Exhibit (a)(1)(I) Altice USA Stock Option Exchange Program January 23, 2023

Agenda Overview Eligibility Exchange Details Illustrative Example Making Your Elections Expected Timeline Important Considerations Questions 2

Stock Option Exchange Overview Stock options have been a key component of our long-term incentive compensation program Substantially all employee stock options are "underwater" (meaning they have exercise prices above the recent trading prices of Altice USA Class A common stock) Altice USA is offering a voluntary opportunity to exchange eligible "underwater" employee stock options for a mix of restricted stock units ("RSUs") and deferred cash-denominated awards ("DCAs") As a reminder, RSUs are units convertible into shares of Altice USA Class A common stock DCAs are cash-denominated units settled in shares of Altice USA Class A common stock or cash at the Company's election RSUs and DCAs require continued employment in order to vest. There are no performance conditions associated with vesting. 3

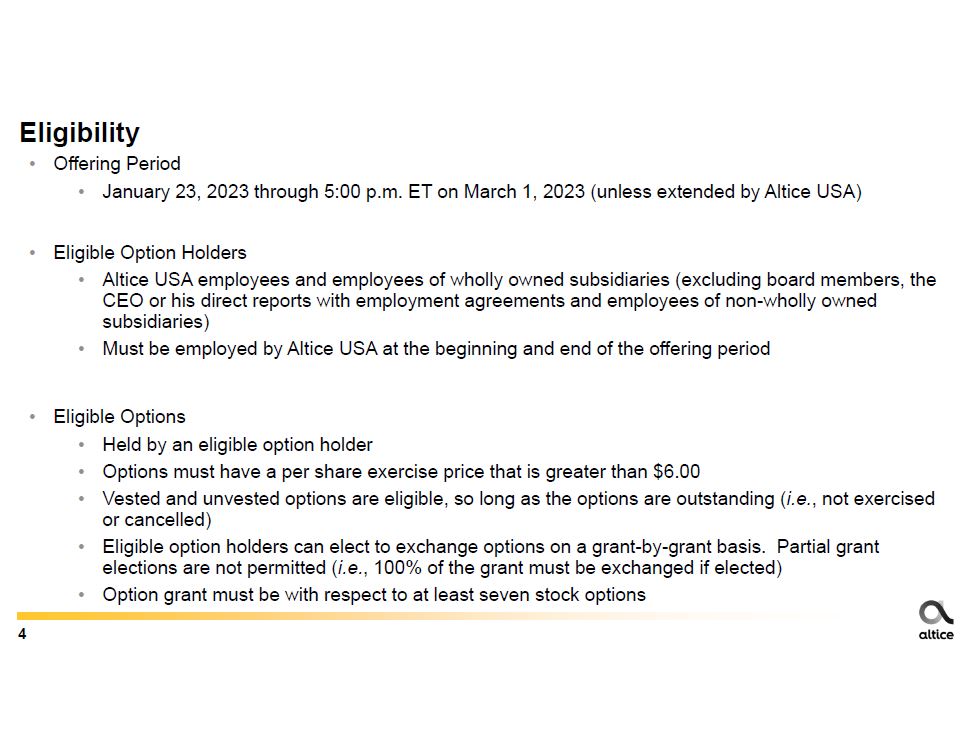

Eligibility Offering Period January 23, 2023 through 5:00 p.m. ET on March 1, 2023 (unless extended by Altice USA) Eligible Option Holders Altice USA employees and employees of wholly owned subsidiaries (excluding board members, the CEO or his direct reports with employment agreements and employees of non-wholly owned subsidiaries) Must be employed by Altice USA at the beginning and end of the offering period Eligible Options Held by an eligible option holder Options must have a per share exercise price that is greater than $6.00 Vested and unvested options are eligible, so long as the options are outstanding (i.e., not exercised or cancelled) Eligible option holders can elect to exchange options on a grant-by-grant basis. Partial grant elections are not permitted (i.e., 100% of the grant must be exchanged if elected) Option grant must be with respect to at least seven stock options 4

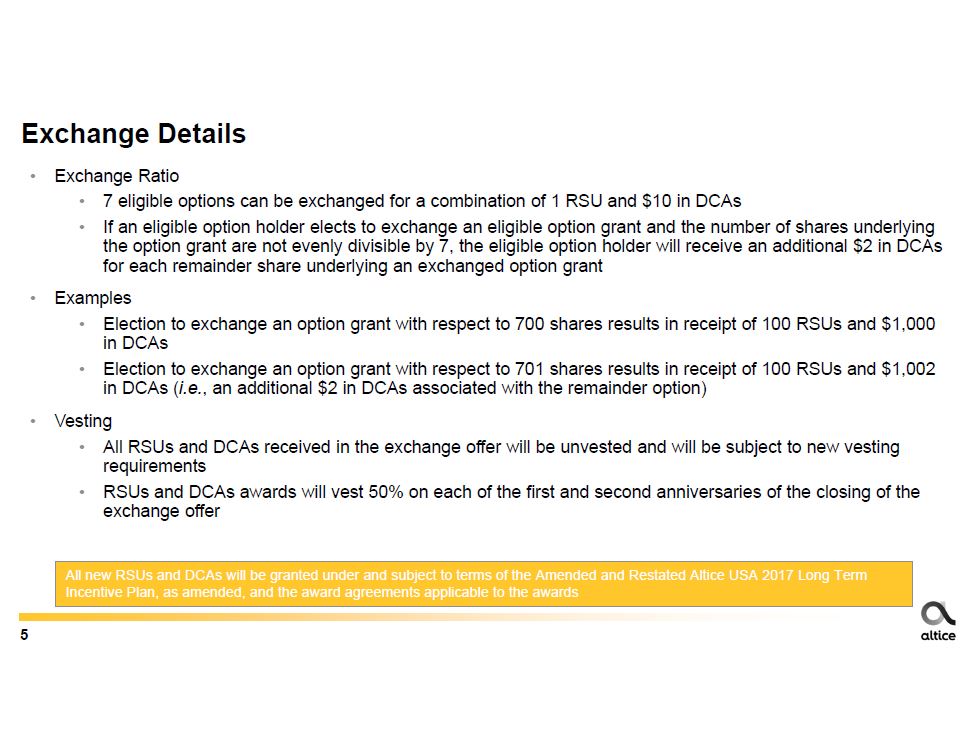

Exchange Details Exchange Ratio 7 eligible options can be exchanged for a combination of 1 RSU and $10 in DCAs If an eligible option holder elects to exchange an eligible option grant and the number of shares underlying the option grant are not evenly divisible by 7, the eligible option holder will receive an additional $2 in DCAs for each remainder share underlying an exchanged option grant Examples Election to exchange an option grant with respect to 700 shares results in receipt of 100 RSUs and $1,000 in DCAs Election to exchange an option grant with respect to 701 shares results in receipt of 100 RSUs and $1,002 in DCAs (i.e., an additional $2 in DCAs associated with the remainder option) Vesting All RSUs and DCAs received in the exchange offer will be unvested and will be subject to new vesting requirements RSUs and DCAs awards will vest 50% on each of the first and second anniversaries of the closing of the exchange offer All new RSUs and DCAs will be granted under and subject to terms of the Amended and Restated Altice USA 2017 Long Term Incentive Plan, as amended, and the award agreements applicable to the awards 5

U.S. Taxation Choosing to participate in the exchange is NOT expected to give rise to an immediate U.S. taxable event in the ordinary course If you elect to exchange your outstanding eligible options, the RSUs and DCAs are expected to be taxed as ordinary income on settlement of the awards for U.S. tax purposes We recommend that you consult with your own tax advisor to determine the personal tax consequences to you of participating in the exchange offer. 6

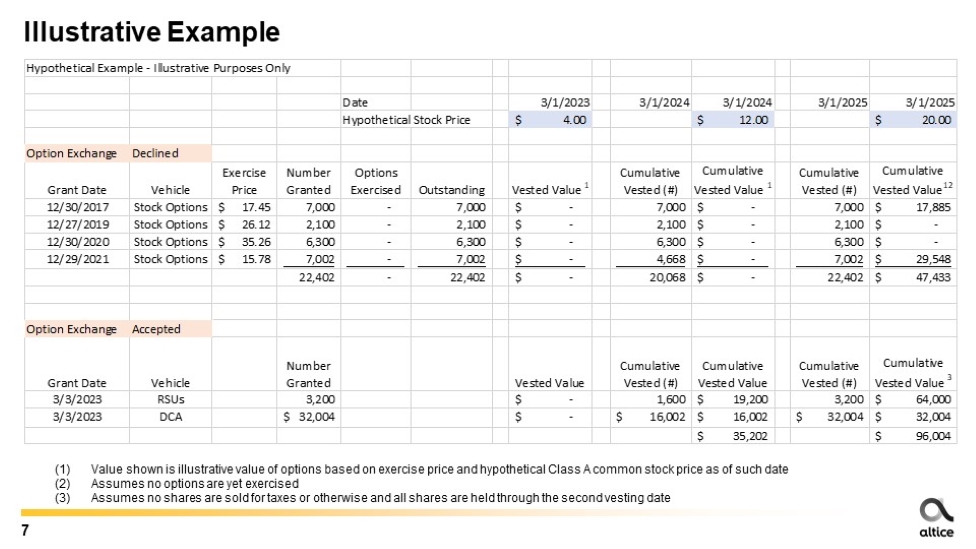

Illustrative Example Hypothetical Example - Illustrative Purposes Only Date 3/1/2023 3/1/2024 3/1/2024 3/1/2025 3/1/2025 Hypothetical Stock Price $4.00 $12.00 $20.00 Option Exchange Declined Grant Date Vehicle Exercise Price Number Granted Options Exercised Outstanding Vested Value1 Cumulative Vested (#) Cumulative Vested Value1 Cumulative Vested (#) Cumulative Vested Value12 12/30/2017 Stock Options $17.45 7,000 - 7,000 $- 7,000 $- 7,000 $17,885 12/27/2019 Stock Options $26.12 2,100 - 2,100 $- 2,100 $- 2,100 $- 12/30/2020 Stock Options $35.26 6,300 - 6,300 $- 6,300 $- 6,300 $- 12/29/2021 Stock Options $15.78 7,002 - 7,002 $- 4,668 $- 7,002 $29,548 22,402 - 22,402 $- 20,068 $- 22,402 $47,433 Option Exchange Accepted Grant Date Vehicle Number Granted Vested Value Cumulative Vested (#) Cumulative Vested Value Cumulative Vested (#) Cumulative Vested Value3 3/3/2023 RSUs 3,200 $- 1,600 $19,200 3,200 $64,000 3/3/2023 DCA $10,004 $- $5,002 $5,002 $10,004 $10,004 $24,202 $74,004 (1) Value shown is illustrative value of options based on exercise price and hypothetical Class A common stock price as of such date (2) Assumes no options are yet exercised (3) Assumes no shares are sold for taxes or otherwise and all shares are held through the second vesting date 7

Making Your Elections 8

Making Your Elections Overview Your elections must be made through the exchange offer website: https://myoptionexchange.com You will be able to do the following: View offering materials, including the offering's terms and conditions and QandAs Elect to exchange eligible options on a grant-by-grant basis (must exchange entire grant) View the number of RSUs and DCAs that may be granted in exchange for each option grant View the value of your options and any RSUs or DCAs that may be granted in exchange for your options at hypothetical future stock prices You will receive a confirmation of your elections upon completion You can change your election at anytime during the offering period Once the exchange offer has closed, only the final election will be considered Options tendered for exchange in the exchange offer will be cancelled at 5:00 PM ET on March 1, 2023, and RSUs and DCAs granted in exchange for tendered options will be granted promptly thereafter Your final elections must be received prior to the expiration of the exchange offer, which is March 1, 2023, at 5:00 pm Eastern Time (unless extended by Altice USA). 9

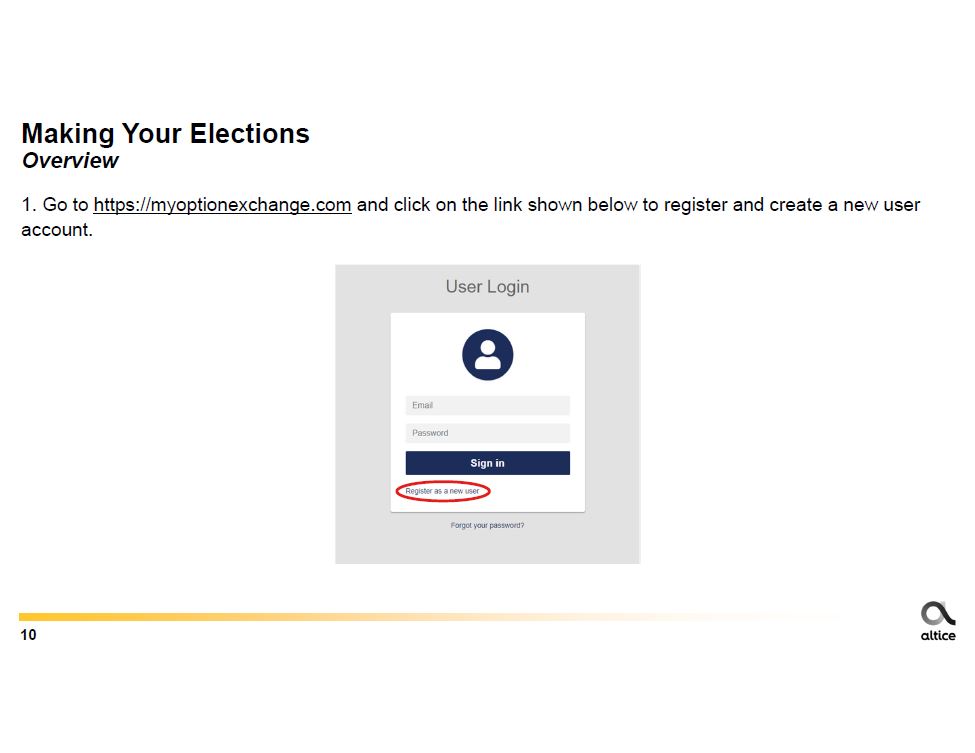

Making Your Elections Overview 1. Go to https://myoptionexchange.com and click on the link shown below to register and create a new user account. User Login Email Password Sign in Register as a new user Forgot your password? 10

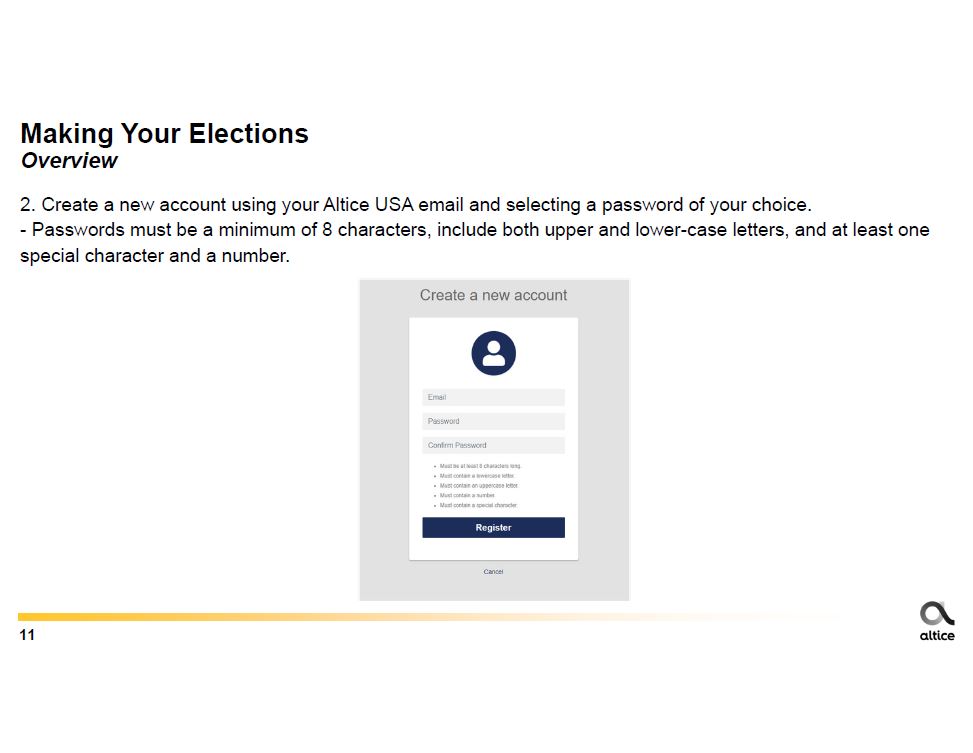

Making Your Elections Overview 2. Create a new account using your Altice USA email and selecting a password of your choice. - Passwords must be a minimum of 8 characters, include both upper and lower-case letters, and at least one special character and a number. Create a new account Email Password Confirm Password Must be at least 8 characters long. Must contain a lowercase letter. Must contain an uppercase letter. Must contain a number. Must contain a special character. Register Cancel 11

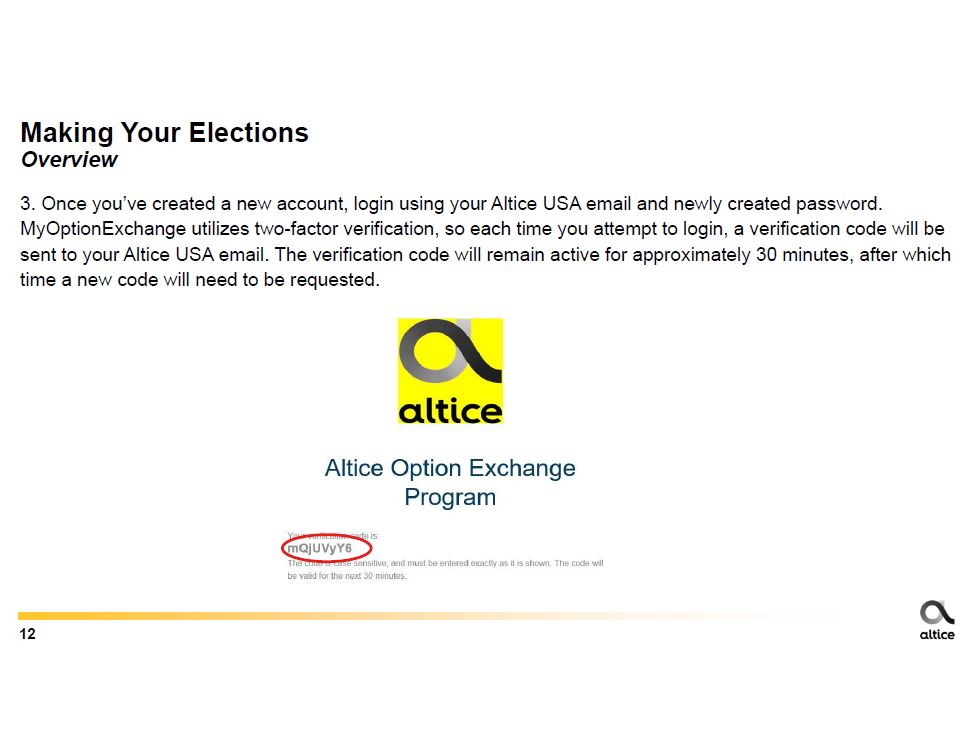

Making Your Elections Overview 3. Once you've created a new account, login using your Altice USA email and newly created password. MyOptionExchange utilizes two-factor verification, so each time you attempt to login, a verification code will be sent to your Altice USA email. The verification code will remain active for approximately 30 minutes, after which time a new code will need to be requested. Altice Option Exchange Program Your verification code is: mQjUVyY6 The code is case sensitive, and must be entered exactly as it is shown. The code will be valid for the next 30 minutes. 12

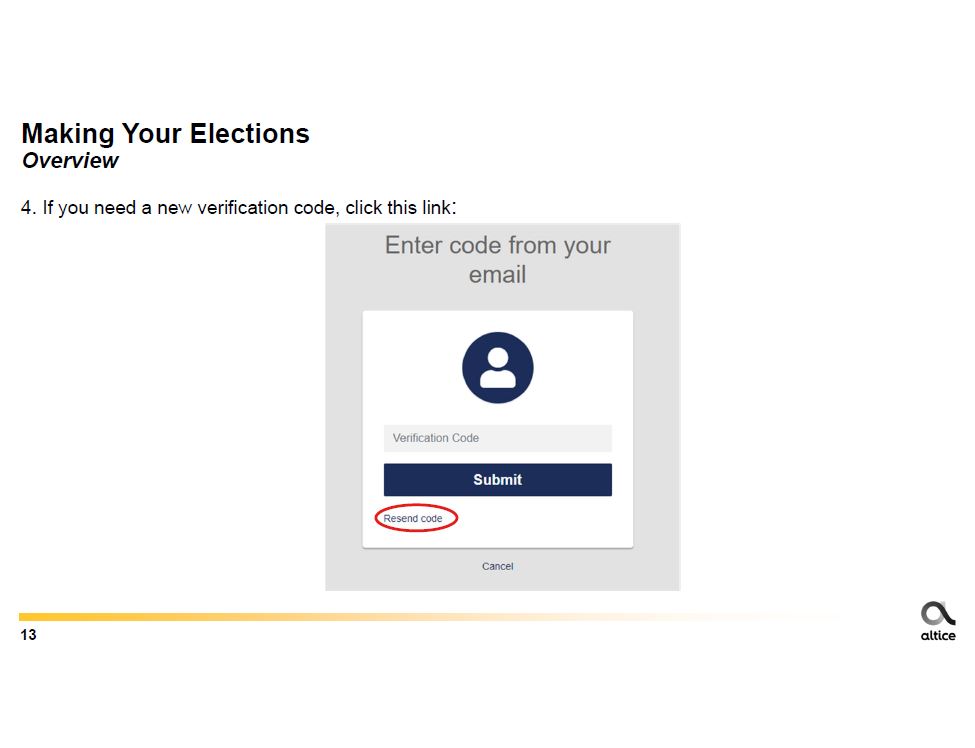

Making Your Elections Overview 4. If you need a new verification code, click this link: Enter code from your email Verification Code Submit Resend code Cancel 13

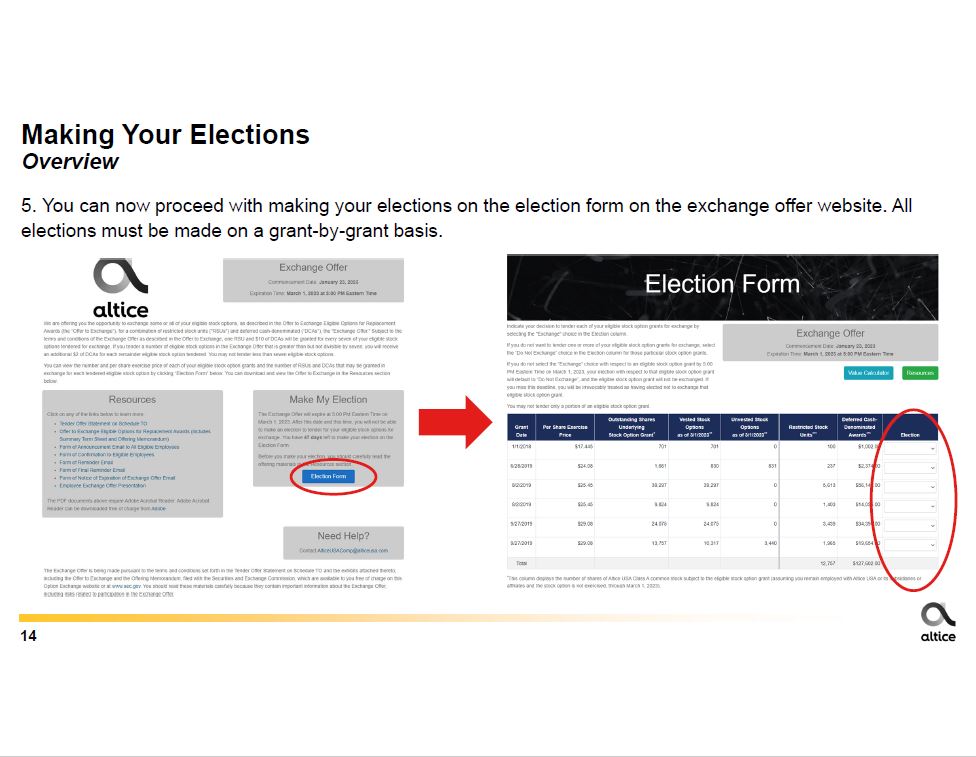

Making Your Elections Overview 5. You can now proceed with making your elections on the election form on the exchange offer website. All elections must be made on a grant-by-grant basis. Exchange Offer Commencement Date: January 23, 2023 Expiration Time: March 1, 2023 at 5:00 PM Eastern Time We are offering you the opportunity to exchange some or all of your eligible stock options, as described in the Offer to Exchange Eligible Options for Replacement Awards (the "Offer to Exchange"), for a combination of restricted stock units ("RSUs") and deferred cash-denominated ("DCAs"), the "Exchange Offer." Subject to the terms and conditions of the Exchange Offer as described in the Offer to Exchange, one RSU and $10 of DCAs will be granted for every seven of your eligible stock options tendered for exchange. If you tender a number of eligible stock options in the Exchange Offer that is greater than but not divisible by seven, you will receive an additional $2 of DCAs for each remainder eligible stock option tendered. You may not tender less than seven eligible stock options. You can view the number and per share exercise price of each of your eligible stock option grants and the number of RSUs and DCAs that may be granted in exchange for each tendered eligible stock option by clicking "Election Form" below. You can download and view the Offer to Exchange in the Resources section below. Resources Click on any of the links below to learn more. Tender Offer Statement on Schedule TO Offer to Exchange Eligible Options for Replacement Awards (includes Summary Term Sheet and Offering Memorandum) Form of Announcement Email to All Eligible Employees Form of Confirmation to Eligible Employees Form of Reminder Email Form of Final Reminder Email Form of Notice of Expiration of Exchange Offer Email Employee Exchange Offer Presentation The PDF documents above require Adobe Acrobat Reader. Adobe Acrobat Reader can be downloaded free of charge from Adobe. Make My Election The Exchange Offer will expire at 5:00 PM Eastern Time on March 1 2023. After this date and this time, you will not be able to make an election to tender for your eligible stock options for exchange. You have 47 days left to make your election on the Election Form. Before you make your election, you should carefully read the offering materials in the Resources section. Election Form Need Help? Contact AlticeUSAComp@alticeusa.com The Exchange Offer is being made pursuant to the terms and conditions set forth in the Tender Offer Statement on Schedule TO and the exhibits attached thereto, including the Offer to Exchange and the Offering Memorandum, filed with the Securities and Exchange Commission, which are available to you free of charge on this Option Exchange website or at www.sec.gov. You should read these materials carefully because they contain important information about the Exchange Offer, including risks related to participation in the Exchange Offer. Election Form Indicate your decision to tender each of your eligible stock option grants for exchange by selecting the "Exchange" choice in the Election column. If you do not want to tender one or more of your eligible stock option grants for exchange, select the "Do Not Exchange" choice in the Election column for those particular stock option grants. If you do not select the "Exchange" choice with respect to an eligible stock option grant by 5:00 PM Eastern Time on March 1, 2023, your election with respect to that eligible stock option grant will default to "Do Not Exchange", and the eligible stock option grant will not be exchanged. If you miss this deadline, you will be irrevocably treated as having elected not to exchange that eligible stock option grant. You may not tender only a portion of an eligible stock option grant. Exchange Offer Commencement Date: January 23, 2023 Expiration Time: March 1, 2023 at 5:00 PM Eastern Time Value Calculator Resources Grant Date Per Share Exercise Price Outstanding Shares Underlying Stock Option Grant* Vested Stock Options as of 3/1/2023** Unvested Stock Options as of 3/1/2023** Restricted Stock Units*** Deferred Cash-Denominated Awards*** Election 1/1/2018 $17.445 701 701 0 100 $1,002.00 6/28/2019 $24.08 1,661 830 831 237 $2,374.00 8/2/2019 $25.45 39,297 39,297 0 5,613 $56,142.00 8/2/2019 $25.45 9,824 9,824 0 1,403 $14,036.00 9/27/2019 $29.08 24,075 24,075 0 3,439 $34,394.00 9/27/2019 $29.08 13,757 10,317 3,440 1,965 $19,654.00 Total 12,757 $127,602.00 *This column displays the number of shares of Altice USA Class A common stock subject to the eligible stock option grant (assuming you remain employed with Altice USA or its subsidiaries or affiliates and the stock option is not exercised, through March 1, 2023). 14

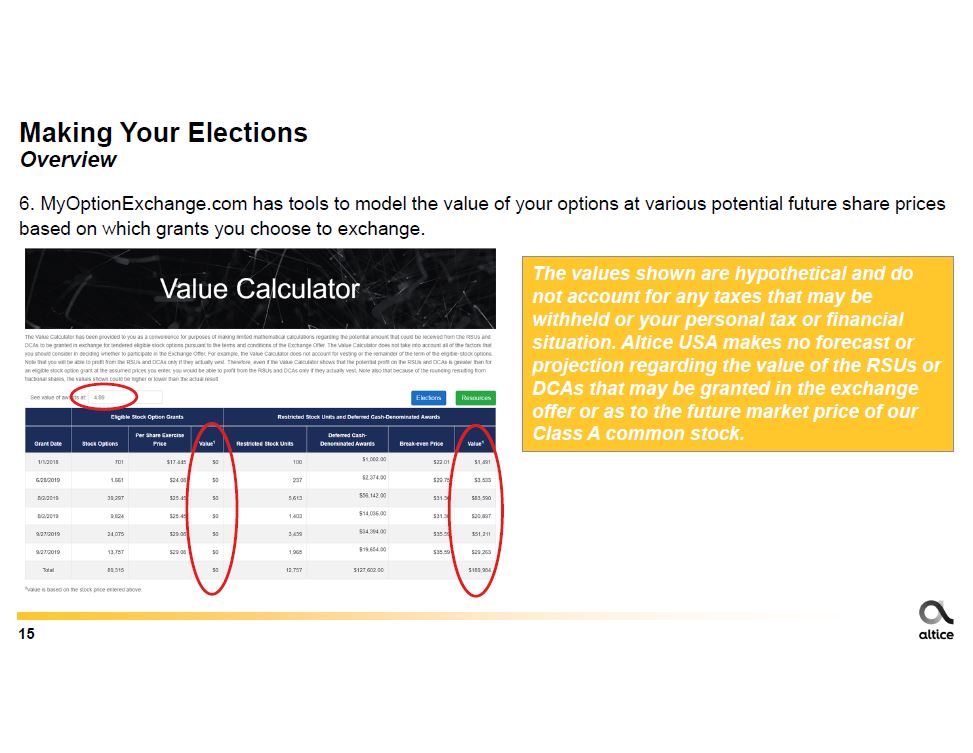

Making Your Elections Overview 6. MyOptionExchange.com has tools to model the value of your options at various potential future share prices based on which grants you choose to exchange. Value Calculator The Value Calculator has been provided to you as a convenience for purposes of making limited mathematical calculations regarding the potential amount that could be received from the RSUs and DCAs to be granted in exchange for tendered eligible stock options pursuant to the terms and conditions of the Exchange Offer. The value Calculator does not take into account all of the factors that you should consider in deciding whether to participate in the Exchange Offer. For example, the Value Calculator does not account for vesting or the remainder of the term of the eligible stock options. Note that you will be able to profit from the RSUs and DCAs only if they actually vest. Therefore, even if the Value Calculator shows that the potential profit on the RSUs and DCAs is greater than for an eligible stock option grant at the assumed prices you enter, you would be able to profit from the RSUs and DCAs only if they actually vest. Note also that because of the rounding resulting from fractional shares, the values shown could be higher or lower than the actual result. See value of awards at: 4.89 Elections Resources Eligible Stock Option Grants Restricted Stock Units and Deferred Cash-Denominated Awards Grant Date Stock Options Per Share Exercise Price Value1 Restricted Stock Units Deferred Cash-Denominated Awards Break-even Price Value1 1/1/2018 701 $17.445 $0 100 $1,002.00 $22.01 $1,491 6/28/2019 1,661 $24.08 $0 237 $2,374.00 $29.75 $3,533 8/2/2019 39,297 $25.45 $0 5,613 $56,142.00 $31.36 $83,590 8/2/2019 9,824 $25.45 $0 1,403 $14,036.00 $31.36 $20,897 9/27/2019 24,075 $29.08 $0 3,439 $34,394.00 $35.59 $51,211 9/27/2019 13,757 $29.08 $0 1,965 $19,654.00 $35.59 $29,263 Total 89,315 $0 12,757 $127,602.00 $189,984 1Value is based on the stock price entered above. The values shown are hypothetical and do not account for any taxes that may be withheld or your personal tax or financial situation. Altice USA makes no forecast or projection regarding the value of the RSUs or DCAs that may be granted in the exchange offer or as to the future market price of our Class A common stock. 15

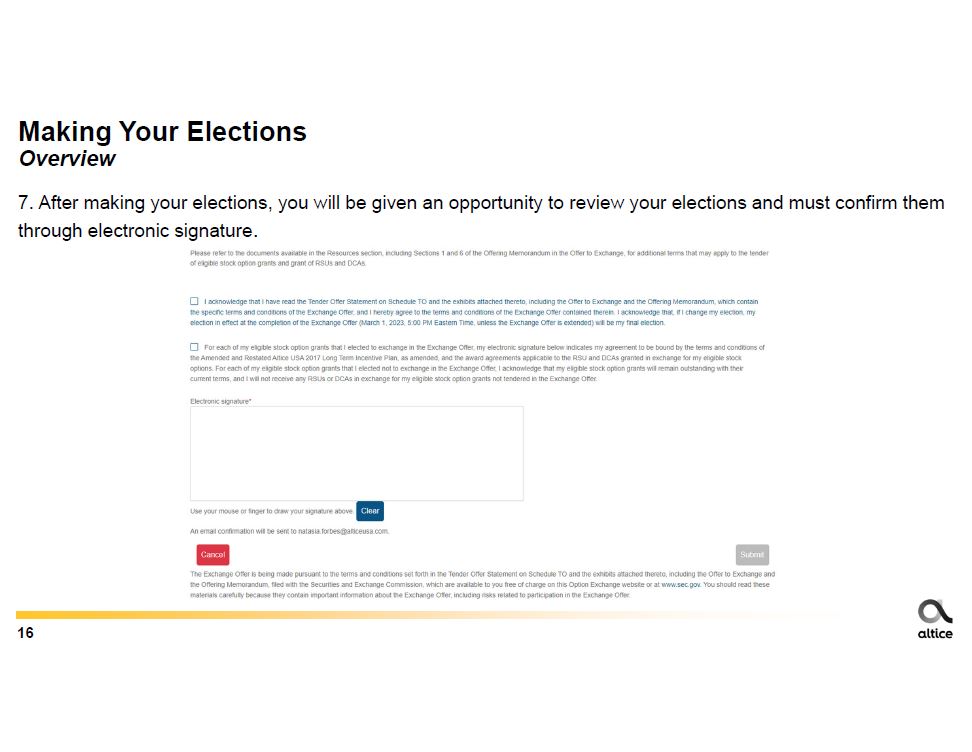

Making Your Elections Overview 7. After making your elections, you will be given an opportunity to review your elections and must confirm them through electronic signature. Please refer to the documents available in the Resources section, including Sections 1 and 6 of the Offering Memorandum in the Offer to Exchange, for additional terms that may apply to the tender of eligible stock option grants and grant of RSUs and DCAs. I acknowledge that I have read the Tender Offer Statement on Schedule TO and the exhibits attached thereto, including the Offer to Exchange and the Offering Memorandum, which contain the specific terms and conditions of the Exchange Offer, and I hereby agree to the terms and conditions of the Exchange Offer contained therein. I acknowledge that, if I change my election, my election in effect at the completion of the Exchange Offer (March 1, 2023, 5:00 PM Eastern Time, unless the Exchange Offer is extended) will be my final election. For each of my eligible stock option grants that I elected to exchange in the Exchange Offer, my electronic signature below indicates my agreement to be bound by the terms and conditions of the Amended and Restated Altice USA 2017 Long Term Incentive Plan, as amended, and the award agreements applicable to the RSU and DCAs granted in exchange for my eligible stock options. For each of my eligible stock option grants that I elected not to exchange in the Exchange Offer, I acknowledge that my eligible stock option grants will remain outstanding with their current terms, and I will not receive any RSUs or DCAs in exchange for my eligible stock option grants not tendered in the Exchange Offer. Electronic signature* Use your mouse or finger to draw your signature above. Clear An email confirmation will be sent to natasia.forbes@alticeusa.com. Cancel Submit The Exchange Offer is being made pursuant to the terms and conditions set forth in the Tender Offer Statement on Schedule TO and the exhibits attached thereto, including the Offer to Exchange and the Offering Memorandum, filed with the securities and Exchange Commission, which are available to you free of charge on this Option Exchange website or at www.sec.gov. You should read these materials carefully because they contain important information about the Exchange Offer, including risks related to participation in the Exchange Offer. 16

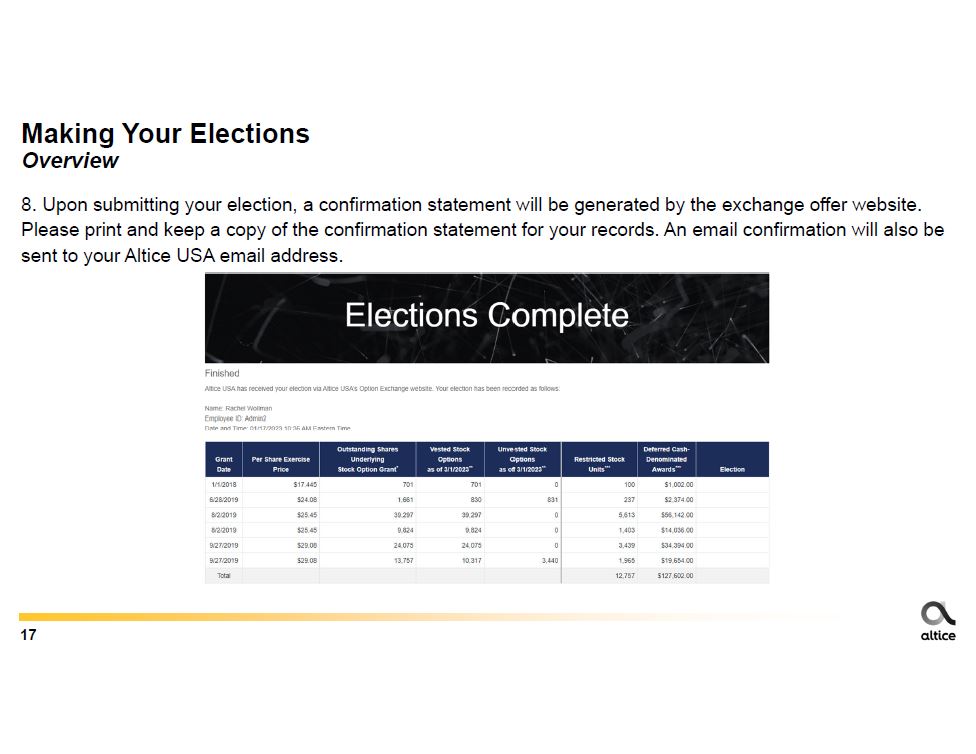

Making Your Elections Overview 8. Upon submitting your election, a confirmation statement will be generated by the exchange offer website. Please print and keep a copy of the confirmation statement for your records. An email confirmation will also be sent to your Altice USA email address. Elections Complete Finished Altice USA has received your election via Altice USA's Option Exchange website. Your election has been recorded as follows: Name: Rachel Wollman Employee ID: Admin2 Date and Time: 01/17/2023 10:36 AM Eastern Time Grant Date Per Share Exercise Price Outstanding Shares Underlying Stock Option Grant* Vested Stock Options as of 3/1/2023** Unvested Stock Options as of 3/1/2023** Restricted Stock Units*** Deferred Cash-Denominated Awards*** Election 1/1/2018 $17.445 701 701 0 100 $1,002.00 6/28/2019 $24.08 1,661 830 831 237 $2,374.00 8/2/2019 $25.45 39,297 39,297 0 5,613 $56,142.00 8/2/2019 $25.45 9,824 9,824 0 1,403 $14,036.00 9/27/2019 $29.08 24,075 24,075 0 3,439 $34,394.00 9/27/2019 $29.08 13,757 10,317 3,440 1,965 $19,654.00 Total 12,757 $127,602.00 17

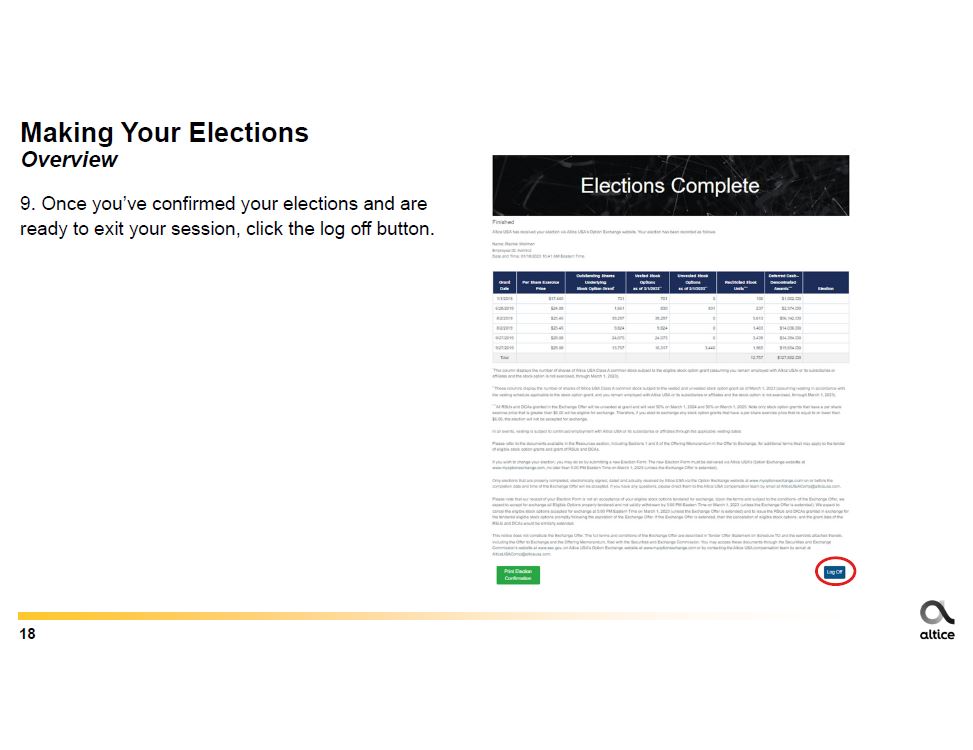

Making Your Elections Overview 9. Once you've confirmed your elections and are ready to exit your session, click the log off button. Elections Complete Finished Altice USA has received your election via Altice USA's Option Exchange website. Your election has been recorded as follows: Name: Rachel Wollman Employee ID: Admin2 Date and Time: 01/18/2023 10:41 AM Eastern Time Grant Date Per Share Exercise Price Outstanding Shares Underlying Stock Option Grant* Vested Stock Options as of 3/1/2023** Unvested Stock Options as of 3/1/2023** Restricted Stock Units*** Deferred Cash-Denominated Awards*** Election 1/1/2018 $17.445 701 701 0 100 $1,002.00 6/28/2019 $24.08 1,661 830 831 237 $2,374.00 8/2/2019 $25.45 39,297 39,297 0 5,613 $56,142.00 8/2/2019 $25.45 9,824 9,824 0 1,403 $14,036.00 9/27/2019 $29.08 24,075 24,075 0 3,439 $34,394.00 9/27/2019 $29.08 13,757 10,317 3,440 1,965 $19,654.00 Total 12,757 $127,602.00 *This column displays the number of shares of Altice USA Class A common stock subject to the eligible stock option grant (assuming you remain employed with Altice USA or its subsidiaries or affiliates and the stock option is not exercised, through March 1, 2023). **These columns display the number of shares of Altice USA Class A common stock subject to the vested and unvested stock option grant as of March 1, 2023 (assuming vesting in accordance with the vesting schedule applicable to the stock option grant, and you remain employed with Altice USA or its subsidiaries or affiliates and the stock option is not exercised, through March 1, 2023). ***All RSUs and DCAs granted in the Exchange Offer will be unvested at grant and will vest 50% on March 1, 2024 and 50% on March 1, 2025. Note only stock option grants that have a per share exercise price that is greater than $6.00 will be eligible for exchange. Therefore, if you elect to exchange any stock option grants that have a per share exercise price that is equal to or lower than $6.00, the election will not be accepted for exchange. In all events, vesting is subject to continued employment with Altice USA or its subsidiaries or affiliates through the applicable vesting dates. Please refer to the documents available in the Resources section, including Sections 1 and 6 of the Offering Memorandum in the Offer to Exchange, for additional terms that may apply to the tender of eligible stock option grants and grant of RSUs and DCAs. If you wish to change you election, you may do so by submitting a new Election Form. The new Election Form must be delivered via Altice USA's Option Exchange website at www.myoptionexchange.com, no later than 5:00 PM Eastern Time on March 1, 2023 (unless the Exchange Offer is extended). Only elections that are properly completed, electronically signed, dated and actually received by Altice USA via the Option Exchange website at www.myoptionexchange.com on or before the completion date and time of the Exchange Offer will be accepted. If you have any questions, please direct them to the Altice USA compensation team by email at AlticeUSAComp@alticeusa.com. Please note that our receipt of your Election Form is not an acceptance of your eligible stock options tendered for exchange. Upon the terms and subject to the conditions of the Exchange Offer, we expect to accept for exchange all Eligible Options properly tendered and not validly withdrawn by 5:00 PM Eastern Time on March 1, 2023 (unless the Exchange Offer is extended). We expect to cancel the eligible stock options accepted for exchange at 5:00 PM Eastern Time on March 1, 2023 (unless the Exchange Offer is extended) and to issue the RSUs and DCAs granted in exchange for the tendered eligible stock options promptly following the expiration of the Exchange Offer. If the Exchange Offer is extended, then the cancellation of eligible stock options and the grant date of the RSUs and DCAs would be similarly extended. This notice does not constitute the Exchange Offer. The full terms and conditions of the Exchange Offer are described in Tender Offer Statement on Schedule TO and the exhibits attached thereto, including the Offer to Exchange and the Offering Memorandum, filed with the Securities and Exchange Commission. You may access these documents through the Securities and Exchange Commission's website at www.sec.gov, on Altice USA's Option Exchange website at www.myoptionexchange.com or by contacting the Altice USA compensation team by email at AlticeUSAComp@alticeusa.com. Print Election Confirmation Log Off 18

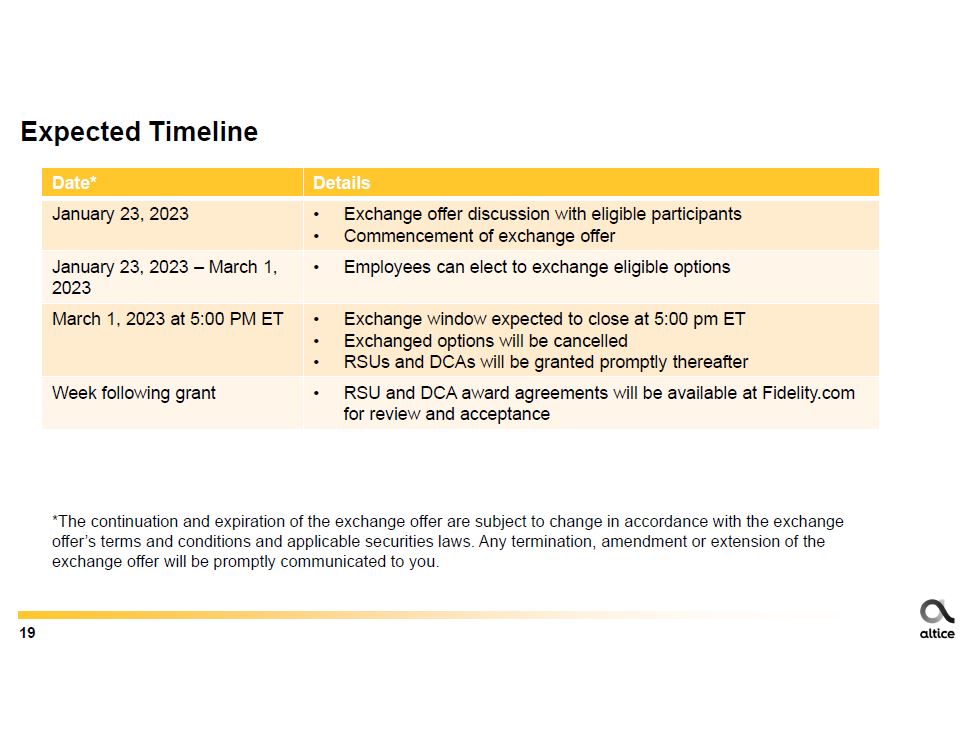

Expected Timeline Date* Details January 23, 2023 Exchange offer discussion with eligible participants Commencement of exchange offer January 23, 2023 - March 1, 2023 Employees can elect to exchange eligible options March 1, 2023 at 5:00 PM ET Exchange window expected to close at 5:00 pm ET Exchanged options will be cancelled RSUs and DCAs will be granted promptly thereafter Week following grant RSU and DCA award agreements will be available at Fidelity.com for review and acceptance *The continuation and expiration of the exchange offer are subject to change in accordance with the exchange offer's terms and conditions and applicable securities laws. Any termination, amendment or extension of the exchange offer will be promptly communicated to you. 19

Important Considerations The terms governing the exchange offer will be set forth in tender offer documents (consisting of a Tender Offer Statement on Schedule TO and related exhibits thereto) to be filed with the SEC and available to you on the exchange offer website: https://myoptionexchange.com You should review the tender offer documents, including the "Risk Factors" section of the tender offer documents. Risks associated with participation in the exchange offer include: Vested options will be exchanged for unvested RSUs and unvested DCAs Extended vesting period may result in increased risk of forfeiture If your employment is terminated with Altice USA (other than as a result of death or disability) before the RSUs or DCAs received in the exchange offer vest, the unvested RSUs and DCAs will be cancelled, and you will receive no value from the unvested portion of the awards Participation does not guarantee continued or future employment with Altice USA or any of its affiliates A benefit or return cannot be guaranteed and participation in the exchange offer may result in no economic benefit You should consult with your personal financial and/or tax advisors to fully assess the benefits and risks involved in participating in the exchange offer Altice USA has not authorized anyone to make any recommendation on its behalf regarding participation in the exchange offer. Should a recommendation or representation be received, it should not be relied upon as having been authorized by Altice USA 20

Questions Please contact a member of the compensation team with any questions 21

About this Presentation This employee presentation (this "Presentation") is for informational purposes only to assist interested parties in making their own evaluation with respect to Altice USA Inc.'s (the "Company") exchange offer (the "Exchange Offer"). The information contained herein does not purport to be all-inclusive and none of the Company or its respective affiliates, or any of its control persons, officers, directors, employees or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Exchange Offer or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of the Company or any of its respective affiliates. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and you confirm that you are not relying upon the information contained herein to make any decision. The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves about and observe any such restrictions. The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the "Exchange Act"), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act. Forward Looking Statements Certain statements, estimates, targets and projections in this Presentation and the documents available to you in connection with the Exchange Offer may be considered forward-looking statements. Forward-looking statements generally relate to future events or the Company's future financial or operating performance. For example, statements regarding projections of the Company's future financial results and other metrics, the trading price of the Company's Class A commons stock and the terms and timing of the completion of the Exchange Offer are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "expects", "anticipates", "believes", "estimates", "may", "will", "should", "could", "potential", "continue", "intends", "plans" and "illustrative", or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are not guarantees of future performance, results or events and involve risks and uncertainties and actual results or developments may differ materially from the forward-looking statements as a result of various factors. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (i) the occurrence of any event, change or other circumstances that could give rise to the termination of the Exchange Offer; (ii) the outcome of any legal proceedings that may be instituted against the Company or others following the announcement of the Exchange Offer; (iii) the inability of the Company to satisfy other conditions to closing; (iv) changes to the proposed structure of the Exchange Offer that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Exchange Offer; (v) costs related to the Exchange Offer; (vi) the possibility that the Company may be adversely affected by other economic, business, regulatory and/or competitive factors, (vii) the Company's estimates of expenses and profitability, (viii) the evolution of the markets in which the Company competes; (ix) the ability of the Company to implement its strategic initiatives and continue to innovate its existing services; (x) the ability of the Company to satisfy regulatory requirements; (xi) other risks and uncertainties set forth in the section entitled "Risk Factors" and "Cautionary Note Regarding Forward-Looking Statements" in the Company's annual report on Form 10-K filed with the SEC on February 16, 2022 and other risks and uncertainties indicated from time to time in the offering documents related to the Exchange Offer, including those set forth under "Risk Factors" therein, and other documents filed and to be filed with the SEC by the Company. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. The Company does not undertake any duty to update these forward-looking statements. 22

Additional Information and Where to Find It At the time the Exchange Offer begins, the Company will provide option holders who are eligible to participate in the Exchange Offer with written materials explaining the precise terms and timing of the program. Persons who are eligible to participate in the Exchange Offer should read these written materials carefully when they become available because they will contain important information about the Exchange Offer. The Company will also file these written materials with the Securities and Exchange Commission (the "SEC") as part of a Tender Offer Statement on Schedule TO upon commencement of the Exchange Offer. The Company's stockholders and eligible option holders will be able to obtain these written materials and other documents filed by the Company with the SEC free of charge at www.sec.gov. You may also obtain these materials for free on https://myoptionexchange.com. Questions and requests should be directed to alticeusacomp@alticeusa.com. 23