Free Writing Prospectus dated April 6, 2018

Relating to Preliminary Prospectus dated January 8, 2018

Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration Statement No. 333-222475

Altice USA, Inc.

This free writing prospectus relates only to, and should be read together with, the preliminary prospectus dated January 8, 2018 (the “Preliminary Prospectus”) included in the Registration Statement on Form S-1 (File No. 333-222475) (the “Registration Statement”) relating to the distribution by Altice N.V., the controlling stockholder of Altice USA, Inc. (the “Company”), of the Company’s Class A common stock and Class B common stock to Altice N.V. shareholders, which may accessed through the following link:

https://www.sec.gov/Archives/edgar/data/1702780/000104746918000085/a2234168zs-1.htm

This free writing prospectus should be read together with the Preliminary Prospectus included in the Registration Statement, including the section entitled “Risk Factors” beginning on page 17 of the Preliminary Prospectus.

* * *

On April 6, 2018, Altice N.V. (“Altice”), the controlling stockholder of Altice USA, Inc. (“Altice USA”), published the convocation for Altice’s annual general meeting (“AGM”) at which shareholders of Altice are invited to, among other items, cast their vote on the proposal to approve the intended separation of Altice USA from Altice (the “Separation”), which was previously announced on January 8, 2018. The Separation is to be effected by a special distribution in kind of Altice’s 67.2% interest in Altice USA to Altice shareholders (the “Shareholders”). Altice still aims to complete the proposed transaction by the end of the second quarter of 2018 following AGM and regulatory approvals.

In connection with the convocation for the AGM, Altice made available to the Shareholders a shareholder circular (“Shareholder Circular”), which includes, among other items, information regarding the Separation and Altice USA. The following are excerpts from the Shareholder Circular prepared and issued by Altice N.V.

***

1 INTRODUCTION TO THE PROPOSED SEPARATION

Before outlining the rationale and specific mechanics of the proposed Separation in more detail in chapters 2 (Strategic Rationale for Separation) and 4 (Implementation), this chapter provides a brief introduction to the proposed Separation.

On January 8, 2018, we announced to our Shareholders that the Board approved plans for the proposed Separation, pursuant to which Altice will distribute substantially all of its equity interest in Altice USA through a distribution in kind in the form of shares in Altice USA to our Shareholders. Following the distribution, Altice will no longer own a controlling equity interest in Altice USA, enabling Altice and Altice USA to operate independently from each other. The implementation of the distribution is, however, subject to certain conditions, including approval from the General Meeting, being satisfied or waived by us in our sole and absolute discretion before the Distribution can occur (to the extent legally permitted and, in certain cases, subject to the approval by the independent directors of Altice USA pursuant to the related party transaction approval policy (the “RPT Policy”)).

The proposed Separation is to be effected by a pro rata distribution to the Shareholders of Altice’s 67.2% interest in Altice USA, represented by 495,366,932 shares (excluding shares indirectly owned by Altice through Neptune Holding US LP (“Neptune”)) consisting of a combination of Altice USA’s class A common stock (that are listed on the NYSE, see section 6.4), par value of USD 0.01 per share (the “Class A Common Stock”), and Altice USA’s class B common stock (that are not listed, see section 6.4), par value of

USD 0.01 per share (the “Class B Common Stock”), together referred to as the “Altice USA Shares” (the “Distribution”). This Distribution will take place out of Altice’s share premium reserve. Prior to the consummation of the proposed Separation, Altice USA intends to pay a USD 1.5 billion special cash dividend to its shareholders and to authorise a share repurchase programme of up to USD 2 billion over three years effective following consummation of the proposed Separation (both of which have been unanimously approved in principle by Altice USA’s board of directors acting through its independent directors). After the proposed Separation, Altice and Altice USA will continue as two separate businesses.

Altice, which will be renamed Altice Europe, will focus on and manage Altice France S.A. (“Altice France”), Altice International S.à r.l. (“Altice International”) and the (newly created) Altice TV subsidiary. The proposed Separation is intended to create simplified, independent and more focused U.S. and European operations to the benefit of their respective shareholders, customers, employees, investors and other stakeholders.

Following the proposed Separation, the two companies will be led by separate management teams. Mr. Patrick Drahi, founder of Altice, will retain control of both companies through Next Alt S.à r.l. (“Next Alt”)(1). Following the proposed Separation, Mr. Drahi will serve as president of the Board of Altice and chairman of the Board of Altice USA.

In the spirit of enhanced accountability and transparency, Altice Europe will reorganize its structure comprising Altice France (including the French Overseas Territories), Altice International and a newly formed Altice TV subsidiary. This will include integrating Altice’s support services businesses into their respective markets and bundling Altice Europe’s premium content activities into one separately funded operating unit with its own profits and losses. In the first quarter of 2018, Altice USA acquired 100% of the equity interests in Altice Technical Services US Corp. (“ATS”) for a de minimis amount.

(1) As a result of Next Alt’s intention to elect to receive only Class B Common Stock of Altice USA (as described in section 4.2.1 (The Distribution), and voting agreements that Next Alt will enter into with certain current and former officers and directors of Altice, Altice USA and other Group companies with respect to all Altice USA Shares they own, Mr. Patrick Drahi will control Altice USA immediately after giving effect to the Distribution regardless of the elections made by the other Shareholders.

2

2 STRATEGIC RATIONALE FOR THE SEPARATION

The Shareholders’ Circular relates to the proposal made to the Shareholders, included as item 6 on the agenda for the AGM, which reads:

“Proposal to approve the separation of the U.S. business from Altice by way of a special dividend in kind in the form of shares in Altice USA, Inc.”

We believe the proposed Separation will allow Altice to deliver on its potential. The proposed Separation is intended to create simplified, independent and more focused European and U.S. operations to the benefit of their respective shareholders, customers, employees, investors and other stakeholders. In particular, we believe the proposed Separation will result in:

· two long-term investment opportunities defined by different market dynamics, industrial strategies and regulatory regimes;

· dedicated management teams with enhanced focus on execution in their respective markets, in each case, led by founder and controlling shareholder Mr. Patrick Drahi;

· simplified, more efficient and dynamic operating and financial structures with clear, distinct targets;

· enhanced transparency into each company’s unique value drivers and fewer intercompany relationships; and

· preserved balance sheet strengths of each company as both businesses benefit from long-term capital structures, no meaningful near-term debt maturities and strong liquidity.

Each of these strategic rationales is described in more detail below.

2.1 Two long-term investment opportunities defined by different market dynamics, industrial strategies and regulatory regimes

The proposed Separation allows the current group, which includes the Altice and Altice USA businesses before the consummation of the proposed Separation (the “Group”) to focus more specifically on local needs. Moreover, the proposed Separation will provide better geographic alignment due to different financial reporting obligations and regulatory regimes. We expect that there will be no material adverse effect from the proposed Separation on each of the individual operating entities and the manner in which they conduct their respective businesses.

3

Additionally, we do not expect the proposed Separation to negatively impact the Altice brand, because the brand can be maintained after the proposed Separation in both the U.S. and European businesses. Furthermore, we expect the impact of the proposed Separation on key constituencies of the European and U.S. businesses to be limited. We do not expect the proposed Separation to have any impact on regulators in France, Portugal, Israel and the U.S., nor do we expect any impact on local or national authorities or any antitrust authorities.

2.2 Dedicated management teams with enhanced focus on execution in their respective markets, in each case, led by founder and controlling shareholder Mr. Patrick Drahi

Altice and Altice USA will be managed by two distinct management teams, focused solely on the performance in their respective markets. Both management teams will benefit from the strategic leadership of founder and controlling shareholder Mr. Patrick Drahi. Furthermore, the proposed Separation is expected to enable greater management focus at Altice on the specific needs of Altice Europe and its markets in order to (i) optimize performance and (ii) create long-term value for the Shareholders and the customers, employees, investors and other stakeholders of Altice Europe. As a consequence, we expect Altice Europe will be better positioned to effect an operational and financial turnaround in France and Portugal under the leadership of the new local management teams.

2.3 Simplified, more efficient and dynamic operating and financial structures with clear, distinct targets

Altice will be renamed Altice Europe and will reorganize its structure in three distinct operating units with new perimeters comprised of Altice France (including the French Overseas Territories), Altice International and a newly formed Altice TV subsidiary. This will include assigning the responsibility and financial performance of Altice’s support services businesses to their respective markets and bundling Altice Europe’s premium content activities into one separately funded operating unit with its own profits and losses.

We expect that the proposed Separation will not result in the loss of any benefits based on volume pricing or other terms under existing supplier agreements because of how these agreements are structured and because many already are negotiated separately by the European and U.S. businesses. Furthermore, both the European and the U.S. segments have benefitted from separate capital structures. In terms of the perception and confidence suppliers, creditors and other market participants have in Altice, we believe that the Separation is likely to have a positive impact.

4

2.4 Enhanced transparency into each company’s unique value drivers and fewer intercompany relationships

ATS was previously owned by Altice and a member of ATS’s management through a holding company. In light of Altice’s determination to focus on businesses other than Altice USA, we and Altice USA concluded it is in Altice USA’s and Altice’s interests for Altice USA to own and operate ATS. In addition, Altice is in the process of selling and transferring Altice’s ownership of i24 News France S.A.S., I24 news S.à r.l. and i24 US Corp. (each an “i24 Entity”) to Altice USA, for approximately USD 17,000,000, prior to the Distribution. Additionally, the enhanced focus on the Altice Europe business following the proposed Separation will allow management to effect the operational and financial turnaround in France and Portugal more expeditiously.

2.5 Preserved balance sheet strengths of each company as both businesses benefit from long-term capital structures, no meaningful near-term debt maturities and strong liquidity

Altice’s credit silos continue to have adequate liquidity and we expect that the proposed Separation will allow Altice to improve the legibility and the market perception of its capital and organizational structure.

Following the proposed Separation, we believe both the U.S. business and the rest of the Group will be more easily evaluated by the market on their own merits. The proposed Separation is expected to benefit the shareholders of both Altice and Altice USA and other respective stakeholders (including but not limited to customers and employees) in the short-term, whilst also enabling us to continue creating long-term value in the years to come.

5

3 ESTABLISHING TWO SEPARATE BUSINESSES WITHIN THE GROUP

3.1 Background

The Group is a multinational broadband and mobile communications, content and media group operating in Western Europe (comprising France and Portugal), the U.S., Israel, the Dominican Republic(2) and the French Overseas Territories. The parent company of the Group, Altice, originates from a cross-border merger completed on August 9, 2015 of Altice, as the acquiring company, and Altice S.A.

Altice is a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands.(3) The merger has enabled the Group to benefit from a powerful equity acquisition currency without prejudicing voting control of Altice’s founding shareholder group. The Group has expanded internationally through a number of acquisitions of telecommunications businesses, including: SFR and PT Portugal in Western Europe; HOT in Israel; Altice Hispaniola and Tricom in the Dominican Republic; Cequel Corporation (which, through its subsidiary Cequel Communications, LLC, operates the “Suddenlink” brand) and Cablevision in the U.S.

3.2 The U.S. business

3.2.1 General

Altice USA is one of the largest broadband communications and video services providers in the U.S. Altice USA delivers broadband, pay television, telephony services, proprietary content and advertising services to approximately 4.9 million residential and business customers. Altice USA’s footprint extends across 21 states through a fiber-rich broadband network with more than 8.6 million homes passed as of December 31, 2017.

Altice USA acquired Cequel Corporation (“Suddenlink” or “Cequel”) on December 21, 2015 and Cablevision System Corporation (“Cablevision” or “Optimum”) on June 21, 2016. Altice USA is a holding company that does not conduct any business operations of its own. Altice USA serves its customers through two business segments: Optimum, which operates in the New York metropolitan area, and Suddenlink, which principally operates in markets in the south-central United States.

Following the acquisitions, Altice USA began to simplify its organizational structure, reduce management layers, streamline decision-making processes

(2) The sale process of the Dominican Republic operations is underway, with the signing of an agreement expected during the first half of 2018.

(3) Substantially all of the assets of Altice S.A. and all of its liabilities were simultaneously transferred to Altice Luxembourg, a newly formed indirect subsidiary of Altice.

6

and redeploy resources with a focus on network investment, customer service enhancements and marketing support. As a result, Altice USA is making significant progress in integrating the operations of Optimum and Suddenlink, centralizing its business functions, reorganizing its procurement processes, eliminating duplicative management functions, terminating lower-return projects and non-essential consulting and third-party service arrangements, and investing in employee relations and its culture. Improved operational efficiency has allowed Altice USA to redeploy physical, technical and financial resources towards upgrading its network and enhancing the customer experience to drive customer growth. In addition, Altice USA expanded, and intends to continue expanding, its e-commerce channels for sales and marketing.

Since the acquisitions, Altice USA has quadrupled the maximum available broadband speeds it is offering to its Optimum customers from 101 Mbps to 400 Mbps for residential customers and 450 Mbps for business customers and expanded its 1 Gbps broadband service to approximately 72% of its Suddenlink footprint from approximately 40% prior to the Suddenlink acquisition. In addition, Altice USA has commenced a plan to build a FTTH network, which will enable it to deliver more than 10 Gbps broadband speeds across its entire Optimum footprint and part of its Suddenlink footprint. Altice USA believes this FTTH network will be more resilient with reduced maintenance requirements, fewer service outages and lower power usage, which Altice USA expects will drive further cost efficiencies in its business. In order to further enhance the customer experience, during the fourth quarter of 2017, Altice USA introduced a new home communications hub, Altice One, and Altice USA has begun rolling it out across its Optimum footprint. Altice USA’s new home communications hub is an innovative, integrated platform with a dynamic and sophisticated user interface, combining a set-top box, Internet wireless router and cable modem in one device, and is its most advanced home communications hub. Altice USA is also beginning to offer managed data and communications services to its business customers and more advanced advertising services, such as targeted multi-screen advertising and data analytics, to its advertising and other business clients. In the fourth quarter of 2017, Altice USA and Sprint entered into a multi-year strategic agreement pursuant to which Altice USA will utilize Sprint’s network to provide mobile voice and data services to its customers throughout the nation, and its broadband network will be utilized to accelerate the densification of Sprint’s network. Altice USA believes this additional product offering will enable Altice USA to deliver greater value and more benefits to its customers.

Following the proposed Separation, Altice USA intends to continue to make significant investments in its customer experience and improve its products and services. This includes expanding the availability of its high-speed

7

broadband services, launching its new integrated entertainment platform Altice One, continuing the rollout of its FTTH network, developing and deploying mobile voice and data services pursuant to the agreement Altice USA entered into with Sprint and investing in a multiscreen addressable and national advertising platform. Altice USA will remain focused on investing for growth in innovation, superior service and an advanced network. In addition, Altice USA will continue to evaluate and pursue value-accretive acquisitions to opportunistically grow.

3.2.2 Altice USA’s products and services

Altice USA provides broadband, pay television and telephony services to both residential and business customers.

Altice USA also provides enterprise-grade fiber connectivity, bandwidth and managed services to enterprise customers through Optimum’s Lightpath business (also marketed as Altice Business) and advertising time to advertisers.

The prices Altice USA charges for its services vary based on the number of services and associated service level or tier its customers choose, coupled with any promotions Altice USA may offer. As part of its marketing strategy, customers are increasingly choosing to bundle their subscriptions to two (“double product”) or three (“triple product”) of Altice USA’s services at the same time. Customers who subscribe to a bundle generally receive a discount from the price of buying each of these services separately, as well as the convenience of receiving multiple services from a single provider, all on a single monthly bill. For example, Altice USA offers an “Optimum Triple Play” package that is a special promotion for new customers or eligible current customers where Optimum broadband, pay television and telephony services are each available at a reduced rate for a specified period when purchased together. Approximately 50% of Altice USA’s residential customers were triple product customers as of December 31, 2017.

Residential services

Altice USA offers broadband, pay television and telephony services to residential customers through both its Optimum and Suddenlink segments.

Business services

Both Altice USA’s Optimum and Suddenlink segments offer a wide and growing variety of products and services to both large enterprise and SMB customers, including broadband, telephony, networking and pay television services. For the year ended December 31, 2017, business services accounted for approximately 14% of the revenue for both its Optimum and Suddenlink segments, respectively, and accounted for approximately 14% of Altice USA’s

8

consolidated revenue. As of December 31, 2017, Altice USA’s Optimum segment served approximately 263,000 SMB customers and its Suddenlink segment served 109,000 SMB customers. Altice USA serves enterprise customers primarily through its Lightpath business, a subsidiary of Cablevision.

Advertising sales

As part of the agreements under which it acquires pay television programming, Altice USA typically receives an allocation of scheduled advertising time during such programming, generally two minutes per hour, into which Altice USA’s systems can insert commercials, subject, in some instances, to certain subject matter limitations.

Altice USA’s advertising sales infrastructure includes in-house production facilities, production and administrative employees and a locally-based sales force, and is part of Altice Media Solutions (“AMS”), the advertising sales division of Altice USA. AMS offers data-driven television, digital and other multi-platform advertising to clients ranging from Fortune 500 brands to local businesses. AMS provides national and local businesses with television and digital advertising opportunities targeted within specific geographies, including in New York City, and throughout the Suddenlink footprint. AMS offers clients opportunities to use interactive television products to reach their customers and provide a deeper level of audience engagement.

In several of the markets in which it operates, Altice USA has entered into agreements commonly referred to as interconnects with other cable operators to jointly sell local advertising, simplifying its clients’ purchase of local advertising and expanding their geographic reach. In some of these markets, Altice USA represents the advertising sales efforts of other cable operators; in other markets, other cable operators represent Altice USA. For instance, AMS manages the New York Interconnect, a partnership between AMS and Comcast that provides national brands with television and digital advertising opportunities over a broader portion of the New York designated market area (“New York DMA”) than AMS’s local offerings. The New York Interconnect is the largest interconnect in the country, with a footprint of over 3.2 million households. In the larger DMAs in the Suddenlink footprint, Altice USA participates in a number of interconnects managed by others, such as the Houston and Dallas interconnects. In December 2017, Altice USA, Charter Communications and Comcast announced a preliminary agreement to form a new Interconnect in the New York market that would provide a single solution to reach more than 6.2 million households across the New York DMA. The new New York Interconnect, which will replace the existing New York Interconnect, is expected to launch in early second quarter 2018.

9

For the year ended December 31, 2017, advertising sales accounted for approximately 5% and 3% of the revenue for the Optimum and Suddenlink segments, respectively, and accounted for approximately 4% of Altice USA’s consolidated revenue.

Data analytics

The advanced data analytics business, which was launched by Optimum in 2013, provides data-driven, audience-based advertising solutions to the media industry, including AMS, programmers and multichannel video programming distributors (“MVPDs”).

Total Audience Data, its flagship portfolio of products, consists of advanced analytics tools providing granular measurement of consumer groups, accurate hyper-local ratings and other insights into target audience behaviour not available through traditional sample-based measurement services. These tools allow Altice USA and its clients to more precisely optimize Altice USA’s product offerings, target and deliver ads more efficiently, and provide accurate measurement to its clients and partners.

Altice USA’s March 2017 acquisition of Audience Partners, a leading provider of data-driven, audience-based digital advertising solutions, expands the scope of targeted advertising solutions it offers from television to include digital, mobile and tablets. In addition, the acquisition expands Altice USA’s audience-based advertising services to include further advanced analytics tools within key and growing segments, including political, advocacy, healthcare, automotive, and programming.

ATS

In the first quarter of 2018, Altice USA acquired 100% of the equity interests in ATS for a de minimis amount (also see section 3.4.3 (The ancillary agreements)). ATS was previously owned by Altice and a member of ATS’s management through a holding company. In light of Altice’s determination to focus on businesses other than Altice USA, we and Altice USA concluded it is in Altice USA’s and Altice’s interests for Altice USA to own and operate ATS. ATS has and will continue to provide technical operating services to Altice USA, including field services, such as dispatch, customer installations, disconnects, service changes and other customer service visits, outside plant maintenance services and design and construction services for HFC and FTTH infrastructure.

Other services of Altice USA include:

· News 12 networks (seven 24-hour local news channels);

10

· franchises (as of December 31, 2017, operating Altice USA’s systems in more than 1,300 communities);

· programming (designing line-ups for each system);

· sales and marketing (pursuant to which sales are managed centrally and multiple sales channels are leveraged to reach current and potential customers);

· customer experience (through investments in people, processes and technology);

· network management (facilitating signal delivery via laser-fed fiber optic cable from control centers known as headends and hubs to individual nodes); and

· information technology (IT systems and IT structure).

For additional information about Altice USA, please refer to Altice USA’s most recent annual report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 6, 2018 (“Altice USA Annual Report”), which is accessible on the SEC’s website at https://www.sec.gov/. You may also access Altice USA’s SEC filings under the heading “Investors” on Altice USA’s website at http://www.alticeusa.com/.

3.3 The businesses and the internal separation

Altice announced on January 8, 2018 its plans to separate the European business and U.S. business to create two focused businesses.(4)

Following this announcement, Altice started with the internal separation to facilitate this aim. The internal separation is ongoing and will be finalized before the consummation of the Separation. The internal separation facilitates the subsequent external proposed Separation of the U.S. business from Altice which is described in Chapter 4 (Implementation) of this Shareholders’ Circular. Several group contracts will need to be (or, as the case may be, have been) entered into or will require amendments, such as:

· a trademark license agreement between Next Alt and Altice USA pursuant to which Altice USA will have a license from Next Alt to use the “Altice” brand;

(4) Please see the press release titled ‘Altice Announces Group Reorganization - Altice U.S.A. Spin-Off and New Altice Europe Structure, dated January 8, 2018 (www.altice.net).

11

· an acquisition agreement for ATS pursuant to which Altice USA acquired 100% of the equity interests in ATS for a de minimis amount in the first quarter of 2018;

· acquisition agreements for the i24 Entities;

· a voting agreement relating to Neptune;

· a stockholders’ agreement between Next Alt, A4 S.A. (“A4”) and Altice USA. The stockholders’ agreement will be substantially similar to the existing stockholders’ agreement between Altice, A4 and Altice USA. The only material changes will be to replace Altice with Next Alt, which will be Altice USA’s (largest) majority shareholder following the Distribution (as defined and described in section 4.2 (The Separation));

· a stockholders’ and registration rights agreement between Altice, Altice USA, funds advised by BC Partners LLP and Canada Pension Plan Investment Board. In connection with the proposed Separation, Next Alt will become a party to this stockholders and registration rights agreement;

· an indemnification agreement between Altice and Altice USA under which each party agreed to indemnify, inter alia, the other and the other’s affiliates with respect to certain matters, which was entered into in January 2018;

· the separation of the D&O insurance contract (one contract for the European business and one contract for the U.S. business); and

· an agreement that terminates the management fees that Altice USA currently pays to Altice upon consummation of the proposed Separation.

Some of these contracts are described in more detail below (see section 3.4.3 (The Ancillary Agreements)).

3.4 The Master Separation Agreement and ancillary agreements

3.4.1 Background

Following the Distribution, Altice and Altice USA will operate independently, and Altice will no longer own a controlling equity interest in Altice USA. In order to govern the ongoing relationships between Altice USA (or its subsidiaries), on the one hand, and Altice and its subsidiaries (other than Altice USA and its subsidiaries), on the other hand, in connection with the Distribution, Altice and Altice USA intend to enter into a master separation agreement (the “Master

12

Separation Agreement”) and certain other agreements providing for various services and rights following the Distribution, and under which they will agree to indemnify each other against certain liabilities arising from their respective businesses.

The following discussion summarizes the material provisions of the Master Separation Agreement. The rights and obligations of the parties will be governed by the express terms and conditions of the Master Separation Agreement and not by this summary or any other information contained in this Shareholders’ Circular. Note that these agreements remain subject to ongoing negotiations.

The terms of these intercompany agreements are being established while Altice USA is a subsidiary of Altice and, therefore, may not be the result of arms’-length negotiations, although these agreements have been submitted to Altice USA’s audit committee in accordance with the RPT Policy. We believe that the terms of these intercompany agreements are commercially reasonable and fair to all parties under the circumstances. However, conflicts could arise in the interpretation or any extension or renegotiation of the foregoing agreements after the Distribution.

Altice and Altice USA expect to enter into the Master Separation Agreement prior to the AGM.

3.4.2 The Master Separation Agreement

General

The Master Separation Agreement will set forth our agreements with Altice USA regarding the principal actions to be taken in connection with the Distribution. It will also set forth other agreements that govern aspects of our relationship with Altice USA following the Distribution.

Transfer of assets and liabilities

The Master Separation Agreement will identify certain transfers of assets and assumptions of liabilities that are necessary in advance of the Distribution so that we and Altice USA retain the assets of, and the liabilities associated with, our respective businesses. The Master Separation Agreement generally provides that the assets comprising of Altice USA’s business will consist of those owned or held by Altice USA or those exclusively related to Altice USA’s current business and operations. The liabilities Altice USA will assume in connection with the proposed Separation will generally consist of those related to the past and future operations of its business. Altice will retain assets and assume liabilities related to the businesses now or formerly conducted by

13

Altice, other than those assets identified as being retained by, and the liabilities identified as being assumed by, Altice USA. The Master Separation Agreement will require the parties to cooperate with each other to complete these transfers or assumptions of assets and liabilities.

If any transfer of assets or assumption of liabilities is not consummated as of the Distribution, then, until the transfer or assumption can be completed, each party will take such actions as are reasonably requested by the other party in order to place such party in the same position as if such asset or liability had been transferred or assumed.

Representations and warranties

In general, neither we nor Altice USA will make any representations or warranties to the other regarding the proposed Separation of Altice USA from Altice, including regarding any consents or approvals that may be required in connection with the Distribution. Except as expressly set forth in the Master Separation Agreement, all assets will be transferred on an “as is”, “where is” basis.

Further assurances

We and Altice USA will use commercially reasonable efforts to effect any transfers contemplated by the Master Separation Agreement that have not been consummated prior to the Distribution as promptly as practicable following the date of the Distribution.

Conditions

The Master Separation Agreement will provide that several conditions must be (to the extent legally permitted) satisfied or waived by us in our sole and absolute discretion before the Distribution can occur (see section 4.3 (The conditions to the Separation)).

Exchange of information

We and Altice USA will agree to provide each other with information reasonably necessary to comply with reporting, disclosure, filing or other requirements of any national securities exchange or governmental authority, for use in judicial, regulatory, administrative and other proceedings and to satisfy audit, accounting, litigation and other similar requests. We and Altice USA will also agree to retain such information until the later of the seventh anniversary of the Distribution and the expiration of the relevant statute of limitations. Each party will also agree to provide to the other party and its auditors reasonable assistance in connection with the preparation of any disclosure regarding related party transactions so long as each party is controlled by a member of Next Alt, A4, Mr. Patrick Drahi (or his heirs or

14

entities or trusts directly or indirectly under his or their control or formed for his or their benefit) or any of their affiliates (collectively, the “PDR Group”).

Termination

The Board, in its sole and absolute discretion, may terminate the Master Separation Agreement at any time prior to the Distribution.

Release of claims

We and Altice USA will each agree to release the other and its affiliates, successors and assigns, and all persons that prior to the Distribution have been the other’s stockholders, directors, officers, members, agents and employees, and their respective heirs, executors, administrators, successors and assigns, from any claims against any of them that arise out of or relate to events, circumstances or actions occurring or failing to occur or any conditions existing at or prior to the time of the Distribution. These releases will be subject to exceptions set forth in the Master Separation Agreement.

Indemnification

We and Altice USA will each agree to indemnify the other and each of the other’s current, former and future directors, officers and employees, and each of the heirs, administrators, executors, successors and assigns of any of them, against certain liabilities incurred in connection with the Distribution. The amount of either our or Altice USA’s indemnification obligations will be reduced by any insurance proceeds the party being indemnified receives. The Master Separation Agreement will also specify procedures regarding claims subject to indemnification.

Insurance

The Master Separation Agreement will provide for the allocation between the parties of rights and obligations under existing insurance policies with respect to occurrences prior to the Distribution and sets forth procedures for the administration of insured claims and certain other insurance matters.

Dispute resolution

The Master Separation Agreement will contain provisions that govern the resolution of disputes, controversies or claims that may arise between Altice USA and Altice related to the Master Separation Agreement and the other ancillary agreements entered in connection with the proposed Separation. These provisions will contemplate that efforts will be made to resolve disputes, controversies and claims by elevation of the matter to senior executives of Altice USA and Altice. If such efforts are not successful, either Altice USA or Altice may submit the dispute, controversy or claim to binding arbitration, subject to the provisions of the Master Separation Agreement.

15

Tax matters

We and Altice USA will each agree to indemnify the other for any liability for taxes of any member of the party’s respective group or certain taxes imposed on any member of the party’s group that are attributable to a pre-Distribution tax period. We and Altice USA will also agree to cooperate with each other in connection with any tax matters relating to the Altice USA group and the Altice Europe Group(5), respectively, including preparation and filing of certain tax returns.

3.4.3 The ancillary agreements

General

In connection with the Separation, in addition to the Master Separation Agreement, we, and/or Altice USA entered into, or expect to enter into or amend agreements which will govern various ongoing relationships between us, Altice USA, Next Alt and/or others prior to or as per the consummation of the Separation, including the following:

· a trademark license agreement between Next Alt and Altice USA pursuant to which Altice USA will have a license from Next Alt to use the “Altice” brand;

· an acquisition agreement for ATS pursuant to which Altice USA acquired 100% of the equity interests in ATS for a de minimis amount in the first quarter of 2018;

· acquisition agreements for the i24 Entities;

· a voting agreement relating to Neptune;

· a stockholders’ agreement between Next Alt, A4 and Altice USA. The stockholders’ agreement will be substantially similar to the existing stockholders’ agreement between Altice, A4 and Altice USA. The only material changes will be to replace Altice with Next Alt, which will be Altice USA’s (largest) majority shareholder following the Distribution (as defined and described in section 4.2 (The Separation));

· a stockholders’ and registration rights agreement between Altice, Altice USA, funds advised by BC Partners LLP and Canada Pension Plan Investment Board. In connection with the proposed Separation, Next Alt will become a party to this stockholders and registration rights agreement;

(5) Altice and the companies connected with it in a group within the meaning of 2:24b DCC, after the consummation of the Separation (“Altice Europe Group”).

16

· an indemnification agreement between Altice and Altice USA under which each party agreed to indemnify, inter alia, the other and the other’s affiliates with respect to certain matters, which was entered into in January 2018;

· the separation of the D&O insurance contract (one contract for the European business and one contract for the U.S. business); and

· an agreement that terminates the management fees that Altice USA currently pays to Altice upon consummation of the proposed Separation.

The material terms of certain of these agreements are summarized below.

In addition to the Master Separation Agreement (described in section 3.4.2 (The Master Separation Agreement)) and the other agreements described below, we (or our subsidiaries) may enter into, from time to time, agreements and arrangements with Altice USA, Next Alt and certain of their respective related entities, in connection with, and in the ordinary course of, our business. Entering into, terminating or modifying any agreements between Altice USA and Altice requires the prior approval of Altice USA’s audit committee pursuant to the RPT Policy.

Trademark license agreement

Altice USA intends to enter into a trademark license agreement pursuant to which Next Alt will grant Altice USA an exclusive, non-transferable license to use the “ALTICE” trademark and variations thereof and logos, designs and other marks containing the term “ALTICE” and variations thereof in North America and any territories under the jurisdiction of any state or country within North America in connection with Altice USA’s business. The terms and conditions of the trademark license agreement remain subject to ongoing negotiations.

Acquisition agreement for ATS

Altice USA acquired 100% of the equity interests in ATS for a de minimis amount in the first quarter of 2018.

Acquisition agreements for i24 News Entities

i24 News is a multi-language international news channel that distributes programming in Europe, Africa, the Middle East and the U.S. The i24 News business is composed of i24 news S.à r.l., i24 News France S.A.S. and i24 US Corp., each of which is indirectly owned by Altice. Altice USA intends to acquire 100% of the equity interests in each i24 Entity from Altice for approximately USD 17,000,000. Discussions regarding the definitive terms of such acquisitions are still ongoing between Altice and Altice USA. Altice and

17

Altice USA intend to complete sale and purchase of the i24 News business prior to the Distribution.

Neptune voting agreement

In July 2016, Altice and Altice USA created a profits interest plan through a partnership, Neptune, so that members of Altice USA management and other participants could have an opportunity to participate in the long term growth and financial success of Altice USA’s operations. The general partner of Neptune is currently controlled by CVC 3 B.V. (“CVC 3”), an indirect wholly owned subsidiary of Altice and controlling stockholder of Altice USA. Prior to the proposed Separation, CVC 3 will transfer its control of the general partner of Neptune to Altice USA. CVC 3 will maintain substantially the same rights as a limited partner in Neptune after the proposed Separation as the rights it had prior to the proposed Separation. In addition, Altice USA and Next Alt intend to enter into an agreement pursuant to which Next Alt will be granted a proxy to vote the Altice USA Shares held by Neptune. These arrangements remain subject to ongoing negotiations and the approval by Altice USA’s audit committee in accordance with the RPT Policy.

Post-Distribution stockholders’ agreement

In connection with the Distribution, Altice USA will enter into the post-Distribution stockholders’ agreement with Next Alt and A4. The post-Distribution stockholders’ agreement will be substantially similar to the existing stockholders’ agreement among Altice, A4 and Altice USA. Pursuant to this agreement, so long as the PDR Group beneficially own in the aggregate, at least 50% of the voting power of Altice USA’s outstanding capital stock, Next Alt will have the right to designate six directors to Altice USA’s board of directors, and Altice USA will cause Altice USA’s board of directors to consist of a majority of directors nominated by Next Alt. In the event that the PDR Group beneficially owns, in the aggregate, less than 50% of the voting power of Altice USA’s outstanding capital stock, Next Alt will have the right to designate a number of directors to Altice USA’s board of directors equal to the total number of directors comprising the entire Altice USA’s board of directors multiplied by the percentage of the voting power of Altice USA’s outstanding common stock beneficially owned, in the aggregate, by the PDR Group, rounding up in the case of any resulting fractional number, and in the event that the PDR Group beneficially owns, in the aggregate, less than 50% of the voting power of Altice USA’s outstanding capital stock, Next Alt will not have the right to designate a number of directors to Altice USA’s board of directors equal to or exceeding 50% of directors comprising Altice USA’s entire board of directors. One of Next Alt’s designated nominations will be an individual designated by A4, and Next Alt will agree to vote its shares in favor of electing the individual designated by A4. If a director designated by Next Alt or by A4 resigns or is removed from Altice USA’s board of directors, as the case may

18

be, only another director designated by Next Alt or by A4, as the case may be, may fill the vacancy.

In the event Mr. Patrick Drahi is not a member of Altice USA’s board of directors, one representative of the PDR Group will have board observer rights. In addition, the post-Distribution stockholders’ agreement will be revised to replace Altice with Next Alt, which will be Altice USA’s largest shareholder following the Distribution, and to terminate the board observer rights of the group advisory council of Altice. The post-Distribution stockholders’ agreement will require Altice USA to obtain the consent of Next Alt before we may take certain actions specified therein.

Stockholders’ and registration rights agreement

In connection with the Distribution, Altice USA will amend and restate its stockholders’ and registration rights agreement with Altice, BC Partners LLP and Canada Pension Plan Investment Board to include Next Alt as a party and to give Next Alt demand registration rights consistent with Altice. Altice USA does not expect there will be any other material changes made to this agreement in connection with the Distribution.

Indemnification agreement

In connection with the Distribution, we entered into an indemnification agreement with Altice USA (the “Indemnification Agreement”). Under the Indemnification Agreement, Altice USA and Altice each agree to indemnify the other, the other’s affiliates and the other’s and its affiliates and it and such affiliates’ officers, directors, employees, agents, attorneys, accountants, actuaries and consultants, against certain losses arising out of or based upon:

· any filings made by Altice USA with the SEC under the Securities Act or the Exchange Act in connection with the proposed Separation of Altice USA and Altice or the Distribution;

· any filings made by Altice USA with the AFM and other relevant regulators in other countries within the European Union under the Financial Markets Supervision Act or any other relevant law in connection with the proposed Separation of Altice USA and Altice or the Distribution;

· the publication of the prospectus prepared by Altice USA and approved by the AFM for the purposes of Article 3 of Directive 2003/71/EC of the European Parliament and the Council and the amendments thereto;

19

· any notifications, filings or submissions made by Altice with governmental authorities having jurisdiction over us in connection with the proposed Separation of Altice USA and Altice or the Distribution; or

· the General Meeting and this Shareholders’ Circular.

Ongoing commercial agreements

In addition to the above agreements, we intend to enter into, or amend the terms of, various other agreements with Altice USA and its affiliates that are intended to continue post-Distribution subject to their existing terms or terms and conditions to be negotiated and agreed to.

These amendments will generally be intended to permit Altice USA to maintain pricing and other benefits as if they were still controlled by Altice. We do not consider these agreements to be material.

20

4 IMPLEMENTATION

4.1 Introduction

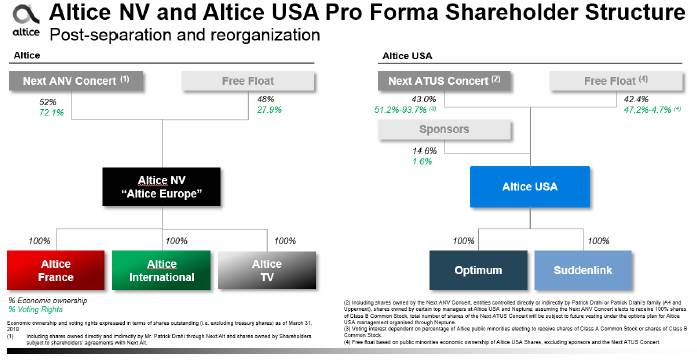

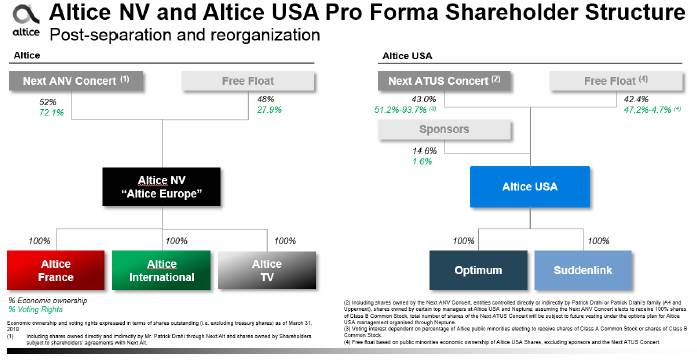

The ownership and control structure of the Group after the proposed Separation can be described as follows:

4.2 The Separation

The proposed Separation is to be effected by a pro rata distribution to the Shareholders of Altice’s 67.2% interest in Altice USA, represented by 495,366,932 shares (excluding shares indirectly owned by Altice through Neptune) consisting of a combination of Class A Common Stock (that are listed on the NYSE, see section 6.4) and Class B Common Stock (that are unlisted, see section 6.4).

4.2.1 The Distribution

S-1 / EU Prospectus

Prior to the start of the election period as referred to in section 4.4 (The timing) the S-1 will be declared effective by the SEC and will be made available for investors and a EU prospectus will be made available for European investors.

Election

The Distribution will be structured as a distribution in kind of Altice USA shares, directly owned by Altice, to the Shareholders (see section 4.2.2 (the object of Distribution)).

21

The distribution will take place out of our share premium reserve. The number of shares of Class A Common Stock and Class B Common Stock to be distributed to each Shareholder as of the Distribution record date will be based on such Shareholder’s ownership of Altice shares. Pursuant to the terms of the Distribution, each Shareholder will be given the right to elect the percentage of shares of Class A Common Stock (that are listed on the NYSE, see section 6.4) and shares of Class B Common Stock (that are unlisted, see section 6.4) such Shareholder receives in the Distribution. The number of shares of Class B Common Stock to be distributed will be subject to a cap of 50% of the total Altice USA Shares being distributed (the “Class B Cap”). If the Class B Cap is exceeded, the shares of Class B Common Stock to be delivered to the Shareholders of record who elected to receive them will be subject to proration, and such Shareholders will receive shares of Class A Common Stock in lieu of the portion of shares of Class B Common Stock that is cut back.

If a Shareholder of record does not make an election by the election deadline, such Shareholder will receive Altice USA shares of Class A Common Stock (the “Default Election”). Based on the final results of the election and any proration, immediately prior to the Distribution, Altice will convert shares of Class B Common Stock into the requisite number of shares of Class A Common Stock for the Distribution.

Altice is ultimately controlled by Mr. Drahi through Next Alt. As of 31 March 2018, Next Alt held 64.07% of the outstanding share capital and voting rights of Altice, representing 49.5% of the economic rights and 69.18% of the voting power in general meetings.

Mr. Drahi has informed us that Next Alt will elect to receive 100% of the shares of Altice USA to which it is entitled in the Distribution in the form of Class B Common Stock and will be subject to proration, in the same manner as other Shareholders, in the event the Class B Cap is exceeded. As a result of Next Alt’s intended election and the voting agreements, Mr. Drahi will control Altice USA immediately after giving effect to the Distribution regardless of the elections made by the other Shareholders.

Distribution ratio

Each Shareholder, irrespective of whether such Shareholder holds Altice’s common shares A (“NV Class A Common Stock”) or common shares B (“NV Class B Common Stock”), will be entitled to receive 0.4163 shares of Altice USA common stock for each whole Altice share held on the record date. As described above, the number of shares of Class A Common Stock and Class B Common Stock to be received by a Shareholder will depend on the mix elected by such Shareholder and any proration as a result of the Class B Cap.

22

Transfer agents and registrars

The transfer agent and registrar for Class A Common Stock and Class B Common Stock is American Stock Transfer Trust Company LLC (“AST”). The transfer agent and registrar for NV Class A Common Stock and NV Class B Common Stock is ING Bank N.V.

4.2.2 The object of Distribution

Share capital

Altice USA has two classes of issued and outstanding common stock: Class A Common Stock and Class B Common Stock. Each share of Class A Common Stock is entitled to one vote. Each share of Class B Common Stock is entitled to twenty-five votes and is convertible at any time into one share of Class A Common Stock. Altice USA also has authorized 4,000,000,000 shares of Class C common stock, par value USD 0.01 (the “Class C Common Stock”), which if issued will be non-voting. Prior to the Distribution, CVC 3 B.V. (“CVC 3”), an indirect subsidiary of Altice and controlling stockholder of Altice USA, will approve and adopt Altice USA’s second amended and restated certificate of incorporation and Altice USA’s Board of Directors will approve and adopt Altice USA’s second amended and restated bylaws. Altice USA’s second amended and restated certificate of incorporation authorizes shares of undesignated preferred stock, the rights, preferences and privileges of which may be designated from time to time by Altice USA’s board of directors. The Altice USA Shares of Class A Common Stock are listed on the NYSE under the symbol “ATUS.” Class B Common Stock will not be listed on the NYSE or any other stock exchange at the time of the Distribution and Altice USA does not currently intend to list its Class B Common Stock on the NYSE or any other stock exchange.

Shares subject to Distribution

495,366,932 shares in aggregate of Class A Common Stock and Class B Common Stock will be distributed in the Distribution. The Altice USA Shares to be distributed by Altice in connection with the Distribution will constitute approximately 67.2% of the issued and outstanding shares of Altice USA immediately after the Distribution. The Distribution will not increase the number of outstanding shares of Altice USA. The Distribution will be structured as a Distribution in kind to the Shareholders. The number of Altice USA Shares to be distributed to each Shareholder as of the record date will be based on such Shareholder’s ownership of Altice shares at such date. Pursuant to the terms of the Distribution, each Shareholder will be given the right to elect the percentage of shares of Class A Common Stock and shares of Class B Common Stock such Shareholder receives in the Distribution. The number of

23

shares of Class B Common Stock distributed will be subject to the Class B Cap.

If the Class B Cap is exceeded, the shares of Class B Common Stock delivered to the Shareholders of record who elected to receive them will be subject to proration, and such Shareholders will receive shares of Class A Common Stock in lieu of the portion of shares of Class B Common Stock that is cut back.

If a Shareholder of record does not make an election by the election deadline, such Shareholder will receive the Default Election. Based on the final results of the election and any proration, immediately prior to the Distribution, Altice USA will convert shares of Class B Common Stock into the requisite number of shares of Class A Common Stock for the Distribution.

As of the date of this Shareholders’ Circular, Altice, through its indirect wholly owned subsidiary, CVC 3, owns 5,281,258 shares of Class A Common Stock and 490,085,674 shares of Class B Common Stock. CVC 3 is also the sole member of Neptune Holding US GP LLC, which is the sole general partner of Neptune. In connection with the Distribution, shares of Class A Common Stock and Class B Common Stock will be distributed by CVC 3 to Altice and then Altice will transfer such shares to its Shareholders. In addition, as of the date of this Shareholders’ Circular, Altice indirectly, through Neptune, owns 46,174,784 shares of Class A Common Stock.

Fractional shares

Fractional shares of Altice USA Shares will not be distributed in the Distribution. Fractional shares of Class A Common Stock and Class B Common Stock (after conversion into shares of Class A Common Stock) will be aggregated into whole shares of Class A Common Stock, which will be sold in the open market at prevailing market prices.

The aggregate cash proceeds from such sales, net of any brokerage fees and other costs, will be distributed pro rata to holders who would have otherwise been entitled to receive a fractional share in the Distribution.

4.2.3 Recommendation

After having considered the possible alternatives and having obtained advice from external financial and legal advisers, the Board believes the Distribution to be the most effective and expedient way to implement the proposed Separation.

24

4.3 The conditions to the Separation

The implementation of the proposed Separation is subject to the satisfaction or waiver of certain conditions. These conditions are:

· The General Meeting adopting:

(i) the proposal to approve the Separation(agenda item 6 of the AGM); and

(ii) the proposal to amend Altice’s articles of association (agenda item 7a of the AGM agenda).

· the obtaining of the required U.S. regulatory approvals;

· the S-1 having been declared effective by the SEC;

· the approval of the AFM for the publication of a prospectus by Altice USA;

· the adoption of the required resolutions by the relevant corporate bodies of Altice USA;

· the entry into the Master Separation Agreement and the entry into, amendments to or termination of various arrangements between Altice, Next Alt and Altice USA, such as a license to use the Altice brand, the stockholders’ agreement among Altice USA, Altice and certain other parties and the management agreement pursuant to which Altice USA pays a quarterly management fee to Altice;

· the declaration and payment of a one-time USD 1.5 billion dividend to Altice USA’s stockholders as of a record date prior to the Distribution;

· no laws in effect or governmental orders issued by a governmental authority of competent jurisdiction that enjoins or makes illegal the consummation of the proposed Separation.

Altice shall, in its sole and absolute discretion, determine the record date, the date of the Distribution and, subject to the RPT Policy, all terms of the Distribution, including the form, structure and terms of any transaction and/or offerings to effect the Distribution and the timing of and conditions to the consummation thereof.

Altice may at any time and from time to time until the Distribution decide to abandon or modify the Distribution, including by accelerating or delaying the timing of the consummation of all or part of the distribution or, subject to the

25

RPT Policy, modifying or changing the terms of the Distribution if, at any time, the Board determines, in its sole and absolute discretion, that the Distribution is not in the best interests of Altice or its shareholders or is otherwise not advisable.

4.4 The timing

Subject to the satisfaction and/or waiver of the conditions described in section 4.3 (The conditions to the Separation), we expect (in the most optimistic scenario) the election period to start at the end of May, 2018 and end in the beginning of June, 2018. Subsequently, we expect the Distribution to take place at the beginning of June, 2018. The exact timing may change. Altice will publish all relevant information after the AGM, including the ex-dividend date, distribution record date, the election period and the date of the distribution.(6)

(6) In accordance with article 5:25k of the Dutch Act on Financial Supervision (Wet op het financieel toezicht).

26

5 CONSEQUENCES FOR ALTICE USA

5.1 Introduction

After careful consideration, Altice and Altice USA believe that the proposed Separation will have a positive impact on Altice USA.

5.2 Financial information on Altice USA

For financial information on Altice USA, reference is made to the Altice USA Annual Report (available via http://www.alticeusa.com/annual-reports). The capital and debt considerations are described in section 5.4 (Capital and debt structure).

We do not expect any rating implication for Altice USA’s outstanding debt instruments.

5.3 Governance of Altice USA

Following the Separation, Mr. Drahi, founder of Altice, will serve as chairman of the board of Altice USA. In addition, following the Distribution, two additional directors to the Altice USA board of directors are expected to be designated for nomination by Next Alt.

5.4 Capital and debt structure of Altice USA

The proposed Separation will have no impact on the debt structure of Altice USA which comprises the two separate Optimum and Suddenlink debt silos other than the effect of the financing transactions related to the USD 1.5 billion special cash dividend (as described in section 4.3 (Conditions to the Separation)).(7) The dividend is expected to be funded via a USD 1.0 billion mix of fixed and floating-rate guaranteed debt at Optimum plus a USD 500 million revolving credit facility draw at Optimum / Cablevision.

Altice USA will benefit from a significantly enlarged free float from approximately 10% to approximately 42% following the proposed Separation, providing for enhanced trading liquidity in its Class A Common Stock. Altice USA confirms its efficiency targets set out at the time of the acquisitions of Suddenlink and Optimum. At the same time, Altice USA affirms that its fiber (FTTH) deployment and new full mobile virtual network operator (MVNO) network investment will be executed within the historical capex envelope.

(7) Note that the satisfaction of this Separation condition is subject to the discretion of Altice.

27

At the end of Q4 2017, Altice USA’s reported net debt position was USD 20.8 billion and Altice USA’s net leverage was 5.1x last 12 months EBITDA. As adjusted for the dividend, Altice USA’s net debt position as of Q4 2017 would have been approximately USD 22.2 billion with a weighted average life of c.6.3 years and a weighted average cost of debt of c.6.2%. Pro forma leverage as of Q4 2017 would have been 5.5x last 12 months EBITDA.

There are no material maturities at Suddenlink until 2020 and near-term maturities at Optimum are covered by available revolving credit facilities pro forma for the dividend payment. As adjusted for the dividend, Optimum’s net debt position as of Q4 2017 would have been approximately USD 15.5 billion with a weighted average life of c. 6.5 years and a weighted average cost of debt of c. 6.6%. Pro forma leverage as of Q4 2017 would have been 5.6x last 12 months EBITDA (vs. 5.1x as reported pre-dividend). During Q4 2017 Optimum repaid USD 725 million of its drawn revolving credit facility. Near-term maturities at Optimum are covered by available revolving credit facilities pro forma for the dividend payment.

Suddenlink’s net debt position was approximately USD 6.7 billion as of Q4 2017 with a weighted average life of c. 5.9 years and a weighted average cost of debt of c. 5.5%. Leverage as of Q4 2017 was 5.3x last 12 months EBITDA which is unaffected by the Altice USA special cash dividend. There are no material maturities at Suddenlink until 2020. Altice USA notes the significant and rapid deleveraging at both Optimum and Suddenlink since the completion of their respective acquisitions as a result of underlying growth and improved cash flow generation.

Following recent developments, Altice USA now targets leverage of 4.5-5.0x net debt to EBITDA (reduced from prior target of 5.0-5.5x).

5.5 Risk factors relating to the U.S. business

Extensive information on risk factors relating to the U.S. business can be found in item 1A (Risk Factors) of the Altice USA Annual Report (available via http://www.alticeusa.com/annual-reports).

5.6 U.S. tax considerations

There will be no U.S. corporate income tax or withholding tax due at Altice USA as a result of the Distribution in kind.

28

6 CONSEQUENCES FOR SHAREHOLDERS

6.1 Introduction

After the proposed Separation, the Shareholders are likely to experience a period of churn as the Altice USA shares find natural holders (either with existing Altice USA holders or new holders). Following the proposed Separation, we expect an elevated volume and volatility due to the expanded float and the redistribution effect of Altice USA.

6.2 Shareholders will receive shares in Altice USA

As explained in section 4.2 (The Separation), the Shareholders will receive Altice USA Shares on a pro rata basis to their shareholdings in Altice. Altice’s 67.2% interest in Altice USA will be distributed to the Shareholders.

Holders of shares of NV Class A Common Stock and holders of shares of NV Class B Common Stock will participate in the Distribution on equal terms.

6.3 Entitlement to profits of Altice USA

Following the pro rata Distribution, the Shareholders will have the same proportionate economic interest in Altice and Altice USA as they did immediately before the Distribution. As such, following the Distribution, the Shareholders will be fully entitled to the shared profits of Altice USA based on their direct shareholdings therein.

6.4 Conversion of shares of Class B Common Stock into shares of Class A Common Stock

Shares of Class B Common Stock are not listed on any securities exchange but each share of Class B Common Stock is convertible into one share of Class A Common Stock at the option of the holder. The Class A Common Stock is listed on the NYSE under the ticker symbol “ATUS”.

Following the proposed Separation, holders of shares of Class B Common Stock may convert such shares into Class A Common Stock. If you hold shares through a broker-dealer or financial institution, you will need to instruct such broker-dealer or financial institution to effect the conversion in accordance with its policies.

29

Defined terms

Capitalised terms used in this Shareholders’ Circular have the meaning given below, unless the context requires otherwise (words in the singular include the plural and vice versa).

|

2013 Altice Financing Revolving Credit Facility Agreement |

|

The EUR 80,000,000 revolving facility agreement originally dated July 1, 2013, as amended on August 2, 2013, October 14, 2013, February 28, 2014, May 14, 2014, June 24, 2014, August 27, 2014, November 19, 2014 and January 20, 2016, between, among others, Altice Financing S.A. as company and Citibank Europe PLC, UK Branch as facility agent. |

|

|

|

|

|

2014 Altice Financing Revolving Credit Facility Agreement |

|

The EUR 501,000,000 revolving facility agreement dated December 9, 2014, as amended and restated on December 10, 2014 and as further amended on June 2, 2016 and July 18, 2016, between, among others, Altice Financing S.A. as company and Citibank Europe PLC, UK Branch as facility agent. |

|

|

|

|

|

2014 Altice Luxembourg Revolving Credit Facility Agreement |

|

The EUR 200,000,000 revolving credit facility agreement originally dated May 8, 2014, between, among others, Altice SA, as borrower, Deutsche Bank AG, London Branch, as facility agent, and Deutsche Bank AG, London Branch, as security agent. |

|

|

|

|

|

2014 SFR Revolving Credit Facility Agreement |

|

The revolving credit facility agreement, dated as of May 8, 2014, as amended on April 23, 2015 and February 18, 2016, and as amended and restated on July 6, 2016, and as amended on June 20, 2017, by and among, inter alios, Altice France, Numericable U.S. LLC, the mandated lead arrangers party thereto, the lenders party thereto, Deutsche Bank AG, London Branch as facility agent, Deutsche Bank AG, London Branch, as security agent and the other agents named therein. |

|

|

|

|

|

2015 Altice Financing Revolving Credit Facility Agreement |

|

The EUR 330,000,000 revolving facility agreement originally dated January 30, 2015, as amended and restated on June 30, 2016, between, among others, Altice Financing S.A. as company and Citibank Europe PLC, UK Branch as facility agent. |

30

|

2015 Cablevision Revolving Credit Facility |

|

The USD 2,105,000,000 senior secured revolving credit facility made available under the credit facilities agreement entered into on October 9, 2015 by, inter alia, CSC Holdings, LLC, certain lenders party thereto and JPMorgan Chase Bank, N.A. as administrative agent and security agent, as amended, restated, supplemented or otherwise modified on June 20, 2016, June 21, 2016, July 21, 2016, September 9, 2016, December 9, 2016 and March 15, 2017, respectively. |

|

|

|

|

|

2015 Cequel Revolving Credit Facility |

|

The USD 350,000,000 revolving credit facility available under the credit facilities agreement entered into on June 12, 2015, inter alios, Altice US Finance I Corporation, certain lenders party thereto and JPMorgan Chase Bank, N.A. as administrative agent and security agent (as amended, restated, supplemented or otherwise modified on October 25, 2016, December 9, 2016 and March 15, 2017). |

|

|

|

|

|

2017 Guarantee Facility Agreement |

|

The guarantee facilities agreement dated June 23, 2017 between, among others, Altice Financing S.A. as company and J.P. Morgan Europe Limited as facility agent. |

|

|

|

|

|

A4 |

|

A4 S.A., a limited liability company (société anonyme) incorporated under the laws of the Grand Duchy of Luxembourg. |

|

|

|

|

|

AFM |

|

Netherlands Authority for the Financial Markets (Stichting Autoriteit Financiële Markten) |

|

|

|

|

|

AGM |

|

Annual General Meeting, to be held in Amsterdam, the Netherlands, on May 18, 2018, beginning at 11.00 a.m. (CET). |

|

|

|

|

|

Al Silo |

|

Altice International together with its subsidiaries. |

|

|

|

|

|

Altice |

|

Altice N.V., a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands, with its corporate seat in Amsterdam, the Netherlands. |

|

|

|

|

|

Altice Corporate Financing |

|

Altice Corporate Financing S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated under the laws of the Grand Duchy of Luxembourg. |

|

|

|

|

|

Altice Dominicana |

|

Altice Dominicana S.A, formerly named Altice Hispaniola S.A., a public limited company (sociedade anónima) incorporated under the laws of the Dominican Republic. |

|

|

|

|

|

Altice Europe |

|

New statutory name of Altice post Separation. |

31

|

Altice Europe Group |

|

Altice and its subsidiaries in the meaning of Section 2:24b DCC after the Separation. |

|

|

|

|

|

ACF Facility |

|

EUR 2,353 million guarantee facility (as amended and restated from time to time), consisting of a EUR 240 million tranche maturing in June 2020, and a EUR 2,113 million tranche maturing in June 2021, each entered into by Altice Corporate Financing. |

|

|

|

|

|

Altice France |

|

Altice France S.A., a public limited liability company (société anonyme) incorporated under the laws of France, which was formerly named SFR Group S.A.. |

|

|

|

|

|

Altice Group Lux |

|

Altice Group Lux S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated under the laws of the Grand Duchy of Luxembourg. |

|

|

|

|

|

Altice Hispaniola |

|

Altice Hispaniola S.A., a public limited company (sociedade anónima) incorporated under the laws of the Dominican Republic, which was renamed Altice Dominicana S.A. in November 2017. |

|

|

|

|

|

Altice France Silo |

|

Altice France together with its subsidiaries. |

|

|

|

|

|

Altice France Silo |

|

Altice France together with its subsidiaries. |

|

|

|

|

|

Altice International |

|

Altice International S.à r.l., a private limited liability company (société à responsabilité limitée) incorporated under the laws of the Grand Duchy of Luxembourg. |

|

|

|

|

|

Altice Luxembourg |

|

Altice Luxembourg S.A., a limited liability company (société anonyme) incorporated under the laws of the Grand Duchy of Luxembourg. |

|

|

|

|

|

Altice Lux Silo |

|

Altice Luxembourg together with its subsidiaries. |

|

|

|

|

|

Altice SA |

|

Altice S.A., a public limited company (société anonyme) which was formerly incorporated under the laws of Grand Duchy of Luxembourg, and which merged with Altice in 2015. |

|

|

|

|

|

Altice USA |

|

Altice USA, Inc., a Delaware corporation, with the State of Delaware Division of Corporations registration number 5823808. |

|

|

|

|

|

Altice USA Annual Report |

|

Altice USA’s most recent annual report on Form 10-K filed with the SEC on March 6, 2018. |

|

|

|

|

|

Altice USA Shares |

|

Class A Common Stock and Class B Common Stock. |

|

|

|

|

|

AMS |

|

Altice Media Solutions, the advertising sales division of Altice USA. |

32

|

ATS |

|

Altice Technical Services US Corp. |

|

|

|

|

|

B2B |

|

Business-to-business. |

|

|

|

|

|

B2C |

|

Business-to-consumers. |

|

|

|

|

|

Board |

|

The board of directors of Altice. |

|

|

|

|

|

Cablevision or Optimum |

|

Cablevision Systems Corporation, a corporation incorporated under the laws of Delaware. |

|

|

|

|

|

Class B Cap |

|

The number of shares of Class B Common Stock distributed will be subject to a cap of 247.7 million shares, representing 50% of the total shares of Altice USA shares being distributed and approximately one-third of the total issued share capital of Altice USA. |

|

|

|

|

|

Class B Common Stock |

|

Altice USA’s Class B common stock par value USD 0.01 per share. |

|

|

|

|

|

CVC 3 |

|

CVC 3 B.V., a private company with limited liability (besloten vennootschap) incorporated under the laws of the Netherlands, with its corporate seat in Amsterdam, the Netherlands. |

|

|

|

|

|

CITA |

|

Dutch Corporate Income Tax Act 1969 (Wet op de vennootschapsbelasting 1969). |

|

|

|

|

|

DCC |

|

Dutch Civil Code. |

|

|

|

|

|

Default Election |

|

If Shareholder as of the record date does not make an election by the election deadline, such Shareholder will receive only shares of Class A Common Stock in the Distribution. |

|

|

|

|

|

Distribution |

|

The planned pro rata distribution by Altice to its Shareholders of 495,366,932 shares consisting of a combination of Class B Common Stock and Class A Common Stock. |

|

|

|

|

|

Dutch Corporate Entities |

|

Entities or enterprises that are subject to the CITA and are resident or deemed to be resident in the Netherlands. |

|

|

|

|

|

Dutch Individuals |

|

Individuals who are resident or deemed to be resident in the Netherlands. |

|

|

|

|

|

Euronext Amsterdam |

|

Euronext in Amsterdam, a regulated market of Euronext Amsterdam N.V. |

|

|

|

|

|

Exchange Act |

|

U.S. Securities Exchange Act of 1934, as amended. |

|

|

|

|

|

European Financial Statements |

|

Pro forma European Financial Statements. |

33

|

FFTH |

|

A fiber-to-the-home network. |

|

|

|

|

|

French Overseas Territories |

|

Guadeloupe, Martinique, French Guiana, La Réunion and Mayotte. |

|

|

|

|

|

General Meeting |

|

The general meeting of our Shareholders, being the corporate body, or where the context so requires, the physical meeting of Shareholders. |

|

|

|

|

|

Group |

|

The current group including the Altice and Altice USA businesses before the proposed Separation. |

|

|

|

|

|

HOT |

|

HOT Telecommunication Systems Ltd., a corporation incorporated under the laws of Israel, and its subsidiaries. |

|

|

|

|

|

HOT Mobile |

|

HOT Mobile Ltd., a corporation incorporated under the laws of Israel. |

|

|

|

|

|

Master Separation Agreement |

|

The master separation agreement setting forth the principal actions to be taken in connection with the Distribution to be entered into by Altice and Altice USA. |

|

|

|

|

|

MVPD’s |

|

Multichannel video programming distributors. |

|

|

|

|

|