interests in the Carry Unit Plan in the form of Class A Units. As of December 7, 2019, CVC 3 had transferred its control of the general partner and all of its then-remaining economic interests in the Partnership to us. See “Certain Relationships and Related Party Transactions—Neptune Holdings US LP Transfer” for further information.

Under the Carry Unit Plan, profits interests denominated in units of ownership (the “Units”) of the Partnership were granted to participants. A profits interest gives the participant the right to share in specified future profits and appreciation in value that the participants of the Partnership may receive, including profits paid upon a sale of the investors’ interests. Economically, a profits interest is similar to a stock option granted on the stock of a corporation insofar as a participant realizes value only if the Partnership from which the profits interest is granted appreciates in value or has profits after the grant date. Holders of vested Units receive Class A common stock at the discretion of the Carry Unit Plan administrator upon vesting in an amount calculated using the fair market value of Units and based on the then trading price of Class A common stock. As of December 31, 2019, approximately 37.5 million Units granted under the Carry Unit Plan were not yet vested.

On July 13, 2016, Mr. Goei received 10,000,000 performance-vesting Units that were scheduled to vest 60 days after completion of our 2019 audited financial statements based on meeting or exceeding a consolidated net revenue target for fiscal year 2019 of $10 billion and meeting or exceeding an adjusted EBITDA target for fiscal year 2019 of $5 billion, or meeting or exceeding a CapEx Adjusted EBITDA target for fiscal year 2019 of $4 billion, and based on Mr. Goei’s continued service to us. This award did not have a threshold or maximum payout. Following a recommendation by the Compensation Committee, on December 31, 2019, the Board, as administrator of the Carry Unit Plan, approved the conversion of these performance-vesting Units into 1,425,153 shares of Class A common stock, subject to Mr. Goei’s entry into a Restriction Agreement with respect to such shares. The Restriction Agreement provides that Mr. Goei will forfeit the shares if an adjusted EBITDA performance target is not met in respect of a fiscal year before fiscal year 2023 or if Mr. Goei does not remain employed with us through the achievement of the performance target.

BENEFITS

The named executive officers are eligible to participate in the health and welfare benefit plans made available to the other benefits-eligible employees of the Company, including medical, dental, vision, life insurance and disability coverage, while employed with the Company.